Payroll Giving for Nonprofits: Leveraging Employee Support

Payroll giving is an increasingly popular effort that allows employees to contribute directly to charitable causes through automatic deductions from their paychecks. For nonprofits, this presents a unique opportunity to tap into the philanthropic spirit of companies’ employees.

Interested in discovering how your own nonprofit can do so? We’ll cover everything you need to know about payroll giving here.

This includes:

- What is Payroll Giving?

- What Are the Benefits of Payroll Giving for Nonprofits?

- How Does Payroll Giving Benefit Companies + Employees?

- What Does the Payroll Giving Process Look Like?

- 8 Companies Offering Payroll Giving Programs

- Tips for Increasing Support Through Payroll Giving

- See it in Action: Nonprofits Promoting Payroll Giving Well

By leveraging employee support through payroll giving, organizations can drive meaningful change while simultaneously enriching the workplace culture. Read on to find out how.

What is Payroll Giving?

Payroll giving is a charitable contribution method that allows employees of participating companies to donate a portion of their salary directly to nonprofit organizations through automatic deductions from their paychecks on a regular basis.

This system simplifies the donation process, making it easy for employees to support causes they care about without needing to manage separate transactions or giving efforts. Meanwhile, organizations receive additional support and resources through the programs, allowing them to make a larger impact in their respective missions.

Typically, companies’ employees can choose how much they want to contribute and select the intended recipient from a list of approved charities or organizations. The donations are then collected by the employer and forwarded to the chosen nonprofits, often according to a monthly or quarterly structure.

For an even deeper dive into all things payroll giving-related, check out this free downloadable resource from Double the Donation: How to Earn More Payroll Donation Revenue.

What Are the Benefits of Payroll Giving for Nonprofits?

According to payroll giving statistics from Double the Donation, nearly 6 million U.S. employees donate through payroll giving programs. That’s more than $173 million each year, which is a big chunk of funding that can make a significant impact on nonprofits like yours.

Here’s how:

1. Payroll Giving Creates a Reliable Source of Income

Payroll giving provides nonprofits with consistent, recurring donations, enabling them to plan more effectively and allocate resources efficiently. This predictable income stream helps organizations sustain ongoing programs, fund new initiatives, and manage operational costs with greater stability.

With regular contributions arriving throughout the year, nonprofits can worry less about fluctuating funding and focus more on achieving their mission.

2. Payroll Giving Encourages Long-Term Donor Relationships

Payroll giving fosters a culture of sustained giving, as donors commit to contributing a portion of their salary on a regular basis. This long-term commitment builds deeper connections between donors and the causes they support, resulting in higher donor retention rates.

3. Payroll Giving Reduces Administrative Overhead

Since payroll donations are automatically deducted from an employee’s paycheck, nonprofits often face lower administrative burdens compared to processing individual one-time gifts. These automated systems reduce the need for extensive follow-up, data entry, or payment tracking, allowing nonprofits to allocate more resources to their programs and outreach efforts.

4. Payroll Giving Amplifies Donations Through Matching Programs

Many employers offer matching gift programs alongside payroll giving, doubling or even tripling the impact of employees’ contributions. For nonprofits, this means that every dollar donated through payroll giving has the potential to go even further, maximizing the overall impact of the program.

Promoting these matching opportunities encourages more employees to participate, creating a win-win for donors, companies, and nonprofits alike.

5. Payroll Giving Strengthens Corporate Partnerships

Payroll giving programs often serve as a bridge between nonprofits and corporate partners, enhancing collaboration and fostering goodwill. By supporting these initiatives, companies demonstrate their commitment to Corporate Social Responsibility (or CSR), while nonprofits gain valuable allies in spreading awareness and increasing their donor base.

These partnerships can lead to additional support, such as sponsorships, volunteer programs, or in-kind donations, too.

6. Payroll Giving Expands Donor Reach

Workplace giving programs introduce nonprofits to new audiences they might not otherwise reach. Employees who participate in payroll giving may not have previously donated but are motivated by the convenience and encouragement of their employer’s program. Over time, these individuals can even become passionate supporters and advocates for the nonprofit’s mission.

7. Payroll Giving Provides a Competitive Edge

For nonprofits seeking to stand out in the crowded fundraising landscape, payroll giving offers a unique advantage. The streamlined, hassle-free nature of these programs makes them appealing to donors and gives nonprofits an edge in retaining long-term support. Additionally, offering payroll giving as an option signals that the organization is innovative and aligned with modern fundraising and corporate partnership practices.

How Does Payroll Giving Benefit Companies + Employees?

Payroll giving programs also benefit both companies and employees in several meaningful ways, enhancing workplace culture, employee satisfaction, and community impact.

Here’s a breakdown of the benefits:

Benefits for Companies

- Enhanced Corporate Social Responsibility (CSR) Profile

Payroll giving demonstrates a company’s commitment to supporting communities and aligns with CSR initiatives, improving the company’s reputation and appeal to socially conscious stakeholders. - Improved Employee Engagement and Retention

Employees value opportunities to contribute to causes they care about, and payroll giving programs make it easy. This boosts morale, engagement, and loyalty, reducing turnover rates. - Strengthened Community Ties

By enabling employees to support local or global causes, companies foster stronger relationships with the community, creating goodwill and unleashing the potential for new partnerships.

Benefits for Employees

- Convenience in Giving

Payroll giving allows employees to donate directly from their paycheck, making the process seamless and eliminating the need for separate transactions. - Increased Giving Power

Many companies offer matching gift programs that amplify employee donations, maximizing the impact of their contributions without additional cost to the employee. - Tax Efficiency

Payroll donations are often pre-tax, reducing the taxable income for employees while ensuring their chosen charity receives the full donation amount. - Empowerment and Purpose

Employees feel more connected to their company and their chosen causes, fostering a sense of pride and purpose in their work.

All in all, payroll giving creates a win-win scenario for companies and employees, building a positive workplace environment while driving significant social impact. It enhances personal fulfillment for employees and strengthens the company’s role as a community leader.

What Does the Payroll Giving Process Look Like?

The payroll giving process is designed to make charitable contributions simple, seamless, and impactful for both employees and employers.

Here’s a step-by-step breakdown of how it typically works:

1. Program Setup by Employer

If a company is interested in developing a payroll giving program, the first step is generally to select a payroll giving provider to facilitate and streamline the process. From there, it’s time to define policies and establish specific guidelines for the program. This should include employee and nonprofit eligibility, frequency of deductions, and whether they’ll offer matching gifts or other incentives.

Then, the company begins promoting the program and educating its workforce about the giving opportunity through onboarding, internal communications, and various promotional campaigns to maximize participation.

2. Employee Enrollment

Interested employees can then decide to enroll in the payroll giving program by selecting a charity they wish to support, generally from a list of registered organizations. Employees decide how much they want to contribute per paycheck, often with the option to set a fixed amount or a percentage of their salary.

This part of the process is typically done by completing a simple enrollment form or online process, authorizing the employer to automatically deduct the approved amount directly from the individual’s paychecks going forward.

3. Payroll Deductions

Once enrolled, the specified donation amount is automatically deducted from the employee’s paycheck, often pre-tax (though this can depend on local guidelines and regulations).

Deductions are generally reflected on employees’ pay stubs, providing a clear record for transparency and tax purposes.

4. Funds Distribution

Finally, donors’ employing companies—or their giving platforms—consolidate all employee donations. From there, funds are distributed to the selected nonprofits on a regular schedule (e.g., monthly or quarterly), ensuring timely delivery.

8 Companies Offering Payroll Giving Programs

For the best results, nonprofits should be familiar with companies offering payroll giving programs. After all, these initiatives will allow organizations to significantly enhance their fundraising strategies, as they provide a reliable source of funding through recurring, employer-sponsored donations.

While we can’t list them all, we have selected a few examples of well-known companies with payroll giving opportunities to spotlight below. These include:

Looking for even more examples of companies with payroll giving programs—along with other giving opportunities? Consider investing in a workplace giving database like Double the Donation!

Tips for Increasing Support Through Payroll Giving

Increasing support through payroll giving requires strategic planning and effective communication with your audience. Here are some best practices to enhance participation and engagement:

Pre-register for companies’ giving portals.

To maximize the potential of payroll giving, nonprofits should ensure their organization is listed and up-to-date in companies’ workplace giving portals. After all, many corporations use platforms like Benevity or CyberGrants to manage employee giving programs. By pre-registering, nonprofits make it easier for employees to select their organization and start donating.

- Best Practices for Pre-registration:

- Verify eligibility and complete all required certifications.

- Provide detailed, compelling descriptions of your mission and programs.

- Regularly update contact and payment details to avoid disruptions.

Pre-registration reduces barriers for donors and ensures that employees can easily find and support your organization. It also demonstrates professionalism and preparedness, enhancing your credibility with both companies and their employees.

Focus on the benefits and impact of payroll giving.

Communicating the benefits and real-world impact of payroll giving is crucial for engaging potential donors. Therefore, it’s a good idea to highlight how payroll giving simplifies contributions and amplifies their impact, especially when paired with other programs, like matching gifts.

Share tangible examples of how payroll giving has transformed your programs, supported your beneficiaries, or helped achieve specific goals. Use metrics, photos, or videos to make the impact relatable and real. And don’t overlook the power of a donor story or testimonial, either.

Provide exclusive incentives for payroll giving donors.

Encouraging donors to commit to payroll giving can be easier when exclusive perks are offered. These types of incentives make donors feel valued and appreciated while fostering a sense of community among supporters.

Here are a few ideas you might consider:

- Early access to event tickets or special donor-only events.

- Personalized thank-you messages or recognition in newsletters and annual reports.

- Branded merchandise, such as tote bags, T-shirts, or mugs, for payroll donors.

- Exclusive updates or behind-the-scenes content about your programs.

Positive incentives create a positive feedback loop, where donors feel rewarded for their generosity, increasing their likelihood of staying committed to your organization long-term. Plus, it can be just what on-the-fence supporters need to make the first jump and enroll in the program!

See it in Action: Nonprofits Promoting Payroll Giving Well

Many nonprofits have established effective strategies for promoting payroll giving opportunities, showcasing innovative ways to engage employees and businesses alike. Here are a few examples of organizations that tend to excel in this area:

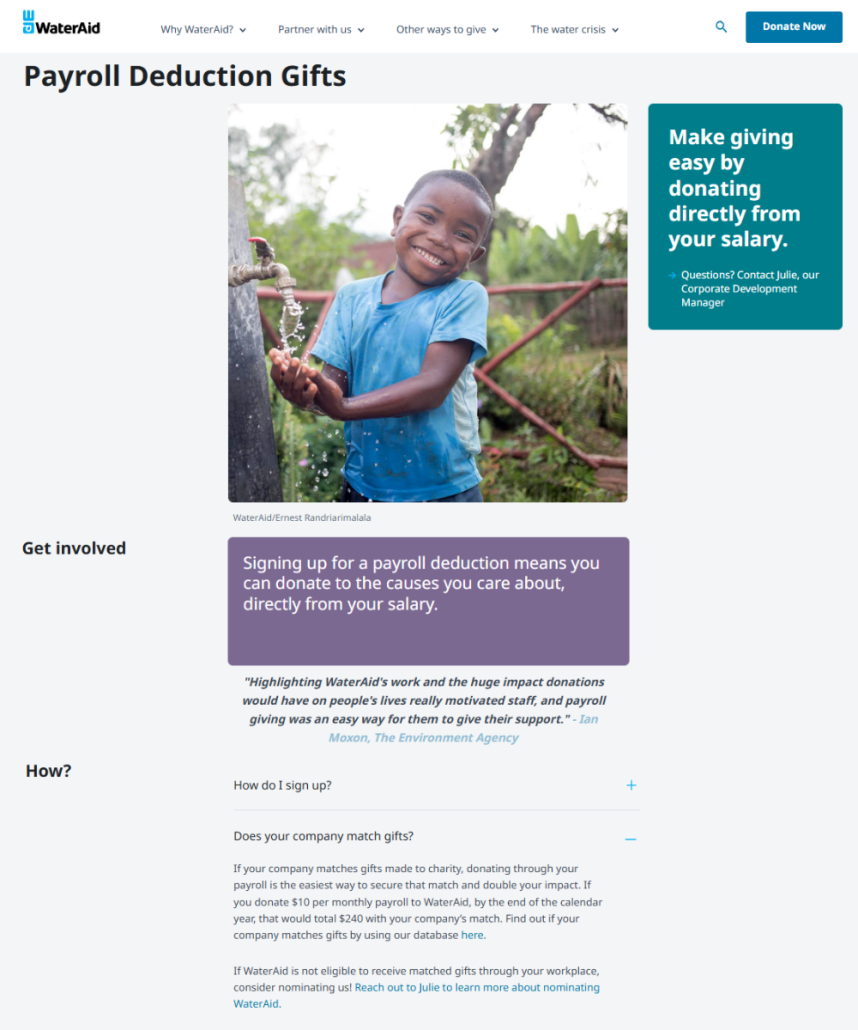

Water Aid

WaterAid is a global organization working to provide clean water, decent toilets, and good hygiene in developing countries. The nonprofit highlights payroll deduction gifts as a leading way for donors to make a difference, and it does so specifically with the Payroll Giving landing page below.

The organization’s FAQ section also calls out another form of workplace giving that often goes hand-in-hand with payroll giving: matching gifts. It even links to the nonprofit’s workplace giving database tool for donors to easily discover their eligibility for a match.

WWF

WWF, also known as the World Wildlife Fund, is an international conservation organization focused on preserving the world’s most vulnerable species and ecosystems. In order to drive support through payroll giving donations, WWF has established the following page dedicated to the programs:

The page also links to a video that further explains the payroll giving opportunity, empowering donors and companies alike to learn more and get involved with the programs. And they really focus on the tax benefits, too—driving the idea that a $5 monthly donation will cost no more than $4!

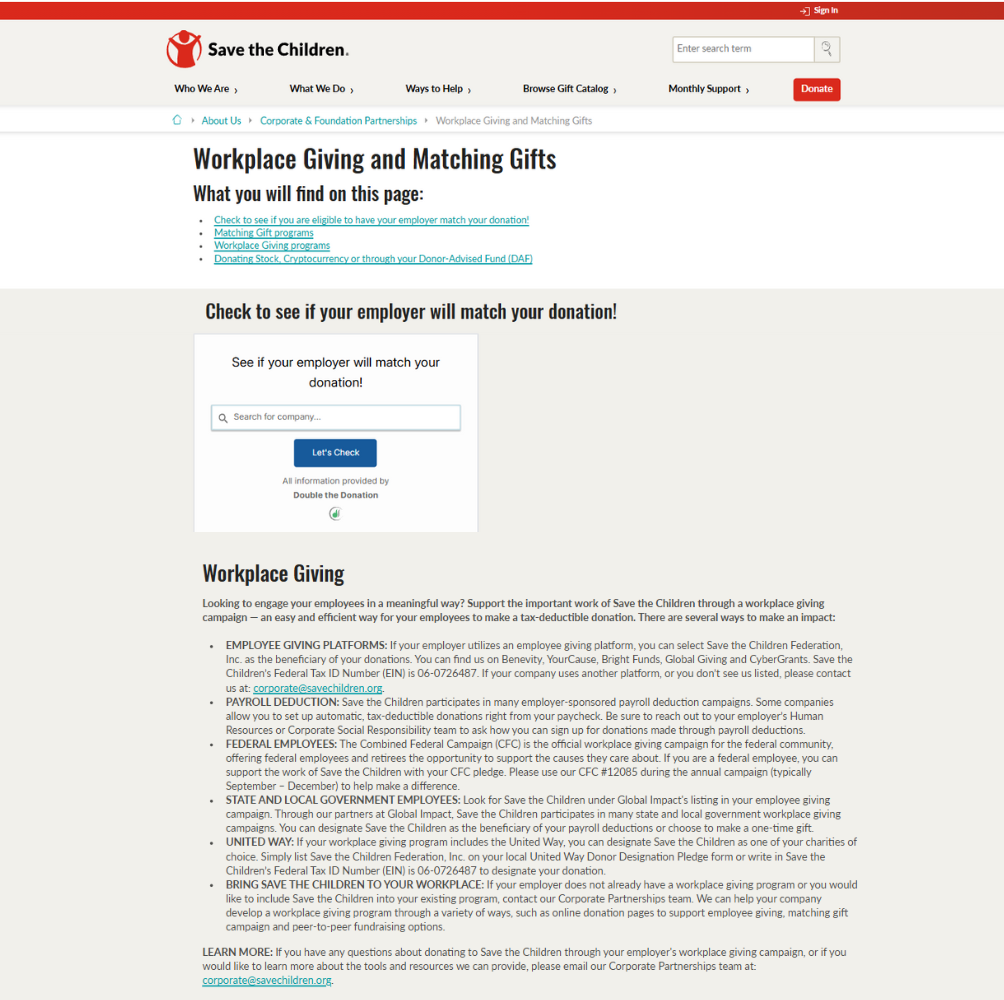

Save the Children

Save the Children is a global nonprofit organization dedicated to improving the lives of children through education, healthcare, emergency response, and advocacy. The organization is dedicated to making the most of workplace giving programs for its cause, which include payroll giving, matching gifts, and more.

One way that it does so is with the following landing page on its website:

Kawartha Lakes Food Source

Kawartha Lakes Food Source (or KLFS) is a not-for-profit distribution center supplying food and personal care items to member organizations in the City of Kawartha Lakes. As the organization aims to raise more through payroll giving programs, the team shared the following social media post to raise awareness:

This outlines the payroll giving opportunity and encourages donors to get in contact with their payroll departments to get set up.

Wrapping Up & Additional Resources

Payroll giving stands out as a powerful and efficient way for nonprofits to harness employee contributions and create a lasting impact on their causes. By facilitating effortless donations directly from supporters’ paychecks, organizations can build a reliable funding stream that supports their missions and programs.

Ultimately, payroll giving represents a win-win scenario. It enables employees to make meaningful contributions while empowering nonprofits to do more than ever before. By embracing this collaborative approach, both parties can work together to create positive change.

Interested in learning more about workplace giving opportunities and beyond? Check out these recommended resources to keep reading:

- Supercharging Philanthropy With Workplace Giving Software. Find out how workplace giving software can play a role in effective corporate partnerships.

- Winning Workplace Giving Strategies & How to Leverage Them. There’s more to workplace philanthropy than payroll giving. Discover other programs here!

- Free Download: The Ultimate Guide to Corporate Matching Gifts. Uncover everything you need to know about corporate matching gifts with this guide.