How to Optimize Your Nonprofit Budget: A Guide & 5 Best Tips

A nonprofit budget is an important financial document that helps organizations allocate expenses and predict revenue. Your budget is crucial in helping your nonprofit plan for the future, stay fiscally responsible, and reach its campaign goals.

This comprehensive guide will walk through the value of a budget and explain how it relates to the actions outlined in your marketing plan. We’ll cover the following points:

- What Is a Nonprofit Budget?

- Why Is It Important to Create a Nonprofit Budget?

- What Makes a Good Nonprofit Budget?

- What Should Be Included in a Nonprofit Budget?

- How Much Do Nonprofits Spend on Marketing?

- Best Nonprofit Budget Tips

These tips will guide you through budgeting basics, and recommend new ways to stay on top of your finances, like supplementing your marketing budget with the Google Ad Grant. Let’s get started by defining what a nonprofit budget is and why it’s important.

What Is a Nonprofit Budget?

A nonprofit budget is a financial document used to plan how an organization will spend its money. It encompasses both your expenses and expected revenue for a set period of time.

A regularly updated and realistic budget helps you know exactly how much money is coming in and out of your organization, allowing you to manage your resources more effectively.

Why Is It Important to Create a Nonprofit Budget?

Your organization likely already has a sense of how much money it spends each year. However, rough estimates are unhelpful when it comes to balancing your finances, and documenting your nonprofit’s expenses concretely has numerous benefits.

A nonprofit budget allows you to:

- Allocate resources effectively. When you have a better understanding of your revenue and expenses, you can allocate resources more effectively. For example, if you no longer qualify for a grant you’ve received in the past, you can take a look at your expenses to determine what to cut to make up for the funding.

- Plan projects ahead of time. A budget enables you to plan ahead. With a clear picture of how much money is dedicated to each of your nonprofit’s program areas, you can plan specific initiatives for the year to come.

- Set better goals. The best goals are SMART goals, which stands for specific, measurable, achievable, relevant, and time-bound. When you align your goals with your budget, you ensure they’re achievable based on your current resources.

- Communicate more efficiently with stakeholders. Let’s say you want to introduce a new project to your board members. Showing your board that you have already budgeted for the costs of your new initiative increases the chance that they’ll support it.

- Predict future expenses. Monitoring your revenue and expenses throughout the year helps you better predict your financial situation for future years.

- Avoid mistakes. It’s difficult to make financial mistakes when you have a clear, regularly updated document with your organization’s revenue and expenses.

Creating and sticking to a nonprofit budget will put your organization in a healthier financial position. As a result, you can spend less time worrying about your nonprofit’s expenses and more time helping your beneficiaries.

What Makes a Good Nonprofit Budget?

Financial planning is vital to an organization’s success and sustainability. The Better Business Bureau recommends that nonprofits spend under 35% of their funding on fundraising efforts and spend at least 65% on programs.

To meet these guidelines, your team must devise a budget that outlines projected expenses and revenue. A budget for a nonprofit organization should be:

- Accurate: Information should be based on logic and strategy. Have your accounting team double-check each line item to ensure your records are accurate and reliable.

- Transparent: Nonprofits must disclose certain financial information to the public per request. Earn the trust of supporters and prospective donors by building a budget that communicates your financial history, goals, and programs.

Accuracy and transparency are crucial for your nonprofit’s image. After you calculate your financial statements, pull insights and share them with your staff, volunteers, and board. This will increase engagement within your organization and allow your team to better understand your nonprofit’s financial health.

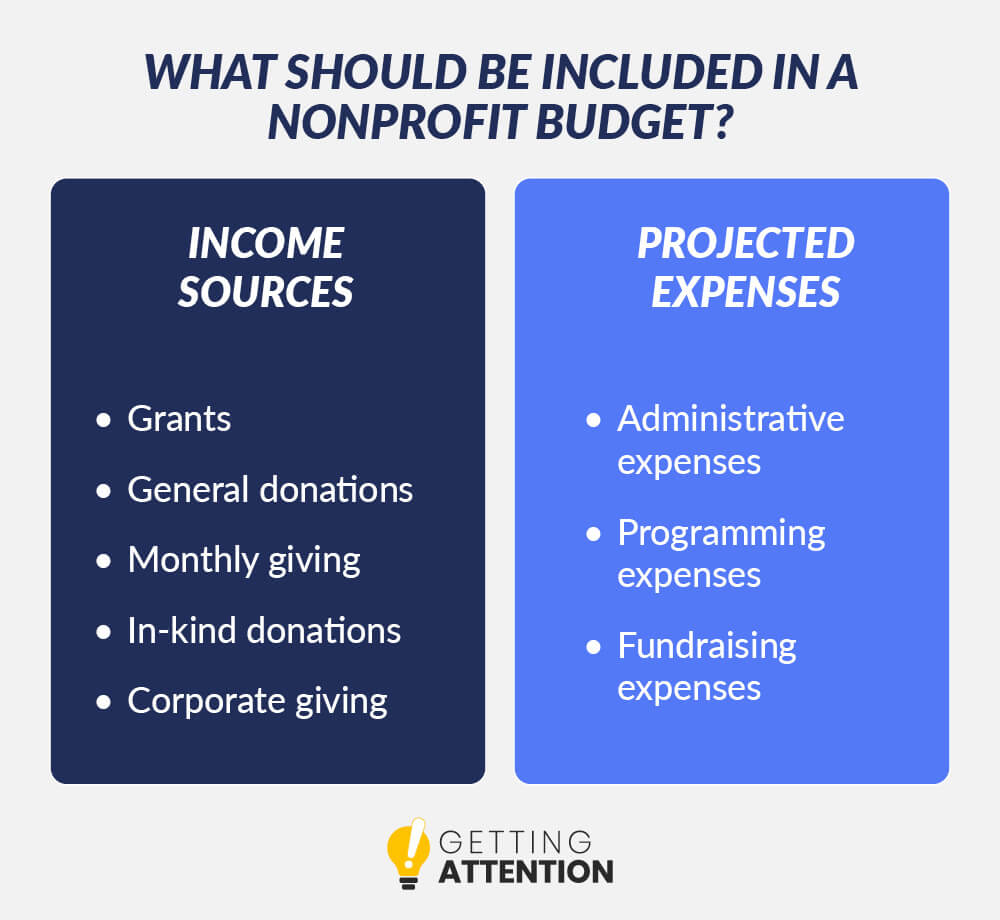

What Should Be Included in a Nonprofit Budget?

From daily operational costs to monthly donations, there is a wide range of elements that should be included in your nonprofit’s budget. We’ll focus on the primary revenue and expense items.

Income Sources

Nonprofits rely on a combination of income sources from individuals, foundations, corporations, and government agencies. Track your diverse revenue streams by accounting for the following types of income:

- Grants: Nonprofits can apply for grants from corporations like Google, private foundations, and the government. Most grants are restricted funds and must be spent on specific projects outlined by the grantor. In your budget, specify which types of programming each grant will cover.

- General Donations: Monetary donations from major donors and a wider donor base are the lifeblood of nonprofits. In your budget, look at past years to estimate how much you can expect to raise from general donations.

- Monthly Giving: Recurring gifts are a reliable source of income. Account for monthly, bi-monthly, and yearly donations.

- In-Kind Donations: These include non-monetary donations, such as volunteered services or supplies.

- Corporate Giving: Corporate gifts can take many forms, such as sponsorships, in-kind donations, and matching gifts. Consider working with a matching gift professional to further boost your donations.

Projected Expenses

Projections are the best way to assess how much you are likely to spend on each campaign or project. Include the following costs in your budget:

- Administrative: This includes expenses for operations and management, including staff salaries, office space, utilities, insurance, and technology.

- Programming: These are the costs needed to carry out your mission-related activities. For example, if a nonprofit is dedicated to feeding the homeless, program expenses would include food and food preparation costs.

- Fundraising: Activities related to soliciting financial support, which can include marketing activities like online ads, print ads, and event

Now that you have the basic line items for your nonprofit’s budget, let’s focus on budgeting for communications and marketing in particular.

How Much Do Nonprofits Spend on Marketing?

Budgeting for marketing costs is vital. Your marketing budget ensures you have the funds needed to reach your goals and determine whether your plans are realistic.

In the for-profit world, it’s fairly standard to determine a marketing budget by allocating 10-20% of projected gross revenue to marketing and communications. For organizations in the nonprofit sector, try to allocate between 5-15% of your budget to marketing.

Of course, exact totals will vary from organization to organization. According to the 2023 M+R Benchmarks Study, nonprofits spent an average of $0.11 on digital advertising for every dollar of online revenue in 2022. Nonprofit investment in digital advertising increased by 28%, with 56% devoted to digital fundraising, 26% to brand awareness, and 15% to lead generation.

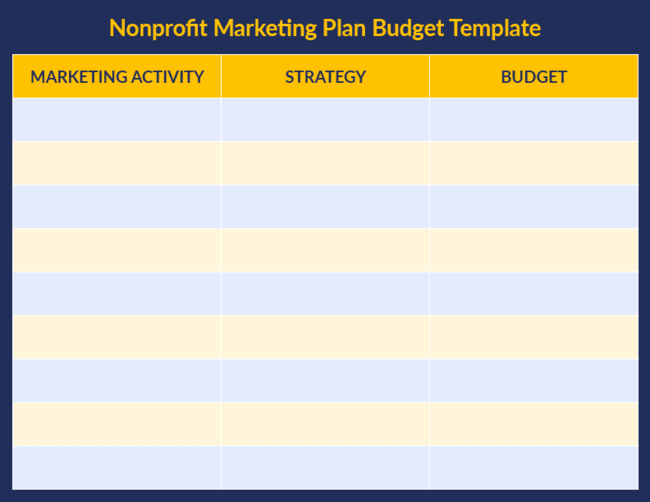

What’s most important is that you establish a detailed marketing and communications budget prior to the start of each fiscal year. Track costs and revenue to analyze your return on investment (ROI) for each fundraiser and campaign. For your annual marketing and communications plan, allocate a specific dollar amount to each strategy (direct mail, email, paid advertising, media relations, etc.), each of which should be broken down further by additional costs that may apply, such as printing, postage, and consulting fees.

The following nonprofit marketing budget template can help your organization stay on track. Simply add each marketing activity, the associated strategy, and how much the activity will cost.

Best Nonprofit Budget Tips

A strong nonprofit budget serves as a framework for making decisions and meeting your goals. Take control of your nonprofit’s finances and start building your budgeting skills with these best practices.

1. Determine a budgeting approach.

No one-size-fits-all budget exists. Adjust your budget approach to communicate financial information in a way that works for your organization. Consider the following strategies when building your nonprofit budget:

- Income-Based Approach: As the name suggests, an income-based approach prioritizes income. Determine how much income you can realistically count on and include only reliable revenue in your budget. Don’t include income projections to fill gaps. If your organization doesn’t meet these income targets, it will create a budget deficit.

- Incremental Approach: The incremental approach builds upon your budget from the previous fiscal year. While this is a quick and easy method to prepare a budget, it’s more difficult to find funding for new campaigns or projects since unspent funds may have been reallocated to another campaign.

- Zero-Based Approach: The current fiscal year’s budget is prepared from scratch without considering income or expenses from the previous year. Although this method is accurate and efficient, it’s time-consuming. Your organization will have to test several assumptions about where money will come from and how it will be spent.

- Percentage Approach: Break down your marketing, communications, and fundraising expenses by percentages of the total budget. This approach is favored by those who believe that marketing and communications expenditures should directly reflect a nonprofit’s evolution and the size of its budget. If done correctly, communications spending will grow as your organization does.

- Flat Dollar Approach: Some experts in the field consider a flat dollar approach to be more relevant and safer than the percentage approach since your total budget has to cover costs like utilities, rent, taxes, and health insurance. Give special campaigns, marketing, communications, and fundraising efforts a set dollar amount based on past expenditures. This method simplifies projections and gives you a clear baseline budget.

Each approach has its own benefits and limitations. That’s why most nonprofits implement a combination of these strategies.

Now that you have solidified a budget approach, share it with your leadership and staff.

2. Create Your Budget Collaboratively

Team-based financial planning is the most effective way to ensure your budget aligns with your organization’s goals. Involve various internal and external stakeholders in the budgeting process to create a comprehensive strategy that incorporates multiple useful perspectives.

Here is a quick breakdown of the process for collaborative budgeting:

- Assemble your budgeting team. Several of your board members should be involved in budgeting to provide oversight, along with your executive team and staff members from multiple departments that will be affected by your budget (fundraising, development, programs, etc.). Additionally, consider bringing on an outsourced accountant, fractional CFO, or other external financial professional to provide an objective, expert perspective on your budget.

- Determine a timeline and goals. From preliminary drafts to approvals, the entire budgeting process can take weeks to months. Set an initial meeting time and post-meeting deadlines to track progress. Your team will also need to agree on your spending and revenue generation goals (both overall and for individual initiatives) early in the process.

- Review past financial data. Examine financial statements from previous years to identify areas where you can capitalize on your organization’s strengths and improve on its weaknesses. External financial professionals can be particularly helpful at this stage since they have the expertise to interpret data accurately and make actionable recommendations in an honest, unbiased manner.

- Draft and revise the budget. If you’ve hired a fractional nonprofit CFO or part-time controller, they’ll take the lead on budget creation. If not, there are plenty of budget templates available online. Choose one that aligns with your organization’s needs, then outline your revenue and expenses based on your goals and data. Once you have a first draft, gather feedback from other team members and make changes accordingly.

- Present the budget to your board. Before the start of the fiscal year, you’ll need to hand your budget over to your board for approval. They’ll assess how effectively resources are allocated, evaluate administrative systems, and ensure all spending and fundraising aligns with your organization’s overarching strategic goals. Then, they’ll either sign off on it or send it back for another round of revisions.

Developing budgets in this way ensures your nonprofit has a clear plan for its funding that’s shaped by concrete data, financial expertise, and insights from across your organization.

3. Include non-monetary contributions.

In-kind donations are donated goods, services, and time. If your organization is fortunate enough to attract in-kind donations, record these contributions to abide by legal standards and create plans to thank specific donors.

Consider the following examples of in-kind donations you may record in your budget:

- Tangible goods: Equipment, office furniture, clothing, food, supplies, etc.

- Intangible goods: Advertisements, patents, copyrights, etc.

- Services: Accounting, printing, catering, consulting, photography, security, etc.

In-kind donations should be recorded at fair market value. The Financial Accounting Standards Board (FASB) defines fair market value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

To determine the value of your in-kind donation:

- Calculate what your organization would have paid for donated goods on the open market.

- Track the hours of professional services donated to your organization.

- Contact your donors and ask them to price their own in-kind services.

Volunteer hours do not need to be reported in a budget. However, your organization can still acknowledge the impact of volunteers in your audit or in a short narrative included in your budget.

4. Conduct regular checks of your budget.

Set regular team meetings to monitor your budget’s progress. Whether you hold these meetings monthly, quarterly, or annually, ensure that your entire team is involved. This will improve communications and management between departments.

Consider the following topics in your meeting:

- Assess the “why” behind budgetary issues.

- Determine which campaigns need more financial attention.

- Review past finances to determine if your budget is on track.

- Compare your budgeted revenue and expenses to actual amounts.

- Inspect balance sheets for discrepancies.

- Account for any unusual circumstances that may arise.

Monitoring your budget throughout the year is the key to financial success, along with setting aside enough funds for marketing.

5. Apply for a Google Ad Grant.

The average small business using Google Ads spends between $5,000 and $12,000 per month on Google paid search campaigns. That’s $60,000 to $150,000 of marketing expenses per year spent solely on ad clicks. Thankfully, Google created a grant to help nonprofits budget for marketing.

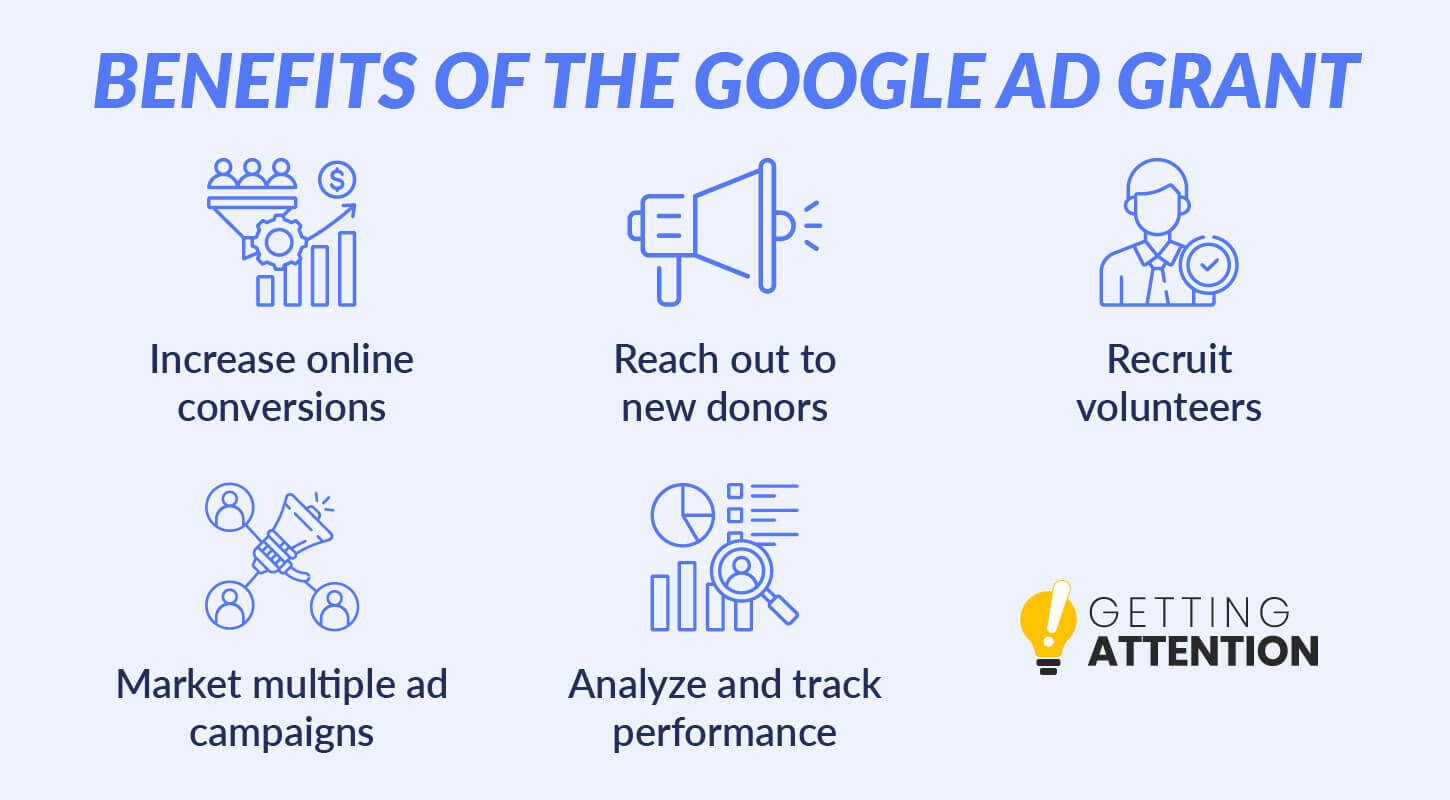

Google Ad Grants provide eligible nonprofits a $10,000 monthly stipend to spend on paid search ads, helping supplement their marketing budgets. While regular Google Ad accounts have to pay per ad click, Google Grant participants can display their advertisements for free. These ads enable your nonprofit to appear on Google when someone searches for topics related to your mission.

The ideal Google Ad Grant candidate has a website that effectively serves its audience and promotes its mission, helping drive more traffic to your website. With the Google Ad Grant program for nonprofits, organizations can:

- Increase online conversions. Create ads that encourage people to click through to your website and take action.

- Reach out to new donors. The Google Ad Grants program requires nonprofits to create ad campaigns based on their goals, such as acquiring new donors.

- Recruit volunteers. Another common campaign goal is to recruit more volunteers. Create ads based on your programs that potential volunteers in your area may be interested in joining.

- Market multiple ad campaigns. With the Google Ad Grant, you can create multiple ad campaigns that target different aspects of your marketing strategy.

- Analyze and track performance. The Google Ad Grant integrates with Google Analytics, which lets you track your campaigns and goal progress. That way, you can adjust your campaigns as you go to make sure your ads are effectively increasing conversions.

We recommend setting a daily budget of $329 to run as many campaigns as possible and take full advantage of your grant.

As long as your organization complies with the eligibility requirements, the grant renews monthly. That means your nonprofit will be allocated funding for Google Ads indefinitely.

Our Final Tip: Work With a Team of Google Ad Grant Experts.

It’s no secret that budgeting guels your nonprofit’s ability to make an impact. When you work with a Google Ad Grant professional like Getting Attention to manage your Google Ad Grant, you’ll be able to develop a strong digital marketing strategy that works for your budget. Our team of experts offers free consultations and resources to help your organization create a successful marketing plan.

Our services include Google Grant application, Google Grant hygiene, Google Grant reactivation, keyword research, and Google Grant management. Maintaining your data and keeping it clean can be a pain point for many nonprofits. We’re here to champion your nonprofit digital campaigns.

To continue learning more about nonprofit budgets and how to optimize your strategy, check out these additional resources:

- How to Create Your New Nonprofit’s First Budget. Your nonprofit’s first budget is a critical tool for both planning and managing cash flow. Learn how to set your budget up right with this guide.

- The Small Nonprofit’s Guide to Budgeting. Too many small nonprofits operate without a budget. Learn how to fund your mission with this quick guide.

- Understanding Your Finances: A Quick Guide for Nonprofits. Understanding your nonprofit’s finances will help you make smarter decisions both now and in the future. Learn how to get started with this article.

- Where can I find examples of nonprofit budgets? Review these examples of nonprofit budgets to find the one that’s right for you.