Matching Gifts: The Ultimate Q&A Guide for Fundraisers

When you hear matching gifts, what do you think of?

Maybe it’s a major donor who matches contributions made during a big campaign. As a nonprofit professional, you might’ve even participated in one of those. But did you know that there’s another type of matching gifts that can actually provide more value and are often easier for organizations like yours to benefit from? Introducing: corporate matching gifts.

Many donors, including those who give to your organization, are eligible for matching gifts through their employers. However, nonprofits often underutilize this fundraising strategy.

As a Google Ad Grants agency, we understand the power of harnessing every tool at your disposal that can help your nonprofit fulfill its mission. That’s why we’ve answered some important questions about matching gifts so you can leverage this major fundraising power. These include the following:

- What are corporate matching gifts?

- How do matching gifts differ from matching grants?

- How does the matching gift process work?

- What are corporate matching gift program criteria?

- What should the donor side of matching gifts look like?

- Is there a deadline to submit a matching gift request?

- Why are matching gifts important?

- Why aren’t more nonprofits using matching gifts?

- Which companies offer matching gifts?

- How do I get leadership support for matching gifts?

- How can I educate my team about matching gifts?

- How can my organization promote matching gifts?

- What is a matching gift database?

- How should I manage matching gifts with multiple chapters or affiliates?

- Are matching gifts the only type of corporate giving?

- Where can I learn more about matching gifts?

Ready to familiarize your team with the basics of matching gifts? Let’s jump right in!

1. What are corporate matching gifts?

Corporate matching gifts are a form of corporate philanthropy in which companies match donations their employees make to nonprofits and schools. Most matching gift programs are open choice, meaning any and all fundraising organizations can benefit without needing to have a formal, pre-existing relationship with the corporation.

That’s the simple version.

Matching gifts are essentially free money. They let donors maximize the impact of their gifts without reaching back into their own pockets. As a result, nonprofits can double or even triple their donation revenue.

2. How do matching gifts differ from matching grants?

Matching gifts are a type of corporate philanthropy where companies match donations made by their employees to eligible nonprofits. This means that when a donor gives, their employer contributes an equal (or sometimes greater) amount, effectively doubling the impact. Many companies match donations at a 1:1 ratio, but some offer 2:1 or even 3:1 matches, making it an easy way to multiply fundraising dollars without additional asks.

Matching grants, on the other hand, are generous funds put up by major donors, foundations, or corporations that will multiply the giving by any donors, often within a limited time frame. Unlike matching gifts, which are donor-driven, matching grants require nonprofits to secure contributions first to unlock the matching funds.

3. How does the matching gift process work?

Matching gift programs vary by company, but here’s an overview of the process in a nutshell:

- An individual donates to a nonprofit. A supporter donates to your nonprofit, either online, by check, or through another giving method.

- The individual checks to see if their employer will match their donation. Many companies have specific guidelines for matching gifts, such as minimum and maximum donation amounts, eligible nonprofits, and deadlines for submitting requests.

- The individual submits a request for a match through their employer. If the donor’s company offers a match, the individual must submit a request for funds, either through their company’s matching gift portal or paper form.

- The employer verifies the donation with the nonprofit. Once the donor submits the request, the employer verifies the donation and ensures it meets their program criteria.

- The employer matches the individual’s donation. After approval, the company issues a matching donation—either by check, electronic funds transfer, or through a matching gift platform. This process can take anywhere from a few weeks to a few months, depending on the company.

Understanding the matching gift process is key to unlocking this hidden source of revenue. By streamlining the experience and making it easy for donors to participate, your nonprofit can unlock thousands (or even millions) in extra funding—all without asking donors to give more!

4. What are corporate matching gift program criteria?

Many companies establish a policy around matching gifts, complete with outlined match ratios, minimum and maximum amounts, and employee/nonprofit eligibility. Let’s dive deeper into each of those categories to see which kinds of guidelines you should be aware of.

Match Ratios

Most companies match at a 1:1 ratio, which means a dollar-for-a-dollar match. However, match ratios can span anywhere from 0.5:1 to 4:1. For example, a 1:1 match on a $50 donation means $100 total, while a 2:1 match on the same $50 gets you $150 total.

Minimum and Maximum Amounts

Companies also have minimum and maximum donation amounts that they’ll match. The most common minimum amount is $25, but these amounts can vary from $1 to $100.

Meanwhile, program maximums have an even wider range, often between $1,000 and $15,000. However, amounts will still vary below and above these figures.

In order to maximize your matching gift potential, it’s a good idea to keep an eye out for programs with low minimums and high maximums. Those are going to offer the best opportunities for revenue!

Eligibility

Many companies have restrictions on the types of nonprofits and employees that are eligible to receive or request a matched donation.

For nonprofits, most 501(c)(3) organizations are eligible for matching gift programs, including educational institutions, arts and cultural organizations, environmental organizations, health and human services, and more. The most common restrictions are usually against religious or political organizations, but it’s still up to the company. Today, most programs are open-choice, meaning the employee can give (and get their gifts matched) to whichever organizations they’d like.

For employees, their eligibility also depends on the company’s guidelines. This can include full-time, part-time, and retired employees. Some companies will even match gifts made by employees’ spouses or significant others, allowing for even greater matching gift potential for organizations!

5. What should the donor side of matching gifts look like?

As you collect donations from your supporters, their experience throughout the process can determine whether you retain their support. That’s why it’s important to streamline your entire donation process, including your matching gift efforts.

Here’s how you can do so!

Evaluate Your Current Donation Process

As donors give to your organization, do they see helpful resources about matching gifts? If not, the time of the donation is a prime opportunity to educate them. This is where that embeddable matching gift search tool comes in handy! Allow donors to use the search tool during the donation stage so they can immediately take action.

Follow Up About Matching Gifts

Once donors have submitted their donation, follow up and let them know that their gift can go twice as far—and give them instructions on how they can do so. If they haven’t submitted a match request to their employer, now is a perfect time to send a follow-up email to get the ball rolling.

Again, if you choose to use a tool like Double the Donation Matching, you can automate this process. This matching gift platform will automatically email donors on your behalf with the information they need to figure out their eligibility.

You can even go beyond email outreach by calling donors. Consider making phone calls to a narrowed-down list of high-value matching gift donors who are more likely to submit a match request. Phone calls take more of your staff’s time, but being selective about who you call can add a meaningful human touch to your matching gift outreach.

Streamline Your Verification Process

While some organizations are unfamiliar with the verification process for matching gifts, the good news is that it’s simple enough for teams to manage well. Verifying the original donation with a matching gift company means familiarizing your team with the corporate giving platforms that companies are using.

Some of these top corporate giving platforms include Benevity, YourCause, and CyberGrants. Understanding the guidelines for each of these major vendors will help you respond to verification requests quickly and avoid missing out on any matching dollars. Be sure to educate your staff so they understand how the verification process works.

Thank Your Donors

Thanking your donors should go without saying, but it’s still something we have to emphasize. Use your automation tools to thank your donors not only following their donation but also after you’ve received the match from their employer. This will help you cultivate the relationships you need to continue growing and serving your mission as a nonprofit.

For high-value donors, think about even more personalized approaches to give your thanks. Handwritten letters, eCards, and phone calls from senior leadership staff are just a sampling of the channels you can use.

Reviewing how your nonprofit handles the matching gift lifecycle can help you streamline the matching gift process for donors. Make it as easy as possible for donors to submit their matching gift requests, and then follow up to make sure they understand what the next steps are.

6. Is there a deadline to submit a matching gift request?

The deadline to submit a matching gift request will vary based on your donor’s employer. Still, there are three main types of deadlines a specific program might implement. This includes requirements for donors to complete their submissions…

- Within a set number of months post-donation. A company will match a gift up to a certain number of months after the donation is made. As an example, this could be three, six, or nine months after the date of the donation.

- By the end of the calendar year. A company will match a gift within the calendar year of when the donation is made.

- By the end of the calendar year, plus a grace period. A company will match donations made through the end of the calendar year and then add additional months for employees to submit a request. These grace periods usually go through the end of January, February, or March.

However, the more time that passes after a supporter makes a donation, the less likely they will be to submit a match request. That’s why you have to promote matching gift opportunities to them as soon as possible.

7. Why are matching gifts important?

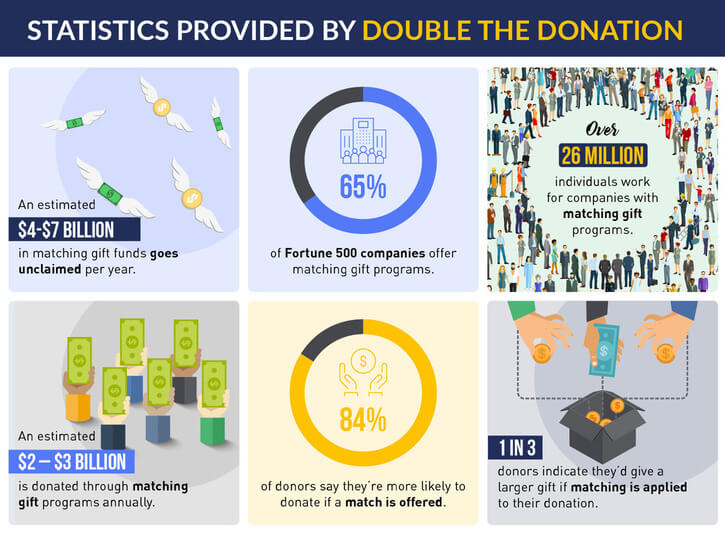

Beyond boosting your fundraising revenue, matching gifts can also help improve donor retention and engagement. Did you know that 1 in 3 donors say they would give a larger gift if a match was applied to their donation?

Just knowing that their donation will go twice as far encourages donors to give a larger gift at the outset. Similarly, 84% of donors say they’re more likely to donate if a match is offered at all. If you have a potential donor who’s on the fence about giving to your organization, promoting corporate matching gifts can give them the extra push they need to make their decision.

Here are some other eye-opening matching gift statistics to help put things in perspective:

As you can see, there are plenty of benefits that come with matching gifts. They encourage donors to give to your organization while also boosting the initial gift amounts.

8. Why aren’t more nonprofits using matching gifts?

It turns out, much of the time, both nonprofits and donors don’t know about matching gifts. And that leads to significant amounts of available revenue being left on the table.

For nonprofits, reasons include a lack of staff, resources, and time needed to zero in on matching gift revenue. Many times, organizations don’t know who a donor’s employer is or what their matching gift policy is, so they’re not of much assistance throughout the donor experience. Not to mention, manual follow-ups would require an investment of resources that many organizations simply lack.

For donors, meanwhile, most don’t even know that their company offers a matching gift program. Additionally, the process of getting their donation matched may seem way too complicated or unclear to get started with, especially without proper guidance.

The result? Approximately $4-$7 billion in matching gift funds goes unclaimed every year. That’s money that could be reinvested into nonprofits to help support their operations and spread their missions. But fortunately, solving for these issues is simple with a dedicated strategy and the tools to back it up.

9. Which companies offer matching gifts?

Good news: There are more companies that match donations than you may think.

Some of the top matching gift companies include Microsoft, Apple, Google, Home Depot, and Disney. In fact, 65% of the Fortune 500 have reported offering matching gift programs for their employers. Many of these companies offer high maximum match limits and match donations to most types of nonprofits.

For example:

- Microsoft matches up to $15,000 in donations to most nonprofits at a 1:1 ratio for full- and part-time employees.

- Disney matches up to $25,000 in donations to most nonprofits at a 1:1 ratio for full- and part-time employees.

- Apple matches up to $10,000 in donations to most nonprofits at a 1:1 ratio for full- and part-time employees.

Still, this is only a snapshot of the many matching gift companies out there. And it’s not just large corporations handing out money, either. These companies range in size and guidelines, which is why it’s essential that you understand where your donors work (and whether they qualify for the programs) to get in on this funding source.

10. How do I get leadership support for matching gifts?

Often, the first step in rallying your team around matching gifts is focusing attention on getting leadership support. Without backing from leadership, it may be more challenging to get the rest of your staff on board in the first place.

First and foremost, you need to help leadership see the value in matching gifts. This momentum will then trickle down to the rest of your staff. Double the Donation outlines effective ways to get your leadership on board with matching gifts. These include:

- Using internal data. Rather than talking about the value of matching gifts, show the impact they can have on your organization through data. Highlight information about your number of match-eligible donations versus actual submitted matches, total revenue raised from matching gifts, and the number of donors who work for matching gift companies.

- Spending time developing a strategy. Take a few hours a month to develop your matching gift strategy, and then encourage your leadership to do the same. This way, you’ll make your strategies even more effective.

- Holding short meetings with leadership. Schedule short, 15-minute meetings that respect your leadership team’s time but still allow you to demonstrate the value of matching gifts. Explain the basics of matching gifts, their impact, and their benefits. Then, schedule future meetings to report back on your progress and growth.

When your leadership is on board with your matching gift plan, your entire team will be more willing to work toward your matching gift goals. Get them excited about the prospect of a considerable revenue increase, and be sure to showcase how leveraging matching gifts effectively can get you there.

11. How can I educate my team about matching gifts?

Next, it’s time to get the rest of your team on board. Unfortunately, many nonprofits don’t spend time educating their staff about matching gift programs. This is especially true for organizations that don’t realize the impact matching gifts can have on their revenue.

That’s why we’ve rounded up some effective steps that you can take to get your team up to speed:

- Target the right staff members. This includes staff members who are in charge of campaigns and events, finances, marketing, and more. For example, campaign and event organizers can advertise matching gifts in their communications with attendees, while finance staff can track and report on matching gift revenue. Your marketing team can then promote matching gifts across all communications.

- Provide educational resources. Offer educational resources (Double the Donation offers a number of great ones for free or low cost) to educate your team about matching gifts so they’re more receptive to the information. This way, they’ll know what there is to know about matching gifts and can answer questions from donors as they arise.

- Make matching gifts part of onboarding. Train new team members on the matching gift process so they know about them from the outset. You can also give out one-pagers, set up calls or meetings, and attend webinars to help educate all current staff. Double the Donation’s Matching Gift Academy can be a great asset for this, too!

Educating your new staff members and giving those refreshers to your entire team will help make matching gifts more effective across your organization. Be sure to offer helpful resources that they can access and provide training so they’re ready to handle anything matching gift-related that comes across their desk.

12. How can my organization promote matching gifts?

We’ve made it clear that a lack of awareness is a big issue when it comes to matching gifts. So, how can your organization market matching gifts to your donors?

We’ll cover some of the top marketing methods below!

Google Ad Grants

Did you know Google offers eligible nonprofits $10,000 in monthly ad credits to promote their websites? The Google Ad Grant is a great marketing tool for promoting matching gifts.

Since the Google Ad Grant program requires you to set up ad campaigns with specific goals, you can create a campaign for promoting matching gifts. Then, you can create ads directing users to your matching gift page to encourage them to participate.

At Getting Attention, we’re committed to helping nonprofits navigate Google Ad Grants, from determining program eligibility to managing ad campaigns. We’d be happy to consult with you to determine how we can best serve your Google Ad Grant needs.

Email Outreach

Email outreach can take a few different forms: confirmation emails, newsletters, thank-you letters, and more. When you send out these types of messages, it’s important to mention matching gifts for the best results.

Here’s some text you can include in your thank-you email after a donor has contributed to your cause:

Thank you for supporting our organization! Did you know that many companies match their employees’ donations to our nonprofit? Check your eligibility and access the appropriate forms and instructions to submit a match today.

You can even include a link to learn more about matching gifts within your email!

Social Media

If your nonprofit has a strong social media presence or is in the process of building one, take advantage of post-scheduling tools to post about matching gifts throughout the year.

Social media impacts donors—in fact, 32% of donors who give online say that social media is the channel that most inspires them to give. Whether you’re using Facebook, Twitter, Instagram, TikTok, or other platforms, be sure to include links that direct supporters to the information they’ll need to submit a match request to their employer.

Double the Donation even provides its users with free, customizable social media marketing templates within the platform to help you get started!

Donation Page

When supporters are already on your donation page, that means they’re serious about donating to your cause. Since donors are most engaged at this step, this is the perfect time to promote matching gifts.

All you need to do is prompt each donor to provide their employer’s name directly within your donation form as they give—either with an optional freeform text field or using a dedicated matching gift search tool. From there, you can use your matching gift database to screen donor information for matchable transactions!

Dedicated Matching Gift Page

By creating a dedicated matching gift page, you can provide donors with general educational information about matching gifts, as well as company-specific matching gift forms, guidelines, and instructions.

Having a specific page that houses all of the information donors need will make it easier for supporters to submit a match request. You can send donors there through social media posts, emails, and other types of communication.

Matching Gift Search Tool

By investing in matching gift software that offers access to a matching gift database, you’ll hand-deliver donors updated and comprehensive information about their employer’s matching gift guidelines and forms. For the best results, this tool can be embedded in your donation forms, confirmation pages, Ways to Give pages, and more!

13. What is a matching gift database?

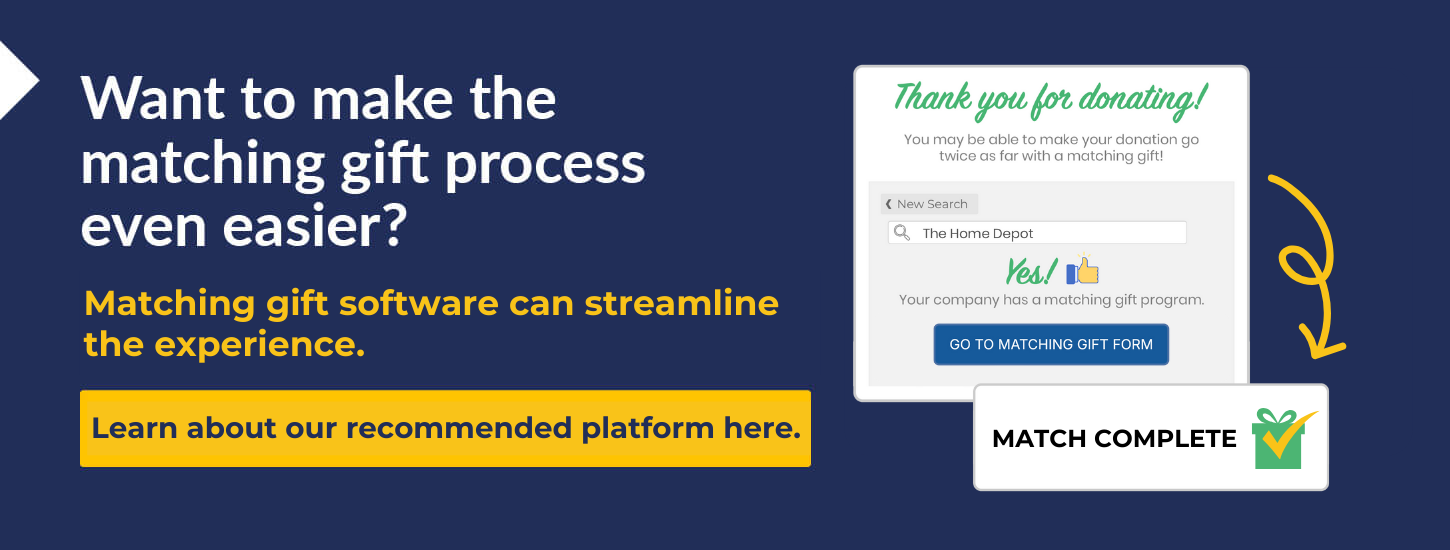

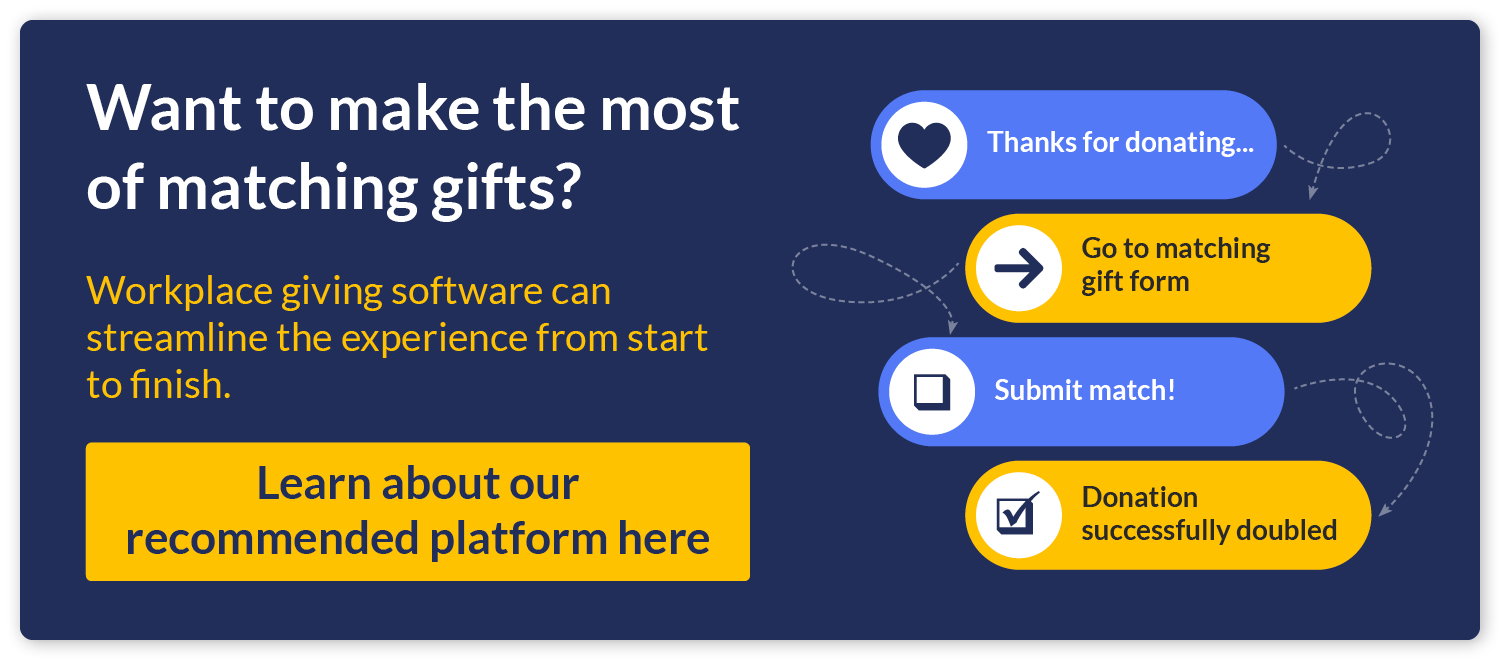

Speaking of embedding a matching gift search tool, making the investment in matching gift software can provide just the boost you need to drive those match-eligible donations to completion. More specifically, a matching gift database can give you access to information about thousands of company matching gift programs.

How does a matching gift database work?

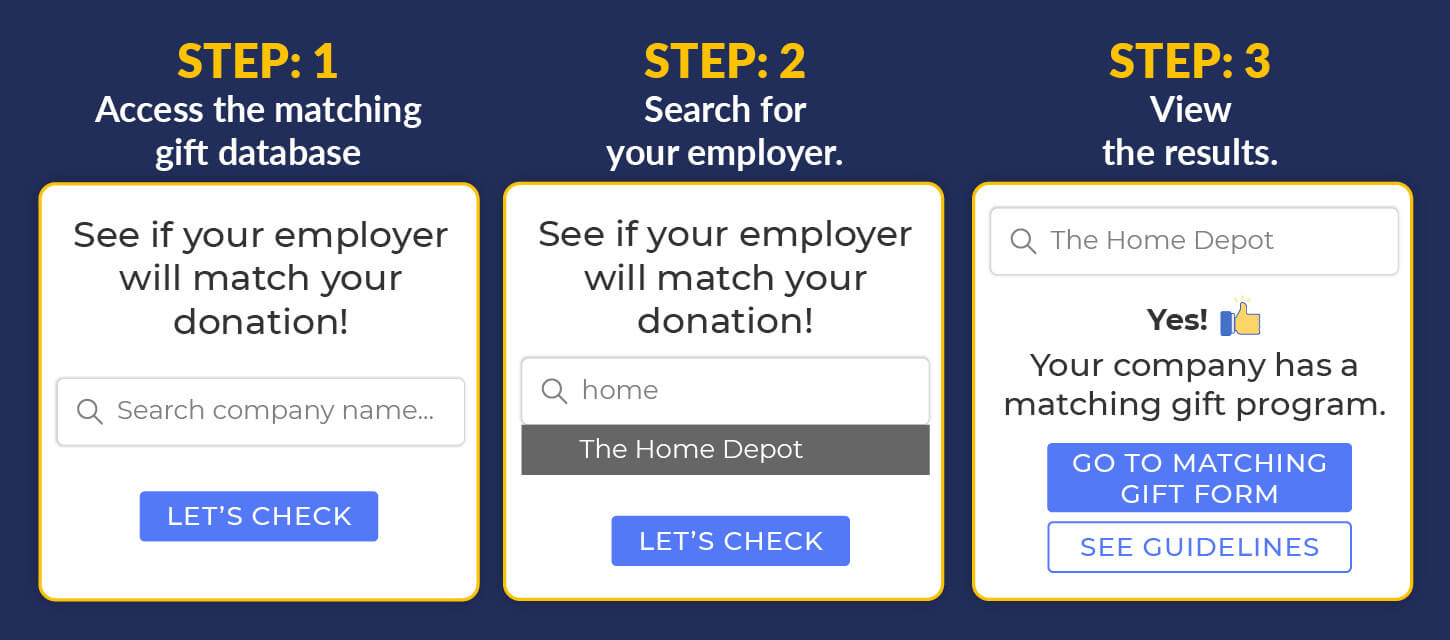

A matching gift database is easily accessible via a search tool plugin. This plugin can go anywhere on your website, including donation forms and dedicated matching gift pages, and allows donors to search for their eligibility in seconds.

Here’s how it works:

- The donor accesses the search tool on your website.

- The donor types their employer’s name into the search tool.

- The search tool then populates with information about their employer’s matching gift program.

Sounds great, right? If you’re looking for effective matching gift software, we recommend checking out Double the Donation, the leading provider of matching gift tools. After all, Double the Donation offers a powerful matching gift automation tool that empowers donors to access Double the Donation’s comprehensive matching gift database. This resource houses information on more than 24,000 companies and subsidiaries and their matching gift programs, making it easier than ever to locate the right data when you (or your donors) need it.

Double the Donation Matching also scans information donors provide during the donation process, determines their matching gift eligibility, and triggers automated emails that outline the next steps specific to the donor. Plus, Double the Donation Matching integrates with more than 100 of the leading nonprofit CRMs, peer-to-peer fundraising software, and donation software, so it’s an excellent choice if you’re already using one or more of those tools.

14. How should I manage matching gifts with multiple chapters or affiliates?

For many organizations, encouraging matching gifts means keeping track of your donors’ employers and having a set process in place for outreach. However, larger organizations that have multiple chapters or affiliates may run into issues when managing matching gifts.

For the best results, these types of organizations should consolidate their matching gift process. According to Double the Donation’s complete guide for chapters and affiliates, consolidation means that each unit will follow a central process to secure matching gifts.

Here are some top tips on how you can do this:

- Choose how you’ll consolidate. Whether this is on a national level, a regional level, or independent by chapters, you’ll want to base this decision on how consistent you want your donor experience to be and how you want reporting to take place.

- Develop an action plan. Your action plan should include understanding your current process, putting together a matching gift team, optimizing the verification process, and determining your revenue goals.

- Standardize the follow-up process. Set clear guidelines to ensure individual chapters are identifying and following up with match-eligible donors. This way, you can continue the conversation around matching gifts and create a more consistent donor experience.

These strategies can make a massive difference if your organization runs in multiple locations. A consistent process will help your teams avoid missing out on matching gift opportunities and create specific guidelines each unit should follow, all while providing a more seamless donor experience.

15. Are matching gifts the only type of corporate giving?

In addition to matching gifts, there are many other types of corporate philanthropy. From monetary grants for volunteer hours to event sponsorships and more, here are some of the top corporate giving programs:

Volunteer Grants

Also known as “Dollars for Doers” programs, volunteer grants are a type of corporate philanthropy in which companies provide monetary grants to organizations where their employees regularly volunteer.

Here’s how volunteer grants work:

- An individual volunteers with a nonprofit.

- The individual tracks their hours and submits a request for a volunteer grant with their company.

- The company verifies the hours with the nonprofit.

- The company provides a check to the nonprofit.

If you already have a dedicated group of volunteers, encourage them to check their eligibility for a volunteer grant. You might be able to get some extra corporate dollars this way.

Volunteer Time Off

Volunteer Time Off (or VTO) is a type of corporate giving program in which companies provide employees with paid time off to volunteer with nonprofit organizations. Unlike traditional PTO used for vacations or personal days, VTO allows employees to give back to their communities without sacrificing their salary or work hours.

When properly utilized, VTO can become a win-win for both businesses and nonprofits. Employees get to make a difference without financial barriers, companies build stronger community connections, and nonprofits gain valuable volunteer support to further their mission.

Fundraising Matches

Fundraising matches are similar to matching gifts in that donations are matched by a company.

The difference?

Fundraising matches apply to fundraising events, like walk-a-thons or 5Ks. The participant’s employer will then match the money the participant raises (rather than gives directly) through sponsorships or other donations.

Automatic Payroll Deductions

One of the simplest forms of corporate giving is automatic payroll deductions. Through this corporate giving program, employees have a portion of their paychecks donated to a nonprofit on a regular basis.

Specific companies may have guidelines on which organizations they’ll donate to. Typically, the organization has to share similar values with the company, like environmental causes or other issues. Once your organization has been approved, this is a great source of recurring donations.

In-Kind Donations

Many companies donate more than just money to nonprofits. Some also provide in-kind donations, which means goods or services. To give you an example, a company might donate computers, consulting services, or even food to organizations.

In-kind donations not only benefit nonprofits but also give companies a sense of pride in helping a worthy cause.

Sponsorships

One of the most impactful forms of corporate giving is sponsorships, where businesses provide financial or other support to nonprofits in exchange for recognition, branding opportunities, or community goodwill.

Sponsorships generally form mutually beneficial partnerships—companies gain visibility and enhance their corporate social responsibility efforts, while nonprofits receive essential funding or resources to further their missions.

16. Where can I learn more about matching gifts?

Now that we’ve answered the most common matching gift questions, you should have a deeper understanding of what matching gifts are. You can now start encouraging participation from your supporters and watch as your donation revenue increases exponentially.

If you need some additional information about matching gifts before you get started, we’ve compiled some helpful resources below:

- Corporate Matching Gift Programs: Understanding the Basics. Learn the ins and outs of matching gift programs with this guide from Double the Donation.

- How to Promote Matching Gifts: Reimagining Your Google Ads. Want to maximize the donation revenue you receive from matching gifts? Promote matching gifts using Google Ads.

- Matching Gifts: A Q&A Guide for Nonprofit Organizations. If you’re interested in learning even more about matching gift programs, check out this guide from re:Charity.