How to Use Matching Gift Forms 101: A Nonprofit Guide

Most nonprofits are familiar with matching gifts. But how many organizations actually pursue them with a dedicated strategy? According to Double the Donation, $4-$7 billion in corporate matching gift funds goes unclaimed every year. When 78% of donors have no idea if their employer matches gifts, the group is not completing the matching gift forms their companies require to secure corporate revenue.

In order to bridge the gap, nonprofits are taking increasingly proactive approaches to educate donors and provide them with the matching gift forms they need. We’re here to show you how to do just that. Supply donors with the right forms, streamline the request process, and drive more matches to completion.

In this guide, we’ll cover all the essentials of matching gift forms, including:

- What Are Matching Gifts?

- What Are Matching Gift Forms?

- How Can Matching Gift Software Help?

- How to Incorporate Matching Gifts in Your Donation Form

- How to Market Matching Gifts Effectively

- Inspiring Matching Gift Form Examples

In the end, you’ll know how to raise more revenue for your nonprofit by strategically promoting matching gifts. Let’s get started!

What Are Matching Gifts?

Matching gifts are a unique and impact-driven fundraising initiative in which one donation is matched by another, ultimately producing double the value. These contributions take place when a company or other entity agrees to match individual donations—either to a specific organization (such as with a one-off matching gift program) or a range of charitable missions.

While various types of programs include personal matching gifts (e.g., a generous supporter matches donations up to a certain amount for an organization during a campaign) and larger matching gift campaigns (e.g., a business, foundation, group of supporters, or another benefactor matches gifts up to a certain amount), the most common by far is corporate matching gifts. In these programs, employers match the donations their employees make to eligible nonprofits, thereby incentivizing philanthropy among their staffs.

Most companies have a set match ratio (usually 1:1, though it can be higher or lower), but lots of employees don’t know their companies even offer these programs. That’s why it’s important to promote matching gifts in your marketing strategy. Many supporters won’t know to check with their employers until you suggest it!

Generally, the corporate matching gift process looks like this:

- An individual donates to a nonprofit.

- The individual looks up their eligibility for a matching gift and accesses the forms needed to submit their request (this is a big part of it, and the purpose of this article!).

- The individual submits the match request to their employer.

- Their employer reviews the request and verifies the donation with the nonprofit.

- The employer matches the donation.

But as you get into the nitty-gritty details of matching gift policies, there are a few other things you need to keep in mind.

Eligibility

Both your donors and your organization have to be eligible for a matching gift. First, donors should confirm that their employment status (full-time, part-time, or retired) allows them to submit a match request. From there, you’ll want to verify that your organization falls into one of the specific nonprofit categories the company donates to. (Hint: most registered 501(c)(3) organizations will qualify!)

Minimum and maximum gift amounts

Most matching gift companies establish a limit on the amount of money they’ll match, typically stating the maximum each employee can request each year. Businesses also determine a minimum amount, though this is generally set at around $25 or less.

For an employee’s matching gift request to be approved, their recent gift should fall within the threshold their company has defined.

Match ratios

Though it ranges from one company to the next, most employers offer a dollar-for-dollar (or 1:1) match, with most ratios ranging from .5:1 to 4:1.

Before a donation can be matched, all of those considerations must be addressed. That’s where matching gift forms come into play!

What Are Matching Gift Forms?

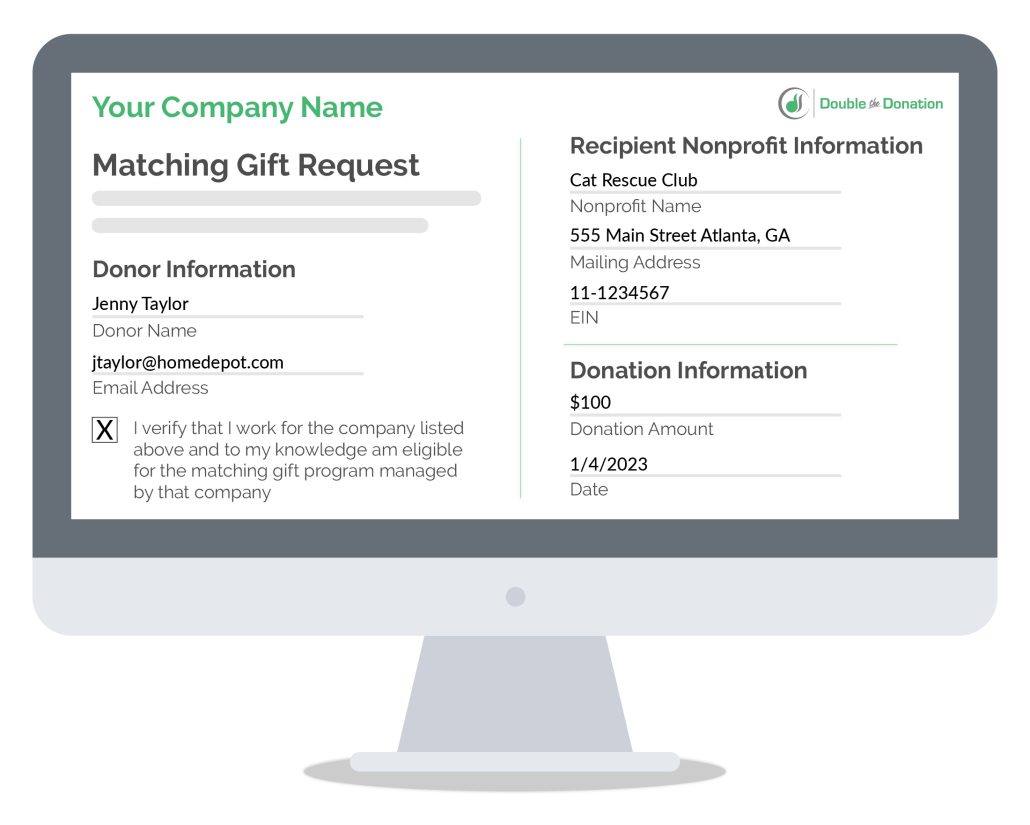

Matching gift forms are a specific type of document completed by an individual donor and used by a matching gift company to review the individual’s eligibility. This form generally captures specific information regarding the donor, their recent gift, and the recipient organization to ensure the requested match adheres to the company’s program guidelines.

As donors initiate their requests, there are a few kinds types of matching gift forms they might expect to use: paper, electronic, and automated. Let’s take a look at each format below.

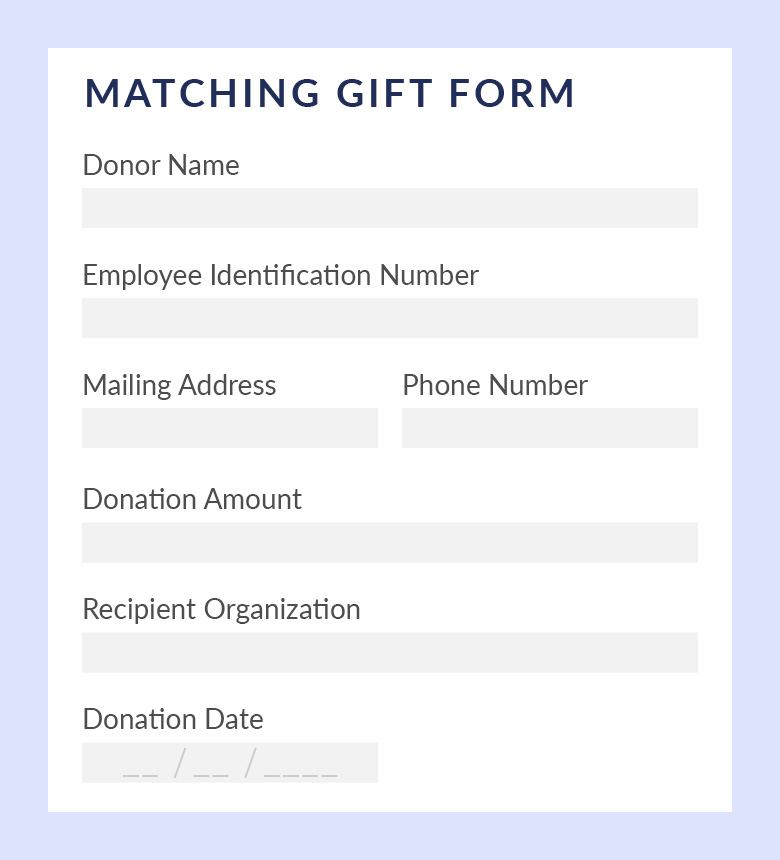

Paper Matching Gift Forms

While paper matching gift forms aren’t very common these days, it’s still important to offer access to a paper version if it’s available. This is especially crucial for older supporters who prefer paper materials or for certain (though few) companies that require them.

Regardless, the paper form includes the following key components:

- Donor Name

- Employee Identification Number

- Mailing Address

- Phone Number

- Donation Amount

- Recipient Organization

- Donation Date

Here’s how it works: The donor will typically need to provide official documentation of their gift (such as a donation receipt, which your nonprofit will need to create), as well as information about the type of organization (cultural, educational, etc.) and the donation date.

Once the paper form has been filled out, the donor can submit it via the employer’s preferred method (mail, fax, etc.), and the company will review the request.

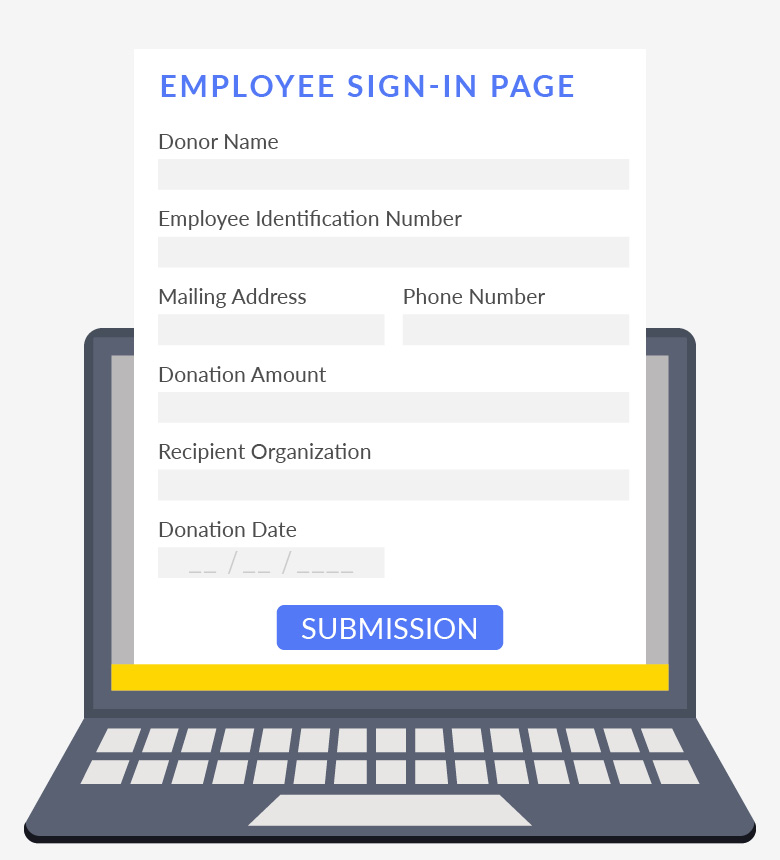

Electronic Matching Gift Forms

Electronic matching gift forms make it easier for employees to submit their matching gift requests, which is great for your organization! The entire process is more streamlined, which results in more donors filling them out.

Plus, electronic forms can be used in conjunction with matching gift software (more on that below), which nonprofits use to encourage matching gift request submissions and automate the entire process.

Here are the key components of electronic matching gift forms:

- Employee sign-in page: In order to access their employer’s electronic matching gift forms, employees typically need to sign into the company website using their employee username and password. Retirees might have to register and log in using a third-party company, but from there, it’s pretty simple to navigate.

- Submission form: Similar to paper forms, employees will be asked to provide information about their donation. This might include the recipient organization’s name and info along with the donation amount and date.

Once the electronic form has been submitted, the employer reviews it and determines whether the donation is eligible for a match. Then, your organization will need to verify the donation for the matching gift company by confirming receipt of the original gift and verifying your 501(c)(3) status.

Automated Matching Gift Forms (From Double the Donation)

The final category of matching gift forms are those exclusive to Double the Donation, the industry’s leading provider of matching gift software. They’ve recently rolled out a few new types of matching gift forms that can make a significant difference in overall program participation rates.

These include Double the Donation’s standard matching gift form (for one-off matching gift programs*) and complete auto-submission functionality (for companies using CSR platforms that integrate with 360MatchPro).

From a donor’s perspective, the key difference between this type of automated submission is that the request process takes place entirely behind the scenes. In fact, the donor is not required to provide additional information about their donation to complete their match submission. Instead, Double the Donation leverages data from the transaction record itself, along with details provided directly by nonprofit organizations, to complete the form behind the scenes.

All the donor typically needs to do is enter their corporate email address to verify their identity and authorize Double the Donation to submit a match request on their behalf. From there, the standard match form is automatically completed and emailed to the donor’s employing company to review, approve, and disperse funding as usual.

*One-off matching gift programs are a unique form of corporate matching gifts in which a company partners with a single organization to encourage employee giving to the cause. It’s a great way to engage companies that don’t currently offer standard matching gift programs but are interested in growing their philanthropy. Check out Double the Donation’s complete guide on the topic here!

How Can Matching Gift Software Help?

You might have heard the term matching gift software floating around in the fundraising landscape. But has your team ever invested in or really considered these options?

Most leading matching gift software solutions (including our top recommendation, Double the Donation) encompass a few key components.

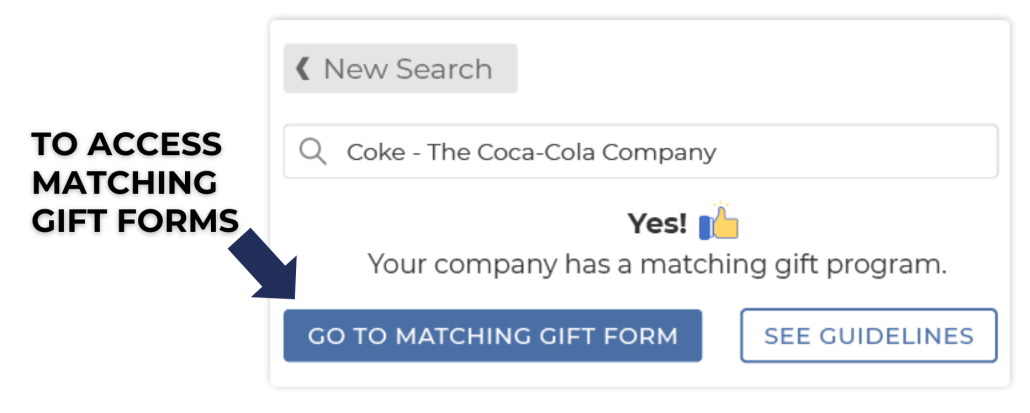

Donation page widget or search tool

A matching gift database houses information on thousands of companies that offer matching gift programs. This means the database includes details about the company, their match ratio, minimum and maximum amounts, and, most importantly, a link to their matching gift form.

Through an embeddable search tool that can go anywhere on your website, donors type in the name of their employer. The tool then pulls up all of the info they need about submitting a match request.

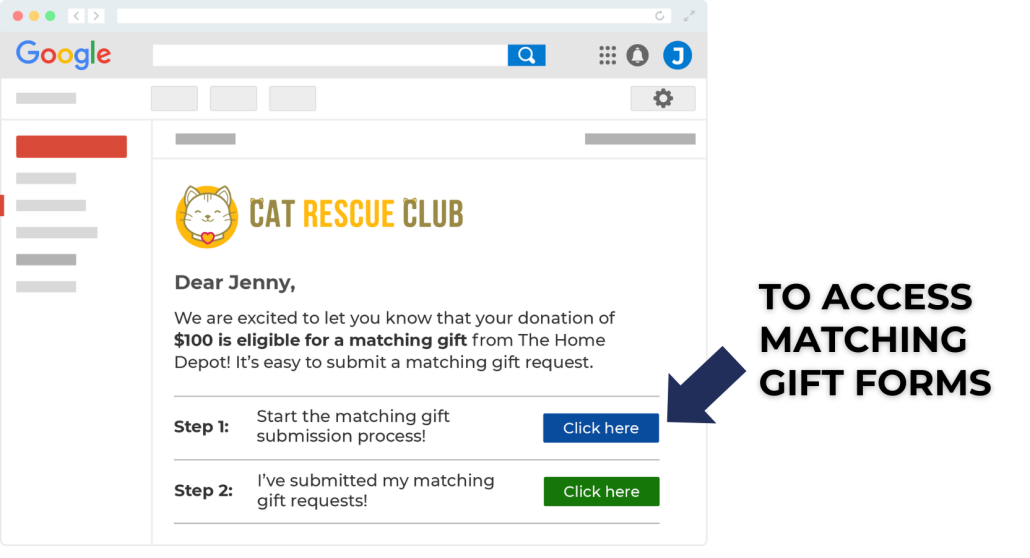

Automated email follow-ups

Some matching gift software automates the entire process. When a donor makes a gift to your organization using a form equipped with this type of tool, the platform automatically scans the information they provide to determine if they qualify for a match.

Then, depending on their eligibility, the platform triggers outreach outlining the next steps the donor should take. For match-eligible individuals, emails generally contain the recipient’s company-specific program guidelines, links to the appropriate matching gift forms, and encouragement to complete the process.

When choosing matching gift software, you’ll want to look at a few different factors:

- Level of database comprehensiveness, to ensure maximal donor coverage

- Number of matching gift forms, to simplify the submission process and drive more matches to completion

- Data accuracy and recency, to enhance the quality of the information provided to donors and produce more completed matches

- Search tool ease of use, to provide a positive user experience for your donors interacting with the widget

- Integrations with current fundraising software, to streamline the onboarding and data management processes

Once you’ve settled on a solution, you’re ready to get started!

If you need a little extra advice, our suggestion is Double the Donation’s complete automation system, 360MatchPro. (Take our word for it! Get a demo of Double the Donation here.)

Double the Donation is the leading provider of matching gift solutions. Its matching gift database has collected data on more than 24,000 companies and subsidiaries, along with each one’s matching gift program information. These businesses employ nearly over 26 million individuals, who make up an estimated 99.68% of all match-eligible donors.

TLDR: You’re likely already aware that the right tools can boost your nonprofit’s ability to raise support and donations for its cause. When you employ matching gift tools alongside your donation form, you can further heighten your chances of receiving matching gifts!

How to Incorporate Matching Gifts into Your Donation Form

When people come to your donation page, they’re seriously considering donating to your organization They’re engaged with your mission and therefore receptive at this time to learning about matching gift opportunities.

Take the following scenario to help this point:

Joe, a prospective donor, visits your donation page, ready to make a gift to your organization.

While on the page, Joe notices a search tool on the donation form that says, “See if your employer will match your donation!”

Joe types in the name of his employer (Microsoft), and Microsoft’s matching gift guidelines and a link to the form come up on his screen.

Joe completes his donation and fills out the electronic form to submit a match request.

This is one of several ways you can incorporate matching gifts into your donation process. Alternatively, you can embed your matching gift search tool into your…

- Donation page

- Confirmation page

- Dedicated matching gift page

- Ways to give page

- And more!

From there, an automation platform will automatically follow up with match-eligible donors and encourage them to submit a matching gift request. Using tools like these, such as Double the Donation’s 360MatchPro, you can:

- Make it easier for donors to access the matching gift forms they need.

- Boost the number of matching gift forms ultimately submitted.

- Grow your organization’s matching gift revenue.

- Increase engagement and individual generosity among donors.

Incorporating matching gifts into your donation form and giving process will raise even more awareness around matching gifts. And that’s exactly what needs to happen if you want donors to submit their match requests!

How to Market Matching Gifts Effectively

So you’ve invested in matching gift software and paved the way to start accepting matched gifts. But, besides promotional tactics on your donation page, how do your donors know to get on board?

Like any other opportunity to give, your nonprofit must do its part to inform supporters and request their donations by spreading the word about your fundraising efforts. The good news is that the message about matching gifts can be incorporated into all of your classic marketing channels. Here’s how!

Social media:

Especially since matching gift forms and the right software make the process so easy, a quick explainer post about matching gifts on your social media channels can encourage followers to check their eligibility and submit a request!

Email marketing:

Whether you’re sending a post-donation acknowledgment or scheduling a mass digital newsletter, your organization’s email communications provide an excellent opportunity to promote matching gifts to your audience. It’s impactful, cost-effective, and can be automated with your matching gift platform.

Your website:

Create a page dedicated solely to matching gifts. Include everything your site visitors need to know, like a definition of matching gifts, the most frequently asked questions, your organization’s contact information and tax identification number, and your embedded matching gift database.

The Google Ad Grant:

If you’re already leveraging Google’s Ad Grant program for nonprofits to draw more traffic to your website, it’s a great place to increase visibility and awareness of matching gifts. If you haven’t already taken steps to secure $10,000 worth of free advertising space for your organization, now’s a good time to look into it. Then, use your credits to promote your matching gifts page or donation form!

Flyers and promotional materials:

Pique supporters’ interest by adding a small section or reminder about matching gifts in any of your promotional materials. Include a link on your fundraising flyers or promotional posters to more information about matching gifts so supporters are reminded to check into it.

Inspiring Matching Gift Form Examples

Interested in exploring the process donors will take to request matching gifts on your organization’s behalf? We’ve pulled a sample entry for you.

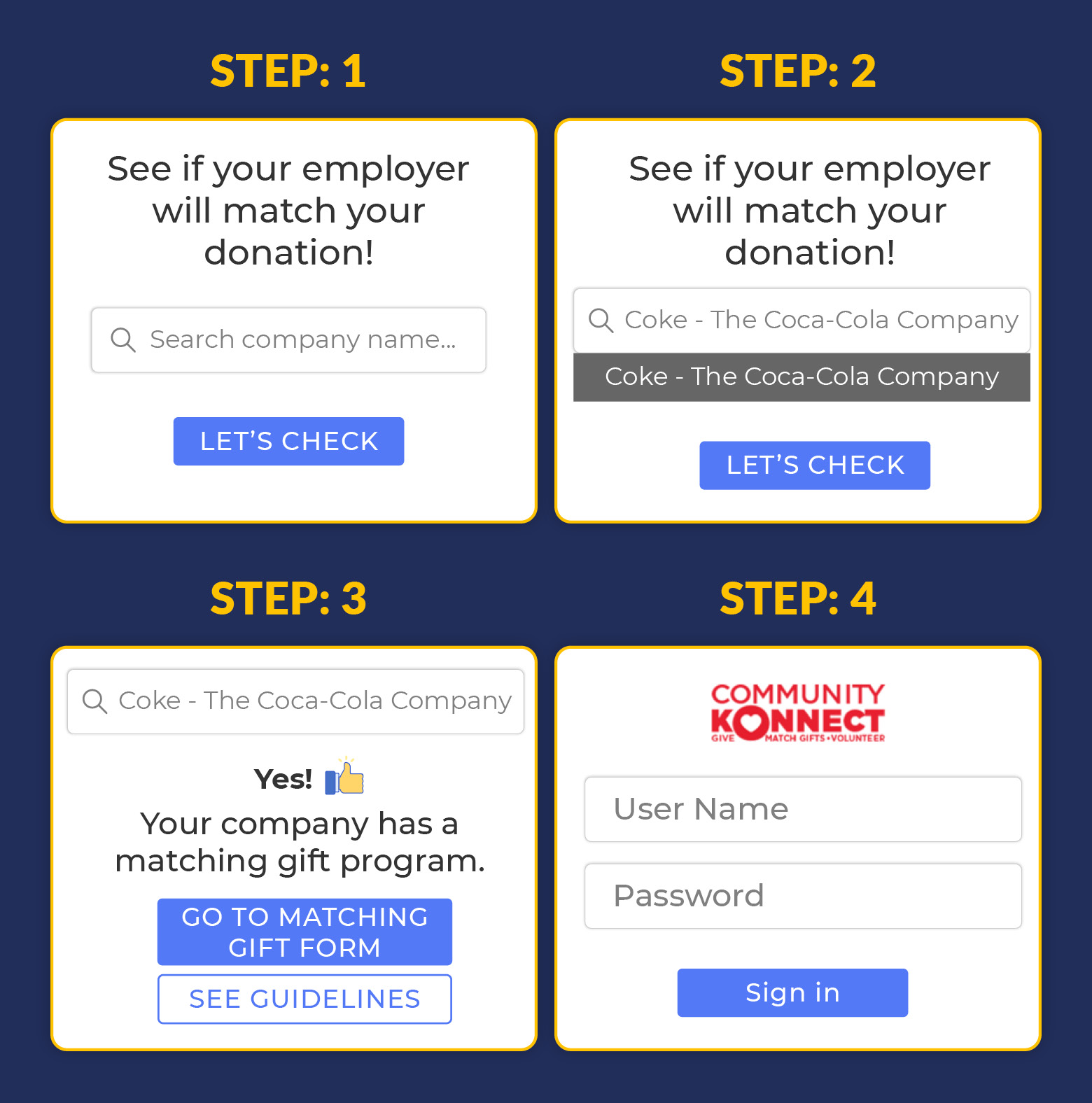

- Step #1: A donor locates the matching gift search tool plugin on a nonprofit’s website or donation form.

- Step #2: The individual types the name of their employer into the search tool and selects the appropriate company.

- Step #3: Their employer’s matching gift program information populates, offering a direct link to the electronic matching gift form (or an option to auto-submit the request from the giving page).

- Step #4: The donor logs into their company giving portal to access the matching gift form and submit all of the necessary information.

From there, your nonprofit will be on its way to securing more matching gift revenue!

Final Thoughts & Additional Resources

Understanding how to use matching gift forms is essential for your nonprofit. For the best results, your team should be able to guide donors to their correct forms, provide additional support when requested, and raise more revenue for your cause as a result.

When you use matching gift software to streamline this entire process, you’ll make it easier on donors and yourself.

To learn more about matching gifts, top companies that offer the programs, or corporate giving in general, check out the resources below!

- 14 Important Questions to Ask About Matching Gifts. Are you still trying to wrap your head around matching gifts? Ask yourself these important questions.

- Top 30 Matching Gift Companies: Find Your Match. Check out this list of the top matching gift companies from 360MatchPro.

- Corporate Giving Programs: The Ultimate Fundraising Guide. Matching gifts are just one type of corporate giving program. Learn about even more programs with this awesome guide from Double the Donation.