You’ve worked hard to build an organization that fulfills its mission and makes a difference for the community you serve. However, your work can’t reach its full potential without a strategic nonprofit marketing plan. Outlining a plan is critical for meeting your audience’s needs and driving meaningful conversions.

Whether you’ve never created a dedicated plan before or you want a refresher, we created this guide to walk through the following topics:

When it comes to representing your mission, reaching your goals, and driving conversions, your team needs a definitive nonprofit marketing guide. Let’s dive into an overview of nonprofit marketing plans.

What Is a Nonprofit Marketing Plan?

A nonprofit marketing plan is a dedicated document that helps marketing teams create promotional materials, stay consistent with branding and goals, and reach target audiences effectively.

This document should be available to everyone in your organization so that no matter the campaign or event you are promoting, your messaging and tactics support your core mission. By maintaining consistency and having a strategic plan you can better communicate with current supporters, acquire new ones, generate sales, and keep all team members on track to reach your goals.

Why Is a Strong Nonprofit Marketing Plan Important?

A strong nonprofit marketing plan should consist of much more than just guidelines for picking the right outreach channels. A well-crafted plan helps nonprofits focus their efforts, allocate resources, and measure results. It’s also essential to document objectives, strategies, and tactics to guide your marketing team and ensure that they’re staying on track.

When you take a comprehensive approach, your nonprofit marketing plan can:

Provide clarity to your team. No matter what, your team should never lose track of its mission and goals. Your nonprofit marketing plan should outline this information so that your team can communicate it to stakeholders.

Keep tasks and team members organized. Whether you’re sending out email blasts, creating flyers, launching an SEO strategy, or engaging with donors on social media, marketing campaigns can be overwhelming. A concrete plan eases that stress with guidance on when and how to complete each needed step.

Focus on reaching your audience. The goals of various marketing campaigns can vary but often include building relationships with your audience, bringing awareness to your mission, increasing sales, and inspiring action from supporters. Your nonprofit marketing plan will walk through your target audience’s motivations as well as the most valuable channels for contacting them.

You won’t be able to accomplish all of this without a well-crafted and developed nonprofit marketing plan. The plan will outline the exact tasks that need to be done, the steps each will take, and when they should be completed.

What Are The Essential Components of a Nonprofit Marketing Plan?

When it comes to your nonprofit marketing plan, be as thorough as possible. Don’t leave any stone unturned to ensure clarity for team members and fill in any gaps in outreach methods.

While your specific marketing plan will be unique to your mission and campaign, several core components will still need to be included.

Overview of The Organization

When crafting your plan, start with the basics of your organization. Think about the foundation on which your organization is built. Then, define elements, such as your:

Mission statement — Your mission statement should summarize why your organization exists, the audience you serve, and how you serve them. Mission statements provide direction for your team members and remind supporters of your nonprofit’s purpose. For example, the ASPCA’s mission statement is “to provide effective means for the prevention of cruelty to animals throughout the United States.”

Key stakeholders and nonprofit staff structure — Define both internal and external stakeholders, including board members, paid staff, program directors, volunteers, donors, customers, and members. This helps you define your audience, assign responsibilities, and reach out to third parties who may need to be consulted.

Goals — What exactly is your organization hoping to accomplish? Outlining both long-term and short-term goals can be helpful for your nonprofit marketing plan. This ensures that immediate objectives help support your overarching annual plan.

Priorities — As you outline your goals, rank them in terms of priority. For instance, if your nonprofit sells products or services, you may need to decide which of your offerings to focus on promoting. You might heavily market new product offerings to bring in new customers or focus on your staples to grow and retain your core base.

Communicating the basics of your organization will give everyone a solid understanding of your mission and what your marketing campaign hopes to accomplish. In turn, your messaging can communicate those aspects accurately.

Audience Overview

Your goal should be to motivate your audience to take action, and that starts with knowing who you want your marketing to reach. As you fill out this section of your nonprofit marketing plan, define the following elements:

Current audience — What types of people currently support your organization? Look at your nonprofit’s database and determine if there are any commonalities. List out the types of people and entities that consistently donate, buy from, and support your organization.

Target audience — Who are the people you are trying to reach? For each marketing push, you should have a specific audience in mind. For example, a nonprofit selling professional development courses might serve both individuals and organizations and would need to determine how to market to each group separately.

You create personas for prospective customers using data about your current customers, like their ages, traits, employers, preferred communication methods, and giving preferences. Knowing who currently supports your work and who else you’d like to reach will enable you to connect with the widest audience possible. Even if you already have a strong base of support, you likely want to grow your organization, which is where defining your target audience comes in handy.

Messaging and Communication

Think critically about how you want to present your nonprofit in its messaging. This will set the tone with your audience and establish your brand image. Some key communication elements you’ll want to define in your nonprofit marketing plan include:

Language and tone — Make sure your language and tone match your mission and audience. For instance, if your organization is focused on education and helping children, you might take on a more friendly and casual tone. Consider including some examples of phrasing or word choices in your plan to make it even easier for your marketing team.

Calls to action — With your nonprofit’s goals in mind, what are the types of actions you want your target audience to complete? This can range from giving a gift, buying your products and services, signing up for newsletters, or taking another action to show support.

Branding, color, logo, font — While the aesthetics of your marketing materials might not seem as important as your messaging, it’s crucial that your branding and other design factors are consistent. This ensures that audience members can recognize your organization as soon as they see your marketing content.

Tactics and marketing channels — How are you going to use your audience and messaging to promote your mission? Your nonprofit marketing plan should outline specific tactics (like donor-segmented email lists) as well as the channels you’ll use.

Marketing calendar — You’ll likely release content and launch campaigns throughout the year, so it makes sense to include a marketing calendar within your dedicated plan. Schedule email blasts, social media posts, blog publications, and any other marketing materials that will be released.

Reporting and analytics method — No marketing plan is complete without a valid way to track performance. Make sure you have reporting and analytics set up so that you can follow a campaign’s success and learn about the tactics that made it thrive and the factors that can be improved.

It’s easy to look at these components and think you can fill them out at once. However, it actually takes careful planning and data analysis to accurately determine factors like the most valuable goals to target and which marketing channels to use.

8 Steps to Create a Nonprofit Marketing Plan

With the basic elements of a solid plan in mind, you can move forward with drafting your plan. We’ll break it down into eight easy steps, ensuring you include all of the essentials.

1. Review Past Performance.

Before you really get into the nitty-gritty of your nonprofit marketing plan, take a moment to reflect on your current standing and past performance. To ensure your marketing plan is as valuable as possible, determining what has and hasn’t worked in the past is your best bet.

Review your previous marketing efforts and ask yourself the following:

Did you achieve your desired goals and objectives?

What was the most successful part of this strategy or campaign?

What KPIs did we track? Did they accurately represent the campaign’s success?

What didn’t go as expected with the campaign?

What could we do differently in the future, or what strategies should we test to improve performance next time?

What strategies and outlets should we use again in future campaigns?

Can any marketing materials (such as photographs, videos, or written content) be repurposed for future campaigns?

Analyzing data, having a sense of your past efforts, and determining the gaps in your strategies will help determine how you can improve your next campaign. If you’re not sure where to start, consider working with a nonprofit marketing consultant.

How to Conduct A Nonprofit Marketing Audit

Along with reviewing past performance, you can even conduct a more in-depth marketing audit. Start by collecting various marketing assets and resources. That way, you’ll have all the information in one place and will be better able to consider your options.

From here, we recommend conducting a SWOT analysis. This method is a strategic planning technique used to help a person or organization identify strengths, weaknesses, opportunities, and threats related to competition or project planning.

Here’s a breakdown of this approach:

Strengths: List anything your nonprofit excels at and separates it from other similar organizations. These might include an exceptionally loyal base of donors, a skilled staff, or unique services.

Weaknesses: This refers to the internal characteristics of the organization that put it at a disadvantage compared to its competitors. This category could include things such as vacant staff positions, a lack of name recognition, or limited resources.

Opportunities: This refers to external factors that could be beneficial to the organization. These could include things such as grants received, a growing market, or new technology.

Threats: Name any external factors that could negatively impact your work. For example, these could include a reduction in government funding, an increase in competition, or economic turbulence.

Knowing what’s actively working to help you and what’s working against you will help you craft a holistic nonprofit marketing plan. After completing your analysis, create an action plan based on what you discovered in your audit. What’s working? What could be improved? Where are the gaps? What’s your unique value proposition that other organizations can’t bring to the table?

In many cases, your internal marketing team can successfully conduct a marketing audit. If this is your first time or you don’t have an established team yet, consider working with a professional marketing consultant.

2. Establish SMART Goals for Your Nonprofit Marketing.

Once you have an idea of your past marketing performance, your current resources, and relevant data trends, you can move forward with setting actionable goals.

Your goals should be carefully chosen and aimed to drive meaningful conversions that support your overall mission. That’s why we recommend using the SMART goal-setting method:

Specific: Your goal should be as specific as possible — focus on one thing rather than trying to accomplish multiple things at once. If it’s a fundraising goal, set a monetary amount; if it’s a conversion goal, determine the rate at which you want to increase actions.

Measurable: Goals are only useful when you can measure their success and progress. Make sure your goal has metrics attached that allow you to assess your progress toward your goal. This way, if you notice rates dropping, you can adjust your strategies.

Attainable: To push your team while ensuring you can achieve your goals, look at your past results, and aim for a slightly higher objective. If your goals are so high they seem impossible to reach, they can be demotivating. For example, if you currently only have 10,000 Instagram followers, it’s much more attainable to set a goal of increasing that number to 20,000 than 1 million followers.

Relevant: Your goals should be stepping stones to fulfilling your organization’s mission. Make sure that every goal you set is helping you get where you want to go.

Time-based: Making sure you have a deadline for when you’d like to meet your goal further motivates you to achieve it. Even if you don’t accomplish your goal by the deadline, this information can help you plan future campaigns and strategies.

Following this framework will allow you to set clear objectives that drive action. Otherwise, you may end up with overly generic goals like “raise more donations” or “get more social media followers.”

Examples of SMART Marketing Goals

If you need help brainstorming potential primary goals, here are some core ideas to kickstart your creativity:

Note that you’ll need to take these primary goals and get more specific to give your team concrete numbers to work toward.

Let’s look at a more specific example. Here’s an example of a SMART goal you might set for your nonprofit to increase awareness of animal welfare:

“By the end of this year, we’ll aim to increase email list sign-ups from 1,000 to 1,300 subscribers. In turn, we’ll raise awareness of shelter overcrowding and animal homelessness. To track our progress, we will record sign-ups and create reports biweekly.”

Or, for a nonprofit looking to earn new customers, a goal might be:

“This year, our organization will expand sales lead from search engine traffic by 20% through a dedicated SEO strategy. Our primary metric will be conversions, but we will also track overall traffic and keyword rankings.”

These goals are time-based, have specific and attainable targets, are relevant to the organization’s missions, and include how their success will be measured.

https://gettingattention.org/wp-content/uploads/2023/04/nonprofit-marketing-plan_compressed-feature.jpg4991034Jessica Kinghttps://gettingattention.org/wp-content/uploads/2021/08/getting-attention-logo.svgJessica King2025-03-31 10:10:032025-06-13 15:18:13Create a Winning Nonprofit Marketing Plan in 8 Key Steps

Are you looking to drive traffic to your nonprofit’s landing pages without breaking the bank? The Google Ad Grant program will help you do exactly that! After completing the Google Grant application process, you’ll receive $10,000 every month to spend on Google Ads.

Whether you’re an advocacy organization looking to boost petition signatures or an animal shelter aiming to increase volunteer signups, Google Grants can empower your nonprofit to broaden its reach, enhance its search visibility, and drive conversions at exponential rates. As long as you meet all of the Google Grant requirements and follow the proper steps, you’ll get your application approved in no time.

In this guide, we’ll dive into the basics and steps of how to apply for Google Grants! Here’s what we’ll cover:

At Getting Attention, we’re a Google-certified Google Ad Grant Agency devoted to helping nonprofits make the most of the Google Ad Grants program. We know exactly how to apply for Google Grants and get approved on the first try. Let’s start our journey by answering some of the most common questions that nonprofits have about the program.

Google Grant Application FAQs

Before diving into the required steps for applying for Google Grants, let’s run through a few of the most common questions that nonprofit professionals have when they first start looking into the program.

What is the Google Grant?

The Google Ad Grants program enables nonprofits to acquire valuable search engine ad space at no cost. The grant supplies eligible organizations with $10,000 in Google Ad credits every month to put toward driving traffic to their websites’ most important content.

Since Google generates more than 80% of desktop search traffic in the United States alone, this program has the potential to boost your nonprofit’s visibility and generate more support for your cause. All you have to do is follow the required Google Grant application process and get approved.

Google Grants can benefit nonprofits in a variety of ways, including:

Increasing conversion rates

Attracting new donors, volunteers, and other prospects

Engaging and strengthening relationships with existing donors

Marketing multiple ad campaigns simultaneously

Analyzing and tracking campaign performance

Learning the needs of online supporters and how they prefer to engage

Action Against Hunger is one of many nonprofits that have benefited from the program, driving 158,000 visitors to its website and raising over $66,000 in just 12 months thanks to Ad Grants. However, the Google Grant has several specific guidelines that determine an organization’s eligibility to participate in the program.

How do I get a Google Grant?

There is a pretty lengthy Google Grant application process that your nonprofit must follow, from verifying eligibility to creating relevant accounts to producing your first ad campaign.

The goal is to confirm that you’re a trustworthy nonprofit that will benefit from the program and promote content users will find valuable. To save time and ensure that your application gets approved the first time around, consider getting guidance from a Google-certified Google Grant experts like Getting Attention.

How long will it take to apply for Google Grants?

The actual Google Grants application itself doesn’t take long to fill out or get approved. However, you’ll need to complete some pre-qualifying steps that may take some time.

For instance, if you’re already registered with Google for Nonprofits, the Google Grant application process will likely take anywhere from 2 to 14 days. Otherwise, you’ll need to apply and await for approval for a Google for Nonprofits account first.

4 Steps to Apply for Google Grants

To set you up for success, let’s explore each step in the Google Grants application process in more detail:

1. Check your Google Grants eligibility status.

To qualify for a Google Ad Grant, your organization must meet several criteria. Check your eligibility upfront to ensure that the time and effort you invest in the application process pay off.

Given that the program is available in over 50 countries, be sure to locate the specific guidelines of your current location. In the United States, the following is required to be eligible:

A current and valid charitable status, which in the United States means registering as a 501(c)(3) organization with the IRS.

A functional website containing valuable content that is relevant to the nonprofit’s mission.

Adherence to Google Grant program policies, including registration with Google for Nonprofits.

An SSL (Secure Sockets Layer) certificate, indicating that your online domain is secure.

Outside of these eligibility requirements, there are specific types of nonprofits that are ineligible, regardless if they meet the above requirements. These include:

Government entities and organizations

Hospital and healthcare organizations, though nonprofits working in the healthcare space (such as breast cancer research or Alzheimer’s awareness organizations) are still eligible

Schools, academic institutions, and universities, though philanthropic arms of educational institutions still qualify

If your organization falls within one of these ineligible categories, consider conducting further research into similar initiatives that do apply to your nonprofit. For example, Google for Education offers separate benefits for educational institutions.

However, if your organization does not fall into one of the above categories, you’re free to apply for the Google Ad Grant! For example, if your church is looking to reach out to the community for more congregation members, consider applying for this program.

Additional Google Grant application requirements

Once you’ve evaluated your initial eligibility, you’re almost ready to start moving through the Google Grant application process. However, there are a few more requirements you should meet before you officially get started.

Some of the most important Google Ad Grant requirements include:

Ensuring your site does not already contain revenue-generating ads, such as Google AdSense.

Having the ability to manage Google Ads campaigns, meaning you’re able to evaluate keywords for relevancy, accuracy, and timeliness on a regular basis.

Doing as much preparation as you can upfront will help you move through the actual application much quicker.

2. Create a Google for Nonprofits account.

The next step is to register for a Google for Nonprofits account. Beyond Ad Grants, Google for Nonprofits offers an array of advantages for growing awareness for your mission. Some of the most useful perks you’ll receive include:

The YouTube Nonprofit Program, which empowers nonprofits to spread the word about their organization through visual storytelling. Using videos as a method for telling your nonprofit’s story will inspire empathy for your cause, form connections within your community, educate mass audiences, and much more.

Google Earth and Maps, which helps share compelling data visualizations and highlight your organization’s impact.

Google Workspace, which offers complimentary access to Google’s most useful apps, such as Gmail, Docs, Drive, Calendar, and Meet.

If this seems like an offer you can’t refuse, follow these steps to successfully apply for a Google for Nonprofits account:

Fill out the subsequent forms, including contact and organization information.

Submit your request and await a response!

When you request a Google for Nonprofits account, Google’s verification partner, Goodstack, will verify your organization’s eligibility.

Make sure you’re signed in with an email address that you check frequently when you create your Google for Nonprofits account. Whatever address you use is where Google will send updates about your account, which also include any outreach about your Google Ad Grants account once you get it up and running.

3. Prepare your website for your Google Grant application.

When you apply for Google Grants, they’ll require you to submit your website, then they’ll evaluate it to ensure you have useful content that users will find trustworthy.

Google will run through a checklist of conditions regarding the quality of your website before approving your application. Beyond getting your Google Grant application approved, improving your nonprofit’s website will help you develop much more valuable ads that users will actually interact with.

Let’s explore a few website optimization tips that will maximize your application chances.

Include your EIN and mission statement

Google requires you to have a clear description of your organization, its mission, and its activities on your site. Doing so is not only crucial for getting your Google Grant application approved, but it also improves your credibility with website visitors and helps them determine whether their values align with your work.

While Google doesn’t require you to display your EIN (in the case of U.S.-based nonprofits), doing so doesn’t pose any security threats. It simply shows that you’re a registered 501(c)(3) organization to anyone who might be considering donating, volunteering, registering for an event, or sharing any sensitive information with your team.

You can display your EIN by including it in your website’s footer, so it will automatically show up on every page of your site without interfering with your website’s design.

Implement the proper security measures for your website

To meet the Google Grant requirements, your nonprofit’s website needs to be secure and trustworthy. The main way to do this is by securing an SSL (Secure Socket Layer) certificate. This encrypts any data that’s transferred on your site, so if someone’s donating, their payment details, name, address, and any other sensitive information they share will automatically be encrypted.

You can check whether a website is encrypted by looking at the URL. If the web address begins with https instead of http, that indicates that it’s SSL-certified. Google Chrome will even mark sites that don’t have an SSL certificate as ‘Not Secure’ in the address bar. Not having an SSL certificate is a quick way to turn visitors away from your website, since they’ll automatically consider your site to be untrustworthy.

Additionally, having an SSL certificate is an effective way to improve your organic traffic. According to Google’s Transparency Report, Google Chrome users on Windows, Android, and Mac all spend over 90% of their browsing time on HTTPs sites. Google, among other search engines, uses SSL certification as a ranking factor. Not having an SSL certificate can actually hurt your rankings!

To obtain an SSL certificate, Hubspot recommends that you verify your website’s information through ICANN Lookup, generate the Certificate Signing Request (CSR), validate your domain by submitting your CSR to the Certificate Authority, and install the certificate on your website.

Optimize your site

Overall, your website should be visually attractive, easy to navigate, and filled with valuable content. To optimize your website and maximize your Google Ads conversions, focus on these primary areas:

Landing pages. Your landing pages are the most common pages you’ll promote via Google Ads. This might include your donation form, volunteer signup page, or event registration page. Since you’re driving traffic to these pages, you want to optimize them to inspire users to actually fill them out.

Load times. 40% of users will abandon your site if it takes more than three seconds to load. You can quicken your load time by compressing your images, reducing the use of third-party plugins, and minimizing the amount of unnecessary code on your site.

Navigation. Keep visitors on your site by only putting your most important pages in your navigation menu and consider including a search feature for all other content.

Branding. If a user clicks a link and thinks they’ve somehow ended up on another site, that can come across as untrustworthy. Make sure every page on your site aligns with your nonprofit’s brand by including your official colors, logo, and voice.

Professional help is the most reliable resource for making the most of your site through Google Ad Grants. A Google Grants agency like Getting Attention that’s a recognized Google Partner will ensure that your website is up to par and optimized for the user experience.

4. Submit your Google Grant application.

Once your Google for Nonprofits account is approved, you’ll receive an email from Google, and you can finally apply for Google Grants! You can find the most up-to-date activation steps in your Google for Nonprofits account. Here’s what the process currently looks like:

Click ‘Products’ and then ‘Get Started’ under Google Ad Grants.

Click the eligibility form link. This will prompt you to fill out an assessment with basic information such as your nonprofit’s official name, website URL, and details regarding your goals with the program. This should only take around 20 minutes.

Return to the Google for Nonprofits homepage. Click the checkbox to verify you’ve completed the form. Then, hit ‘Activate’ to submit your organization for review by the Google Ad Grants team. Normally, they’ll review your application within a few business days.

Accept the invitation. Once you’ve been approved, accept the email invitation from the Google Ad Grants team. From here, start running your Google Ad campaigns and automatically receive $10,000 in ad credits per month so long as you maintain compliance with the program’s rules.

At this point, you’re all ready to start creating your campaigns, spreading your message, and connecting with new prospects online.

Advice for completing your Google Grant application

If you’re eligible and follow the provided steps, you’ll more than likely get approved. Even if your application is denied the first time around, Google’s team will provide you with a reason why so you’ll have clear next steps on how to get approved.

Some best practices for maximizing your chances of success include:

Not entering any credit card information, even if prompted to do so. If you receive any emails or any pop-ups requesting payment details, don’t provide any. There will likely be a red bar at the top of your Google Grant Application, but you should ignore it. Sharing billing information means you’ll be setting up a paid standard account, not a Google Grants account.

Noting your customer ID number within your Google Ad Grant account. You can find this in the top right corner of the page, written in this format: XXX-XXX-XXXX.

Putting thought behind the eligibility form questions. Some questions have a straightforward answer (such as your nonprofit’s website URL). However, the form also asks questions that will impact your Google Grant experience, such as how you’d like to learn more about the program. Think through what will be most useful for your organization so the Google Grants team can tailor the program to your preferences.

If you’re still confused about the process or you simply don’t have enough time in your day to apply, we fully recommend reaching out to a professional Google Grants agency. Our team is happy to chat about your needs and handle the entire Google Grant application process for you!

What to Do When Your Google Grant Application Gets Approved

Learning how to apply for Google Grants was the easy part! Now you have to create highly targeted campaigns and ensure you’re meeting the program’s compliance requirements.

While your best bet for success is to outsource account management to a Google-certified grants agency, here are the immediate next steps your team should take after getting approved:

Configure your Google Ads account

To start leveraging your grant money, you must set up your first few campaigns. Within Google Ads, you’ll find the Campaigns tab on the navigation bar to the left.

Keep these tips in mind to configure a well-organized account:

Follow the required account structure. Within each of your campaigns, you should have at least two ad groups. Within each ad group, you should have at least two active ads.

Do plenty of keyword research. To choose ideal keywords for your campaigns, pinpoint search queries that receive a decent bit of monthly traffic and relate to your mission. Google even has a keyword quality score tool that will check the expected CTR, ad relevance, and landing page experience for your different campaigns.

Use sitelink assets. These will allow you to link to specific parts of your website below your ads. This gives users additional options to click and interact with your cause. Typically, these include other pages relevant to the ad, like donation or volunteer signup pages.

If you’re interested in learning more about setting up high-performing campaigns, check out our ultimate guide to optimizing your Google Grant account. In it, we dive into account management tips and requirements that will help you connect with your audience.

Meet Google Grants compliance requirements

To ensure your account remains in good standing with the program’s rules, keep an eye on these essential components:

Account activity. Log into your account at least once a month and update it every 90 days to prove to Google that you’re still using the grant funding.

Ad relevance and geotargeting. Be sure that your ads have specific relevance to their audience. You can do this by including geotargeting, so Google knows their users are receiving ads relevant to them.

Monthly keyword evaluation. Google requires a Keyword Performance Report once a month to ensure that you are optimizing your keywords for the best results.

A minimum of 5% click-through rate (CTR). You must have at least a 5% CTR, starting at 90 days post-approval. This ensures that your ads are actually useful to users and relevant to their search intent. Accounts that fail to meet this requirement will be notified, and if they fail to meet a 5% CTR for two consecutive months, those accounts will be suspended.

Google implements these requirements to ensure that you’re actually generating value from the program. Failing to meet these compliance requirements will result in account deactivation, so keep an eye on your account and continue optimizing your ads over time!

How an Expert Can Help You Apply for Google Grants

To see meaningful results from this marketing grant, you need consistent upkeep, performance tracking, and compliance with Google’s official account requirements. With the weight of running a nonprofit already on your shoulders, this may seem like a lot to handle. Have no fear—that’s why Google Grant agencies exist.

From application assistance to ad creation, Google Grant agencies that are official Google partners like Getting Attention will ensure your success every step of the way. Some valuable areas of assistance include Getting Attention offers include:

Assistance With Applying for Google Grants: Our agency will check your eligibility and then provide guidance for completing your Google Grant application. There’s no need for you to even understand how to apply for Google Grants beforehand since we’ll walk you through the entire process!

Strategy Creation: We’ll help you pick goal-oriented conversion actions, such as donations, volunteer sign-ups, and event registrations. That way, your ads will be focused on advancing your mission.

Ad Creation: Our Google Ad pros will create ads that promote your mission to likely supporters. Each ad will be backed by effective keyword research, so you can reach your target audience.

Routine Account Optimization: We’ll keep an eye on your ad performance to adjust bid strategies, tweak ad copy, and ensure compliance with Google’s rules.

Monthly Data Reporting: Your nonprofit will have insight into results with transparent reports that highlight metrics like conversions, CTR, and ad spend.

If you’re curious about the role that an agency will play in Google Grants management, our team is happy to chat! Reach out to our team to discuss how we can support all your Google Grants needs, from applying to the program to researching the best keywords for your cause.

Final Thoughts on Applying for Google Grants

The Google Grants program is a wonderful opportunity for any nonprofit looking to amplify its digital marketing strategies. All you need to do is learn how to apply for Google Grants and then configure your Google Ads account according to your goals.

All of this information may feel a bit overwhelming, but the opportunity to utilize $10,000 a month of free Google Ads spending is worth weathering the confusion. Contact us today for a free consultation with our agency to help plan the best Google Ad Grants strategy for your nonprofit.

In the meantime, learn more about the program and maximize the success of your ad campaigns with these great resources:

Crafting a Nonprofit Marketing Plan: Key Tips & Channels.If you’re feeling lost on how to develop an effective marketing plan for your nonprofit, have no fear! This article will outline everything you need to develop a full-proof plan and provide free templates to support your process.

https://gettingattention.org/wp-content/uploads/2023/07/How-to-Apply-for-Google-Grants_Feature.png320835Jessica Kinghttps://gettingattention.org/wp-content/uploads/2021/08/getting-attention-logo.svgJessica King2025-03-25 12:00:382025-04-29 18:06:04How To Apply for Google Grants: 4 Easy Steps for Approval

A successful fundraiser doesn’t just happen. It needs strong promotion to attract donors, rally supporters, and build momentum. Whether you’re hosting an in-person event, a digital fundraising campaign, or a grassroots effort, getting the word out is essential.

Reaching the right audience and inspiring them to take action requires a thoughtful strategy and the right marketing techniques. But with new marketing platforms and donor engagement strategies popping up each year, how do you ensure your fundraiser stands out? This guide will walk you through the essentials of how to promote a fundraiser using both digital and offline methods. We’ll cover the following:

No matter what type of fundraiser you’re running, effective promotion requires planning and strategy. It’s easy to feel overwhelmed by all the moving parts, but the right approach can set you up for success.

Types of Fundraisers to Promote

Knowing how to promote different types of fundraisers is key to maximizing engagement and reaching the right audience. Fundraisers come in many forms—some rely on in-person events and community participation, while others leverage digital platforms to reach a wider network of supporters. Whether you’re promoting your donation page or inviting people to charity run, each type requires a tailored marketing approach to ensure success.

Let’s explore the most common types of fundraisers to promote.

Nonprofit Digital Fundraising Campaigns

A nonprofit digital fundraising campaign is a strategic fundraising effort conducted online to achieve a specific goal within a set timeframe. It leverages digital fundraising tools and online marketing channels to engage supporters, collect donations, and maximize impact.

With over5.5 billion internet users worldwide, your potential donors are just a click away. A well-planned digital fundraising campaign that’s promoted effectively can make your nonprofit experience the following benefits:

Expand your reach and raise awareness. Digital fundraising campaigns help share your mission across multiple online channels, reaching supporters worldwide. Potential donors everywhere can engage with your content and give to your campaigns, helping you form relationships with diverse supporters.

Lower fundraising costs. Often, digital fundraising campaigns have lower overhead costs than in-person campaigns. In-person fundraising often involves renting an event venue, purchasing print materials, and paying other costs that aren’t necessary for digital fundraising.

Increase supporter engagement. Nonprofit digital fundraising campaigns often occur over a long period of time and involve activities that encourage long-term involvement. With a digital fundraising campaign, your supporters have the opportunity to play a huge role in your success and marketing potential by reposting your messages and directing friends and family to your donation page.

Draw attention to programs and initiatives. Nonprofits often raise funds for specific needs. Launching a digital fundraising campaign can be the perfect conduit for raising funds for specific programs and projects to help your beneficiaries.

Collect valuable data. An important part of fundraising is seeking opportunities and information to improve your nonprofit’s future campaigns. With digital fundraiser marketing, you can easily collect and analyze data to assess what you can do better for your next campaign. Over time, you’ll find that your digital fundraising campaigns generate greater impact.

While the main goal of a digital fundraising campaign is to generate revenue, you can also raise awareness of your mission and build your reputation along the way. Digital fundraising campaigns can do wonders for your mission and your nonprofit’s larger public image. You just need to use the right fundraiser marketing tools to power these fundraisers.

Fundraising Events

Fundraising events are a powerful way to engage supporters, build community, and generate donations. Whether in-person, virtual, or hybrid, events create opportunities for interaction and storytelling that inspire giving.

Popular types of fundraising events include:

Galas. These high-energy gatherings can attract major donors and adapt to fit either the virtual or offline space. Host additional fundraising activities like raffles, and encourage online engagement by livestreaming entertainment and speakers. By offering online options, you’ll sell even more tickets than you would for an in-person event since people can attend from any location.

Auctions. Auctions give donors fun prizes in exchange for their contributions. Procure high-value items to auction off and invest in a remote auction tool that allows attendees to conveniently bid on items they’re interested in if you’ll allow online participation. You can even promote your fundraiser by posting unique or valuable items to your social media pages.

Walkathons and runs. Bring your community together with a charity run. Encourage supporters to participate in fundraiser promotion by adding a peer-to-peer fundraising element. They’ll create personal fundraising pages and encourage their friends and family to give in support of their participation.

Webinars or panels. Invite nonprofit leaders and experts to discuss topics related to your digital fundraising campaign. Allow attendees to ask questions directly through a live chat. Some guests will be more inclined to participate this way since speaking to a crowd virtually may be less intimidating than asking a question in front of a large in-person audience.

No matter what event you’re hosting, active fundraiser marketing is key. Use social media, email marketing, and community outreach to boost attendance. You can even encourage supporters to invite their loved ones to expand your event’s reach.

Ongoing Giving Programs

Ongoing giving programs provide nonprofits with a steady stream of donations, often through recurring contributions or membership-based fundraising. Consistently promoting fundraisers that are continuous is essential for growth.

Common types of giving programs include:

Monthly giving programs. Supporters commit to automated, recurring donations, creating a reliable revenue stream.

Sponsorship programs. Donors support specific initiatives, such as sponsoring a child, animal, or community project.

Corporate partnership programs. Companies provide financial support in exchange for public recognition, such as their logo on a corporate sponsor page on your nonprofit’s website.

Peer-to-peer fundraising. Supporters raise funds on behalf of your nonprofit by creating personal fundraising pages. This puts fundraiser promotion in their hands.

You can promote fundraising programs like these through targeted email campaigns and social media to highlight long-term impact. If you feature them on your website, paid ads are also a great way to promote these fundraisers.

The Elements of Successful Fundraiser Marketing

Successful fundraiser marketing requires a strategic approach to drive donations. From crafting compelling messaging to choosing the right channels, every element plays a role. Let’s explore the key components of an effective fundraiser marketing strategy.

A Strong Nonprofit Marketing Plan

Even engaging fundraising ideas will fall short if not promoted effectively. A clear, comprehensive marketing plan ensures your team is clear on messaging and timing. Include these elements in your fundraiser marketing plan:

Effective messaging: Craft compelling, mission-driven messaging that resonates with your audience and inspires action. You’ll want to gather stories that focus on the donations and the people who benefit from your work.

Marketing materials. Develop high-quality content, including emails, social media posts, flyers, and videos, to support your campaign.

Clear target audience. Define who you’re trying to reach and tailor your messaging accordingly. Segment donors based on giving history, demographics, and engagement levels to ensure more personalized and effective outreach.

A well-structured marketing plan gives your fundraiser the direction needed to engage supporters and drive donations.

SMART Goals

Set a firm foundation for your campaign by setting well-defined goals. We recommend using the SMART goal framework:

Specific: Clearly outline what you want to accomplish, including the who, what, where, and why of your goal.

Measurable: Define success with quantifiable metrics, such as a donation target or number of new donors.

Attainable: Set a realistic goal based on your resources, capacity, and past performance.

Relevant: Ensure your goal aligns with your nonprofit’s mission and fundraising needs.

Time-Based: Establish a deadline to create urgency and hold your team accountable.

Let’s say you’re hosting a fundraising gala. Here’s what your SMART goal might look like:

“Sell 500 tickets and raise $50,000 for our annual charity gala by the end of the event through targeted email campaigns, social media ads, and corporate sponsorships.”

Essentially, be realistic about what you can achieve, but push your team. If you have multiple priorities for your fundraiser, create different goals and list them in order of priority to focus your fundraiser marketing.

Effective Key Performance Indicators

After determining your campaign goals, consider the key performance indicators (KPIs) you’ll use to measure success. Examples include:

Total Funds Raised: The total amount of money collected during the campaign

Donation Conversion Rate: The percentage of visitors who donate after viewing your campaign page (especially crucial for digital fundraising campaigns)

Ad Click-Through Rate: The percentage of people who click on your fundraiser’s ad after seeing it, indicating how relevant your ad is to viewers

Average Donation Amount: The average contribution size per donor

New vs. Returning Donors: The ratio of first-time donors to repeat supporters

Email Open and Click-Through Rates: Engagement with email campaign promoting your fundraiser

Social Media Engagement: Likes, shares, comments, and reach of promotional posts

Event Attendance: The number of participants for fundraising events

For instance, one of your goals might be to increase the matching gifts you receive online by sharing educational materials. You might measure your digital fundraising campaign’s success based on the number of donors who work at organizations with corporate giving programs and whether you receive a match from their employer.

With KPIs, you’ll have a sense of whether your fundraiser promotion is working and what you could do to improve your results.

Multiple Marketing Platforms

With new marketing platforms emerging constantly, nonprofits have a wide range of tools and channels to promote their fundraisers. Each marketing tool has its own strengths, so carefully research and choose the ones that best fit your strategy. Here are some useful channels, some of which we’ll dive further into later:

Google Ads: Targeted fundraising advertising to reach potential donors actively looking for causes to support

Instagram & Facebook: Visual storytelling, community engagement, and fundraising tools

LinkedIn: Corporate donor outreach and professional networking

Email Marketing: Direct supporter communication and campaign updates

Website & Blog: Central hub for donations, event details, and impact stories

Print Media: Flyers, brochures, and local newspaper ads to spread awareness

Direct Mail: Personalized letters and postcards to engage donors

Phone Outreach: One-on-one conversations to strengthen donor relationships

Some fundraising platforms have built-in marketing tools to simplify outreach. For instance, your online auction software might offer email and text marketing features to notify participants about new bids, event updates, and donation opportunities.

A balanced approach using both digital and offline channels will maximize your reach. If you’re running a digital fundraising campaign, online marketing channels will be especially useful in reaching donors.

How To Promote a Fundraiser

Depending on your resources and target audience, there are likely tons of digital fundraising marketing trends you can capitalize on. For the ambitious nonprofit professional, you may even try to combine several of these strategies into one campaign!

Let’s explore some of the most effective promotional strategies for you to explore.

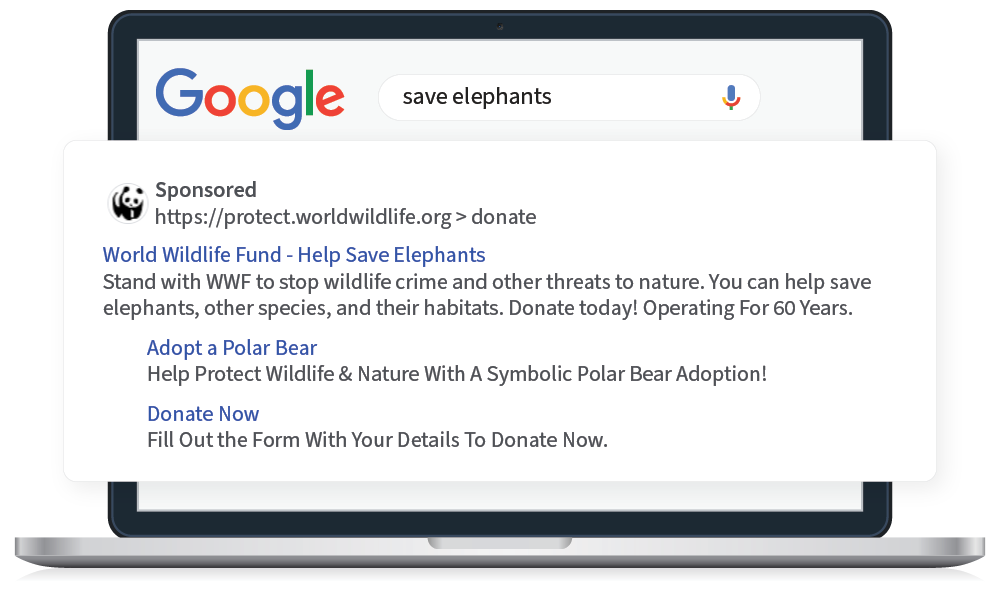

1. Advertise on Google.

Fundraising advertising is an important part of any online campaign, because digital ads can increase brand awareness by 80%. One of the best places to run ads is Google. For a majority of web users, if they have a query they want answered, they’ll turn to Google’s search engine.

Google Ads allows organizations to promote their services, products, digital fundraising campaigns, and other mission-related content in search engine results as well as non-search websites, mobile apps, and videos. Since Google owns around 90% of the global search market share, Google Ads can make a world of difference for your nonprofit.

To help nonprofits with their digital fundraising campaigns, Google offers the Google Ad Grant program. This program offers nonprofits $10,000 in Google Ad credits to spend each month on text ads. Here’s a rundown of the program:

Plus, any eligible nonprofit nonprofit can make use of this grant! It’s not just allocated for a few lucky winners like other grants are. Any eligible nonprofit will receive the grant, and it’s comparatively easy to apply for.

How To Promote a Fundraiser on Google

A Google Ad Grants campaign is one of the best ways to push your digital fundraising campaigns and educational content to a targeted audience without blowing your marketing budget. To maximize your impact with this program, try the following tips:

Know your target audience. Understand what your audience is searching for and tailor your ad copy to meet their needs. Beyond keyword selection, Google Ads offers audience targeting capabilities, so you can reach prospective donors based on location, interests, demographics, and other characteristics.

Pick the right landing pages. Use your ads to direct users to landing pages that fulfill their needs. For instance, you might direct people searching for nonprofit volunteer opportunities to your volunteer registration page or users searching for ways to support deforestation to an optimized donation page like these nonprofits did:

Optimize your website. Once prospects visit your site, entice them to stay and make a gift to your digital fundraising campaign. Do so by developing professional-looking web content that positions your organization as a trustworthy steward of donations.

Track ad campaign performance. Evaluate your fundraising advertising performance by tracking relevant data through Google Analytics, such as click-through rate and average session duration. Regularly tweak ad copy and targeting to drive traffic and clicks.

To fully maximize the Google Ad Grant for your digital fundraising campaigns, your nonprofit needs a solid understanding of digital marketing. If your team lacks expertise, consider partnering with a Google Ad Grant agency like Getting Attention to manage your campaigns, optimize content, and ensure you maximize your grant funds.

2. Leverage Email Marketing.

Email outreach generates approximately 28% of all online nonprofit revenue, making it a powerful tool for fundraiser marketing. An email series for a digital fundraising campaign will likely span weeks or months to introduce your campaign, build anticipation, and drive donations.

Try these strategies to make your nonprofit’s emails stand out in donors’ inboxes:

Personalize your messages. Emails with the recipient’s first name in the subject line have higher click-through rates than those that don’t. Use marketing tools to automatically insert names, making your outreach feel more personal (e.g., “Hello David” instead of “Dear Donor”).

Segment your audience. Tailor your fundraising appeals based on donor history, location, or engagement level. For instance, you might tailor your donation request to suggest amounts that reflect a group of mid-level donors’ past contributions.

Include compelling calls to action. The success of your digital fundraising campaign depends on whether supporters take action. Always include a call to action (CTA) in your outreach. Whether it’s “Donate Now” or “Register for Our Event,” make the action easy with a direct link.

To maximize success, schedule emails for fundraisers in advance. Automate personalization with email marketing tools that integrate with your CRM system to streamline outreach, improve engagement, and run a more effective digital fundraising campaign.

3. Launch A Social Media Campaign.

Whether you’re promoting an in-person event or a digital fundraising campaign, social media is essential for reaching a wide audience. When current supporters share your posts, you’ll reach their friends and family members who share similar values and are likely to contribute.

These platforms have become one of the most meaningful ways for nonprofits to engage with their supporters and release exciting news. In fact, 32% of donors are most inspired to give via social media.

With so many social media platforms out there, it can be difficult to decide where to promote a fundraiser. Carefully consider the following platforms:

Facebook. Facebook boasts over 3 billion monthly active users, making it perfect for posting fundraiser announcements, sharing campaign updates, and inviting supporters to events by creating a Facebook Event. You can also take advantage of Facebook’s fundraising tools to add a donate button to your page and empower supporters to launch their own digital fundraising campaigns for your nonprofit.

LinkedIn. This online professional network is a perfect place to post updates about your organization and connect with viable volunteers or employees. It’s also a great place to find potential corporate sponsors for your digital fundraising campaigns.

Instagram. This social media platform focuses on images and short videos, both of which offer great opportunities to connect emotionally with your supporters. Develop professional and creative visual content to draw attention to your events and digital fundraising campaigns. Your followers can easily comment on your posts and interact with your Stories.

TikTok. While a majority of Facebook and Instagram users are ages 18 to 34 and LinkedIn users are even older, TikTok users are much younger. This social media platform is perfect for connecting with Gen Z through short-form video content. There are tons of viral trends to try out, so consider sharing your nonprofit’s messages in these fun formats.

Across these platforms, use hashtags, Stories, polls, and more to drive engagement. Get creative with your content, such as by posting beneficiaries’ testimonials or behind-the-scenes footage of fundraising events.

Rather than trying to master all of these channels, we recommend focusing on the platforms where you already have a following or where supporters are active. With each post, aim to bring attention to your fundraiser and work, encouraging your audience to donate.

4. Create Meta Ads.

Meta Ads (formerly Facebook Ads and Instagram Ads, respectively) are an effective way to promote a fundraiser to a targeted audience. With billions of active users across Facebook, Instagram, and Messenger, you can tap into these platforms to drive awareness and donations for your cause. The key to success is creating compelling, targeted ads that resonate with your audience.

Here are some strategies for using Meta Ads effectively:

Target specific audiences. Use Meta’s targeting features to narrow your audience by demographics, interests, and behaviors. For example, target people who have previously interacted with your nonprofit or shown interest in similar causes.

Create engaging ad content. Develop ads with eye-catching visuals, videos, and powerful storytelling that connect with your audience emotionally. Make your CTA clear and direct, such as “Donate Now” or “Join Our Campaign.”

Leverage retargeting. Meta Ads also offer the ability to retarget users who have engaged with your content but haven’t yet donated, increasing the likelihood of conversion.

Check out this example ad on Facebook for Doctors Without Borders:

This ad was part of its GivingTuesday campaign and encouraged supporters to donate within a certain time frame to receive a match from a campaign sponsor. This fundraiser advertising campaign led to $72,000 with a 2.8x return on ad spend.

When set up correctly, Meta Ads can help expand your nonprofit’s reach, drive traffic to your donation page, and engage a larger group of potential supporters. Unlike Google Ads, Meta Ads doesn’t offer discounts to nonprofits, though.

5. Encourage Donations with Matching Gifts.

Matching gifts are a corporate philanthropy initiative in which employers financially match donations that their employees make to eligible nonprofit organizations. In a nutshell, here’s how they work:

Someone donates to your nonprofit.

They research their eligibility and submit a matching gift request to their employer.

The company also donates to your nonprofit based on a fixed match rate. Companies will usually match gifts at a 1:1 (or dollar-for-dollar) ratio.

While valuable, not all eligible donors know about this opportunity! In fact, Double the Donation estimates that $6 to $10 billion in matching gift funds go unclaimed each year, primarily because of a lack of awareness.

On the bright side, roughly two to three billion dollars are donated through matching gifts annually, and there’s been an increase in companies offering matching gifts to their employees over the last three years as well, from 12% to 51%.

How To Promote A Matching Gift Fundraiser

If you want to conduct a digital fundraising campaign focused on matching gifts, either encourage donors to check their eligibility for their companies’ programs or find a sponsor for a matching donation challenge. In the latter option, a major donor or a company will promise to match any and all donations during a set time frame.

Alternatively, to encourage individuals to check into their employers’ programs, launch a matching gift awareness campaign. Here’s how to do that successfully:

Create a dedicated matching gift page. Include all the information needed to answer the frequently asked questions your donors have. Be sure to link to your donation page to make it convenient for supporters to make a gift and have it matched.

Bring together a matching gift team. This team will ensure that eligible gifts are matched. You might even invest in a matching gift software solution to help your team track and follow up with eligible donors.

Incorporate matching gifts in the giving process. You can do this by embedding a searchable matching gift database into your donation page so that donors can quickly look up if their employer will match their gift.

As you incorporate matching gifts in your digital fundraising campaign, keep track of those who submit matching gifts and where they work. This can help uncover other eligible donors and ensure future matches don’t go unclaimed.

6. Rely on Supporters With Peer-to-Peer Fundraising.

Peer-to-peer fundraising leverages your supporters’ passion and energy. It’s one of the most valuable ways to promote your nonprofit’s mission and reach new prospects. In fact, nearly 40% of Americans have donated due to a friend or a family member’s request.

Here’s how this type of digital fundraising campaign works:

Recruit passionate volunteers to fundraise on your nonprofit’s behalf.

Set each volunteer up with a personal fundraising page, so they can collect donations and share what your organization means to them.

Participants share their page with friends and family.

Individuals donate to your nonprofit’s digital fundraising campaign by contributing to their loved one’s peer-to-peer page.

Your peer-to-peer software tracks how much each fundraiser raises to make a friendly competition out of it!

Ensure your staff members are available to answer questions and assist volunteers so that they have a positive experience as they help you fundraise.

7. Create A Text Fundraising Campaign.

Text fundraising is a form of digital fundraising for connecting with your supporters through their most frequently used devices, their mobile devices. Donors simply text a short code or a donation amount to your organization’s assigned number. With a text fundraising tool, you can:

Send marketing messages directly to mobile phones.

Accept gifts through text messages.

Thank donors who have given.

Beyond using texting as your fundraiser, you can promote other fundraisers with text marketing. Send short, impactful texts to announce events and digital fundraising campaigns they can contribute to like this:

This is a valuable way to establish consistent communication. Just make sure you have their permission to send texts. You can get each donor’s preferred cell number and their confirmation to opt into texts when they sign up for opportunities.

8. Leverage Corporate Partnerships.

Your corporate partners can promote fundraisers to their employees and customers to expand your reach. They might post on social media, highlight your fundraiser in an email, or even post a flyer on a bulletin board in their storefront.

If you don’t already have corporate partners, start by identifying local businesses with similar values and audiences. For instance, an animal shelter might partner with a pet supplies store. Once you’ve established a partnership, work together on cross-promotion. Ask your partners to share your campaign across their marketing channels by featuring it in their newsletters, on social media, on their websites, or among their employees.

In return for them promoting fundraisers, offer them prominent branding opportunities at events, on your website, and across marketing materials.

9. Create Compelling Flyers

Flyers are a great way to promote a fundraiser in your local community. Design eye-catching flyers that convey key information, such as the event date, location, or how to donate. Include a strong CTA, clear contact details, and a website URL or QR code to easily contribute. Keep the design simple but impactful, using bold fonts and visuals that grab attention while conveying your message quickly.

Distribute these flyers in high-traffic areas like community bulletin boards, local businesses, and schools. You can also target previous donors by sending them in the mail.

10. Reach Out to Local Media Outlets

Media coverage can greatly expand your fundraiser’s reach. Reach out to local newspapers, radio stations, and TV stations to promote your campaign. Write a compelling press release that highlights the impact of your fundraiser and its impact.

Many local media outlets offer public service announcements (PSAs), which are free ads for organizations. Nonprofits often qualify for PSAs, especially on community radio stations, due to Federal Communications Commission (FCC) rules. Consider also working with local journalists to feature stories about your cause or upcoming event. By leveraging local media, you can promote and increase community support for your fundraiser.

Examples of Successful Fundraiser Marketing

Now that you know of the variety of strategies for promoting fundraisers, let’s take a look at some successful digital fundraising campaigns. Fundraisers can take a variety of shapes, and you can create successful campaigns by learning lessons from other great marketing and advertising examples.

These concrete examples will show you how to promote a fundraiser like yours.

1. ALS Ice Bucket Challenge

The ALS Ice Bucket Challenge went viral in 2014. It challenged participants to pour a bucket of ice water over their heads to promote awareness of amyotrophic lateral sclerosis (ALS) and encourage donations to research associations. The ALS Ice Bucket Challenge allowed the ALS Association to increase its annual funding for research around the world by 187%, and it was all thanks to effective fundraiser marketing.

The success of the ALS Ice Bucket Challenge was driven by its clever marketing strategy, which leveraged social media and user-generated content to create a viral movement. By encouraging participants to challenge their friends, the campaign spread quickly, generating massive visibility while encouraging donations through a fun experience.

2. The Red Cross’s Haiti Earthquake Relief Effort

The Red Cross held this digital fundraising campaign in 2010 to help Haitians affected by the earthquake by providing food, water, shelter, medical care, and other essentials. This campaign implemented a text fundraising strategy by asking supporters to “Text HAITI to 90999” to donate $10. The Red Cross raised tens of millions of dollars to help more than 4.5 million Haitians, making this digital fundraising campaign a huge success.

The Red Cross’s Haiti Earthquake relief campaign capitalized on the convenience of mobile giving, making it easy for people to donate directly from their phones. The campaign’s use of high-profile media coverage and celebrity endorsements further amplified its reach, encouraging widespread participation and rapid fundraising support.

3. Children’s Miracle Network Hospitals’ Extra Life Campaign

The Extra Life campaign is an annual digital fundraising event held by the Children’s Miracle Network Hospitals. Participants sign up to play games from home or online and ask friends and family to donate in support. There are Game Days every year, and the funds raised go towards helping children get the medical care they need.

The Extra Life campaign is effectively marketed through a combination of social media engagement, influencer partnerships, and gaming community outreach. The nonprofit even offers a charity stream toolkit, such as stream overlays, flyers, and graphics. By tapping into the gaming culture and encouraging participants to share their fundraising efforts, the campaign has successfully built a dedicated and growing community of supporters.

Additional Resources for Promoting Fundraisers

If you’re looking to boost your fundraising efforts, engage your supporters, and reach new prospects, learning how to promote a fundraiser is key. Don’t just rely on sharing your donation page for a digital fundraising campaign. Use the strategies outlined above to amplify your fundraiser and create lasting connections with your audience.

To continue becoming an even better fundraiser, explore these free resources about marketing:

https://gettingattention.org/wp-content/uploads/2025/03/How-to-Promote-a-Fundraiser_Feature.png6401660Jessica Kinghttps://gettingattention.org/wp-content/uploads/2021/08/getting-attention-logo.svgJessica King2025-03-14 12:00:032025-03-14 17:54:28How To Promote a Fundraiser: 10 Ideas To Boost Donations

The Google Ad Grants program provides eligible nonprofits with $10,000 per month to spend on Google Ads. Since its inception, the program has driven over 14 billion clicks to nonprofit websites, boosting donor acquisition, volunteer recruitment, and more. While many organizations recognize the program’s value, some may hesitate to apply simply because they find Google Ad Grants confusing.

To simplify the Google Ad Grants program for your nonprofit, we’ll cover these topics:

At Getting Attention, we provide professional Google Ad Grant support to help nonprofits make the most of this valuable opportunity. We’ll eliminate any confusion surrounding the program so you can start connecting with more committed supporters. Let’s get started!

Why Are Google Ad Grants Confusing?

Many nonprofit professionals have limited experience regarding their Google Ad Grants accounts, which can lead to missed opportunities over time. Some of the most common roadblocks you may face include:

Unfamiliarity with account compliance requirements

All of that said, managing nonprofit marketing grants like the Google Ad Grant doesn’t have to be confusing. Learning more about the program can prevent potential obstacles down the line.

FAQs to Clear Up Google Ad Grants Confusion

Let’s clear up anything that might be making Google Ad Grants confusing for your team with these frequently asked questions.

How much are Google Ad Grants worth?

Google Ad Grants are worth $10,000 per month, which averages out to $329 per day. So far, the program has awarded over $9 billion in free advertising to more than 115,000 nonprofits around the world. You won’t receive the grant in cash, but in the form of Google Ad credits.

Plus, if your nonprofit uses Google Ad Grants to promote your fundraising initiatives, that will make the Google Ad Grant worth even more as more donations start to roll in.

How long does it take to get approved for Google Ad Grants?

Depending on where you are in the process of applying, it may take several weeks to get approved for Google Ad Grants. The application process requires you to:

In your approved Google for Nonprofits account, fill out the Google Ad Grants application.

Wait for an email from the Google Ad Grants team. Accept their invitation and start creating ads.

We recommend that you start the application process as early as possible. If applying for Google Ad Grants still seems confusing to you, our team of experts is here to help you succeed!

Can I have an Ad Grants account and a paid Google Ads account at the same time?

Yes, Google actually encourages nonprofits to create a paid Google Ads account if the program is positively benefiting the organization! Standard, paid accounts are a proven way to expand your impact and gain access to features that are not included with your Google Ad Grants account, such as:

Remarketing. This feature allows you to customize your display ads campaign for people who have previously visited your site.

Image Ads. This enables you to feature ads with static and animated images on webpages in Google’s Display Network.

Video Ads. With this feature, you can create video ads to display on YouTube and across video partner sites.

Your accounts won’t compete with one another since Ad Grants ads already appear below paid ads on search results pages. Your Google Grant ad will be eligible to show if there’s available space, regardless of whether a paid ad is already showing.

Do I have to spend the $10,000 every month to keep my Google Ad Grant?

There are no Google Ad Grant rules regarding how much you have to spend each month to maintain your eligibility. In fact, most nonprofits don’t spend the full $10,000 every month.

The ultimate goal is to drive meaningful outcomes for your mission, not spend as much money as possible. A specialized agency can help you strike the balance between maximizing your monthly ad credits and generating optimal results.

Why does Google have a policy regarding click-through rate (CTR)?

Google requires grantees to maintain a 5% CTR every month. They use this as an indicator of ad quality since it lets them know whether users find the ads relevant to their search query.

While Google Analytics will automatically calculate your CTR for you, you can do so yourself by dividing the number of people who click through to your landing page by the number of impressions (i.e., how many people see your ad). So, if 100 people see your ad and five people click the link to your website, your CTR will be 5%.

Google recognizes that it takes time to get your account up to speed and understand what compels users to click an ad. That’s why new accounts have a grace period of 90 days to comply with the policy.

How do I use Google Ad Grants effectively?

While there’s room for a lot of flexibility with the Google Ad Grant program, there is a proper account management protocol you should follow to make the most of this technology grant. Effective Google Ad Grant management consists of:

Choosing the right keywords that will connect you with qualified users searching for causes like yours.

Developing effective ad copy and writing three to five compelling ads that are relevant to the keywords for each ad group.

Tracking your analytics to determine how well your ad campaigns are performing and what you can improve.

Using ad assets to promote additional pages on your site under your ads.

Conducting A/B tests to determine the specific elements that drive users to click through.

Choosing appropriate landing pages to promote and optimizing them to compel users to take the desired action.

To ensure success and free up your staff resources, consider reaching out to a dedicated Google Ad Grant agency to have them effectively manage your account for you.

5 Confusing Google Ad Grants Marketing Challenges

Alongside their unique benefits, Google Ad Grants can bring about some unique marketing challenges. Let’s walk through five confusing challenges that nonprofits often face with the program.

1. Failing to meet Google Ad Grants guidelines

Some nonprofits may not understand how to meet all of the Google Ad Grants guidelines. Failing to follow these requirements can result in a temporary suspension of your account or loss of the Google Ad Grant.

Here’s a quick breakdown of Google’s guidelines:

Avoid single-word keywords. Don’t use single keywords that are not included on this list of approved exceptions. Avoid generic or broad keywords as they will be more difficult to rank for—only go for the ones that specifically relate to your nonprofit so you can create ads that are relevant to users.

Choose keywords with a minimum keyword quality score of three.Google grades keywords for quality on a 10-point scale. Each score is based on the expected clickthrough rate, how closely your ad matches the user’s search intent, and the landing page experience. Ensure that your keywords maintain a score of at least three.

Maintain a minimum click-through rate of 5% for your account. Your account must receive a click-through rate of at least 5% for all ads, so at least 5% of those who view your ads should click through to your website.

Use at least two ad groups per campaign. For each active ad campaign on your account, you must have at least two ad groups with at least two ads within each.

Use at least 2 sitelink ad assets. Sitelink assets allow you to link specific pages related to your ad below your main landing page. You should include at least two of these.

While these rules are extremely important for remaining compliant and retaining access to the grant, they also double as tips for improving your ad campaigns.

2. Neglecting your website’s landing pages

To give your ads the best chance of success, fortify your nonprofit’s web presence before applying for Google Ad Grants. Each ad you run will direct users to a landing page on your website, through which they’ll be able to complete a desired action, such as registering for an event or making an online donation.

If your web pages are outdated or have unclear calls to action, your supporters won’t know what to do once they follow an ad and land on the page.

3. Targeting broad and generic keywords

Broad keywords like “donation” or “fundraising event” often have many bidders, and Google’s algorithm is not particularly conducive to smaller organizations winning these highly competitive terms. Therefore, it’s unlikely that your nonprofit will be able to edge out large organizations that are bidding on the same words, lowering the chances for supporters to see your ads.

Plus, with generic keywords, it’s more difficult to create relevant, targeted ads that will actually motivate many users to click through to your nonprofit’s website and engage with your content.

If you’re struggling to pick the right keywords for your cause, consider seeking professional help from Google Grants experts, like Getting Attention. We’ll take care of anything that makes Google Ad Grants confusing for your team, including keyword research!

4. Not running multiple ads in each group

Each Google Ads account is broken down into campaigns that contain different ad groups assigned to specific keywords. Then, each ad group is made up of multiple ads that feature your ad copy, link to a relevant landing page, and target those keywords.

Running only one ad violates Google’s policies and could put your account at risk. Additionally, with one ad, your nonprofit can’t track or evaluate performance. With no way to note how and why ads perform differently, it can be hard to improve your Google Ad Grants strategy over time.

Essentially, running multiple ads per group helps test different messaging, improve relevance, and comply with Google’s best practices for better ad rotation.

5. Creating unclear calls to action