Whether you’re preparing your program application or have already created several ad campaigns, it’s never too early (or too late!) to optimize your Google Grant account.

By not understanding Google Grant optimization, many nonprofits miss out on the incredible opportunities the Google Ad Grants program provides nonprofits.

Proper management helps you maximize your $10,000 budget, boost the number of conversions made in response to your ads, and keep your account compliant with Google’s grant policies.We’ve compiled our knowledge of Google Grant optimization into these core topics:

Using the tips we share, you’ll be several steps closer to optimizing your Google Grant account and connecting with more prospects. Let’s get started.

Avoid These 6 Google Ad Grant Management Mistakes.

Mistakes happen, especially in the confusing world of Google Grant management. Confusion or unfamiliarity with Google’s Ad Grant policies can result in an unintentional violation of Google’s guidelines.

With that in mind, let’s cover the top management mistakes that you can avoid with a little training and a few reminders:

Mistake 1: Failing to Follow The Google Ad Grants Management Policy

Several years after its inception, the Google Ad Grants program created a set of compliance policies that nonprofits must follow to maintain their status in the Google Ad Grants program. These policies include guidelines for your account and the ads you run.

While Google Ad Grant recipients should look over the list of requirements in full, a few standout points are:

- Having at least 2 ads per ad group

- Having at least 2 ad groups per campaign

- Maintaining a 5% CTR each month

- Not using single-word or generic keywords

- Having a minimum keyword quality score of 2

- Enabling at least 2 sitelink ad extensions

The goal of these rules is to enhance the search experience for users and help nonprofits benefit from the program as much as possible.

Mistake 2: Using Generic Keywords

Another mistake in Google Grant management is relying on generic keywords. Short, generic keywords like “fundraising” lack the specificity your ads need to be effective.

Instead, look for specific long-tail keywords. For instance, you might bid on terms like “animal shelter volunteer opportunities” rather than “volunteer opportunities.” These will connect you with more qualified users, and they’re also typically cheaper to bid on.

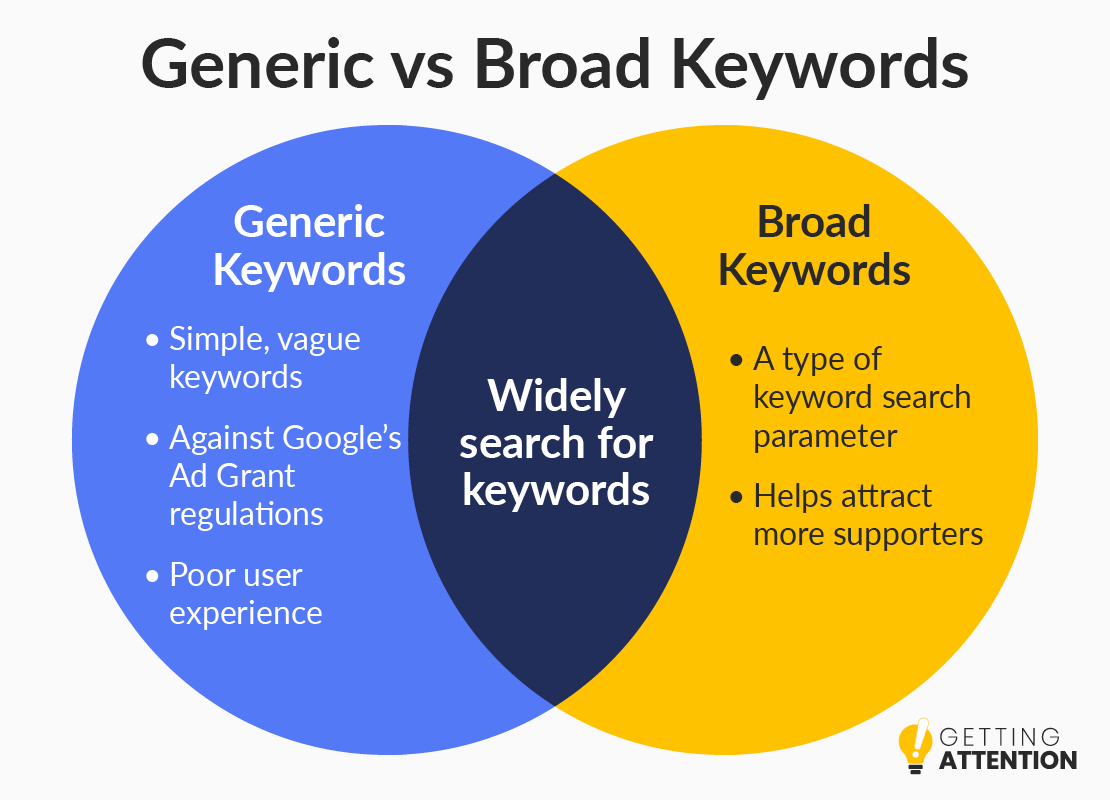

Additionally, it’s essential to know the difference between generic keywords and broad keywords. Here’s a breakdown of these two terms:

- Generic keywords are keywords where it is unclear what page someone will find after clicking on them. For example, “video,” is a generic keyword. Will the page have a video to watch? Explain video making principles? Review YouTube videos?

- Broad keywords are a parameter you can select for your keyword campaigns to influence what types of queries your ad will show up for. For example, you might want the keyword “animal shelter volunteer opportunities” to show up for searches that don’t include the exact keyword, like “animal shelter volunteering” and “volunteering with animals.”

Generic and broad keywords both cast a wide net for searches. However, while broad keywords help you connect with supporters who just phrased their searches a little differently, generic keywords can violate Google Ad Grant policy.

Mistake 3: Using Dirty Keyword Data

Any nonprofit professional who deals with metrics understands the importance of data hygiene. In terms of Google Grant management, cleaning your keyword data is a process that involves pausing or removing irrelevant and low-quality keywords.

Here are some key reasons why you should optimize your keyword data:

- Keyword traffic may fluctuate over time. Some of the keywords you target will not be relevant year-round. For example, seasonal keywords or those related to specific events do not need to be tracked outside of those time frames.

- Low-quality keywords can clutter your data. Google assigns a quality score to keywords, calculated based on expected CTR, landing page experience, and ad relevance. Scores below 3 are considered poor quality. Using low-quality keywords is against Google’s policies, and targeting these terms is a waste of your ad budget.

Keywords are a vital part of optimizing a Google Grant account. Not to mention, they play an essential part in your nonprofit’s organic SEO strategy. Start your account optimization process by using search terms with a quality score of at least 3 and removing irrelevant ones.

Mistake 4: Featuring Just 1 Ad Per Group

Nonprofits sometimes make the mistake of featuring only one ad in each ad group, resulting in account suspension. Within Google Grants, individual ads are organized into groups that fall under broader campaigns.

Even if you follow every other compliance step, using only one ad per group is not a viable way to run your Google Grant account. Plus, single ads prevent nonprofits from analyzing performance across different ads, resulting in missed learning opportunities.

Instead, include multiple ads per group. Differentiate your ads by including different ad copy to drive users to click through to your site. Keep an eye on your campaign results to see which ads have the highest click-through rates (CTR), conversions, and site engagement. Finally, replace ads with low CTR with refined versions that drive better results!

Mistake 5: Providing a Poor User Experience

In the context of Google Ad Grants, a poor user experience is often linked to your ad copy, call to action, or linked landing page being misaligned. It’s confusing for website visitors when they click on an ad urging them to join an email list but instead are directed to an online donation page.

This mistake can frustrate potential supporters, deter them from taking the action you want them to, and ultimately impact your ability to optimize your Google Grant account. Think critically about the user experience you’re providing with your Google Ads.

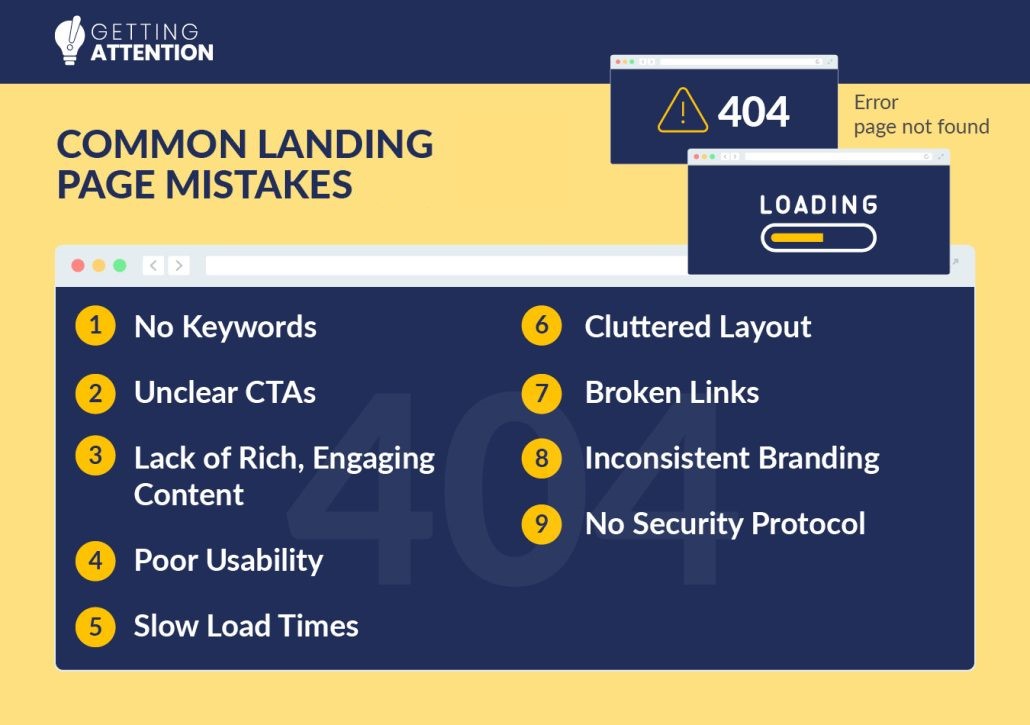

Mistake 6: Neglecting Your Landing Pages

Your nonprofit’s website plays a crucial role in marketing your mission. It’s a place to share all of your resources, content, and marketing material in one convenient location. Plus, the ads you create for your Google Grant account will direct users to your website. In that sense, a neglected website and poorly designed landing pages can do more harm than good.

A poor-quality or irrelevant landing page can negatively impact your keyword quality score. What’s more, higher quality scores often lead to a lower cost-per-click rate, so you’ll receive more traffic for the same price.

Here are a few of the most common landing page issues that nonprofits encounter:

- Keywords featured in your ads are not included on the landing page.

- It’s unclear what supporters are supposed to do on the page.

- There is a lack of rich, engaging content.

- The overall website is challenging to navigate.

- The website loads slowly. Reports show that 53% of mobile users will abandon a website if it takes 3+ seconds to load.

- The layout is overwhelming and has an unprofessional layout.

- Broken links signal the website is outdated or even unsecured.

- The branding is inconsistent and makes the site appear untrustworthy.

- The site lacks an SSL certificate, meaning it isn’t secure.

If users follow your ad and have a bad site experience, even the best-written ads won’t help you earn conversions. Not to mention, there are also rules in place regarding website quality. For instance, you’ll need to include a clear description of your organization, have an adequate load speed, and feature unique content. Conversely, optimizing your landing pages will keep your quality score up and maximize your chances of reaching and converting qualified users.

Follow the Appropriate Google Grant Account Structure.

After you apply for Google Ad Grants and get approved, you’ll set up your first ad campaign. Before creating your ads, it’s vital to understand the structure of your Google Ad Grant account. That way, you can get a feel for how to set up your campaigns.

Your Google Grant account is broken down into the following:

- Campaigns: These are the largest building blocks of your Google Ads account. They contain multiple ad groups and ads. To optimize your Google Ad Grant account, we recommend assigning a theme to each campaign. For instance, if you work for an animal shelter, you might create a “Volunteer” campaign with keywords related to animal shelter volunteer opportunities in your area. You might have another campaign for “Donations,” “Adoptions,” etc. Themes allow you to easily organize your ads within campaigns.

- Ad Groups: Think of these as clusters of ads within your campaigns. Ad groups are associated with specific keywords that someone might search related to your cause. Note that Google requires you to have at least two ad groups per campaign.

- Ads: This is the smallest element of your Google Grant account but is arguably the most important since it consists of the copy and links you’re promoting. Google requires you to have at least two ads per ad group. Google will automatically rotate between these ads and provide you with performance data. For instance, if ad A performs significantly better than ad B, you’ll know to tweak ad B to improve its performance.

One important thing to remember when optimizing your account is not to spread your budget too thin across several ad groups and keywords. You’ll have more success by allocating more funds to a core group of services or resources related to your mission.

While this structure is required for your nonprofit’s Google Grant account, following it will provide you with insightful performance data you can use to produce better ads over time.

Choose the Right Keywords for Your Google Grant Account.

Choosing the keywords you want to target is one of the first steps you’ll take when setting up your first campaign.

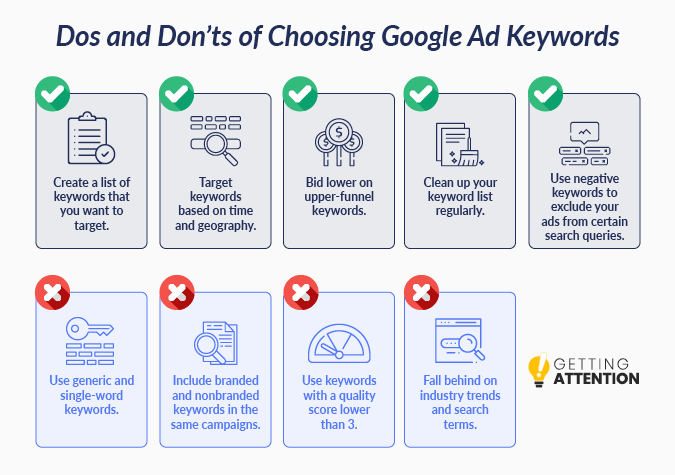

Instead of blindly guessing what you think people are searching for and will drive conversions, we’ve created a checklist you can follow to come up with educated keyword choices. As you start optimizing your Google Grant account, here are some dos and don’ts for choosing the best keywords for your cause:

- DO create a list of keywords that you want to target. Using specific keywords relevant to your organization is an excellent place to start. Leverage Google Keyword Planner to get helpful metrics regarding different keywords, such as search volume trends, average monthly searches per keyword, and bid estimates. You can also leverage Google Trends to explore what people are searching for related to your mission.

- DO target keywords based on time and geography. These keywords could relate to holidays like, “Christmas gift drive” or location-specific events like, “clothing donation centers in Boston.” Some keywords are seasonal, so focus on them when relevant.

- DO bid lower on upper-funnel keywords and vice versa. Upper funnel keywords are general search queries that someone higher in the search conversion funnel might search. On the other hand, lower-funnel keywords usually are longer, more specific, and searched by people who are likely to convert.

- DO clean up your keyword list regularly. Pause any seasonal terms like “Thanksgiving food donations” when they are not relevant, and remove low-quality keywords that do not serve your account.

- DO use negative keywords to exclude your ads from specific search queries. More than likely, there are search terms you don’t want your ads to display for. Add negative keywords to your ad groups to avoid ranking for those terms. You might also leverage a strategy called “traffic sculpting,” in which you add negative keywords to an ad group to avoid competing with your ads in other ad groups.

- DON’T use generic and single-word keywords. Examples of this include “volunteers” and “animal shelter.” Not only does Google ban the use of these keywords, but your nonprofit will probably be outbid for generic search terms like these. Instead, try using long-tail keywords such as “animal shelter volunteer opportunities near me.” Long-tail keywords like this involve multi-word phrases and are highly specific.

- DON’T include branded and nonbranded keywords in the same campaigns. You’ll likely rank organically for branded terms, so allocate your grant money to run ads for nonbranded search terms.

- DON’T use keywords with a quality score lower than 3. Google scores keywords on a scale of 1 to 10 based on their quality. Keywords that receive a score of 1 or 2 are considered low quality and are not permitted for targeting. These keywords must be removed or paused.

- DON’T forget to research industry trends and search terms. If like many nonprofits, you’re struggling to maximize spending on your Grant account, try researching new keywords to expand your campaigns. What keywords could you add? When was the last time you looked at Keyword Planner for new ideas? What are your competitors ranking for?

A healthy Google Grant account will have around 25 keywords per group. However, conducting keyword research could help you uncover dozens more valuable keywords.

Optimize Your Google Grant Account’s Ads.

But don’t forget the reason behind all of your optimizing: the ads!There are several best practices to keep in mind when creating your ads. Here are a few to get you started:

- Create compelling ad copy. It should go without saying that your ad copy is one of the most crucial components of your ads. This is primarily why Google requires you to have multiple ads per ad group—it allows you to see what resonates with people and encourages them to click through. We suggest leveraging keywords in the ad copy to parrot back similar phrases to what users are searching for, including a specific call to action, and using short sentences to keep your ads scannable.

- Choose the right landing pages. Your landing pages are just as important as your ad copy. It’s where you’ll drive users when they come across your ads and ultimately determine whether they get involved with your nonprofit. Choose the most relevant landing pages for each ad, whether it’s a digital donation page, volunteer registration form, or email newsletter signup form.

- Have 3 to 5 ads per group. While Google only requires 2 ads per ad group, we recommend using at least 3. Try to vary these ads so you can experiment with different targeting approaches. The ads within each group will rotate, and Google prioritizes the ads that perform the best.

- Highlight what’s unique about your nonprofit. Avoid blending in by sharing what’s interesting about your organization.

- Don’t immediately optimize ad rotation for your campaigns. No more than one ad from an ad group can show at a time. The “ad rotation” setting allows you to specify how often Google will serve your ads relative to one another. Within your Search and Display campaign settings, you can choose “Optimize” or “Do not optimize” for this setting. If you’re starting a new campaign, we suggest that you don’t optimize your ad rotation. Instead, keep ads rotating indefinitely to see which messaging works best and optimize rotation manually on your end.

Producing high-quality ads doesn’t have to be overwhelming. Keep these tips in mind to steer your nonprofit’s choices when creating ads.

Track Your Google Grant Account’s Conversions and Other Metrics.

As you set up your Google Ads account, sign up for Google Analytics and connect it with your Ad Grant account. The metrics you gather from Google Analytics will help you refine your ads, improve your landing pages, and ultimately optimize your Google Grant account.

For one, Google requires you to track and report on conversions and CTR.

Conversions

For many nonprofits, conversions are the goal of their ads. Conversions measure how many people take the ad’s desired action after seeing it, such as making a donation, registering for an event, or signing up to volunteer.

Here are a few best practices for conversion tracking:

- Track conversions that are meaningful to your organization. Google Analytics offers different options for conversion tracking. Focus on those that align with your goals. For example, you might track registrations for your upcoming annual gala or donations made during your year-end giving campaign.

- Set up goals in Google Analytics. Setting up goals in Google Analytics can help you see what impacts your ads’ conversion rate. In addition to enhancing conversion performance, Google Grants accounts are required to set up goals.

- Take note of which ads are best at leading to conversions. Experiment with the style and wording of your ads to analyze which ones yield the most conversions. From there, you can improve future ads to ensure the best performance from your campaigns.

Google requires Google Ad Grants accounts to track their conversions if applicable. To do so, set up an account within Google Analytics by using these account setup instructions.

Click-Through Rate (CTR)

The Google Ad Grant team uses CTR to measure ad quality. Google interprets a high CTR for an ad as the ad being very relevant and valuable to users. While Google Analytics will automatically calculate each ad’s CTR for you, it can be helpful to understand how it’s calculated manually.

Calculate CTR by dividing the number of people who click your ad’s link by the number of impressions the ad receives. Here’s what the formula looks like:

For example, if your ad is shown to 100 people, and 5 people click the link, your CTR will be 5% for that ad.

If you notice that your CTR is lower than you’d like, here are some ways you can boost that metric and directly optimize your Google Grant account:

- Pause keywords with a low CTR. Take a look at the keywords that receive the most impressions and pause any with a low CTR. While a keyword may be relevant to your mission, you should focus on keywords that yield results.

- Improve your ads. Do your ads inspire readers to click through to your website to get involved or learn more about your mission? Think critically about your ad copy and whether you’re pointing users to a relevant landing page.

- Use A/B testing. One of the great things about Google Ads is that you can rotate between multiple ads for the same keywords. This makes it incredibly easy to see which ad copy performs the best, so you can boost your CTR with each rendition of your ads.

Google requires you to have a 5% click-through rate for each ad. Otherwise, your account will be at risk of being temporarily suspended. But don’t worry! An optimized Google Grant account will easily meet the minimum threshold.

Use Manual Bidding for Your Google Grant Account.

Google recommends that nonprofits automate their bids with Google Ads to save time managing their accounts.

However, we suggest that you start with manual bidding. That way, you’ll have more control over your budget.

If you go with automated bidding, we suggest that you don’t use the “Maximize Clicks” automated bidding strategy, even though it’s Google’s default option. That bidding strategy focuses on clicks rather than conversions (your ultimate goal for your ads). Instead, select the “Maximize Conversions” bidding strategy. This will allow you to be more competitive with bidding and effectively spend more of your ad budget.

Use Targeting and Extensions To Improve Response to Your Ads.

To help your ads reach their intended audience, Google offers targeting settings and extensions to improve your ads’ performance and optimize your Google Grant account.

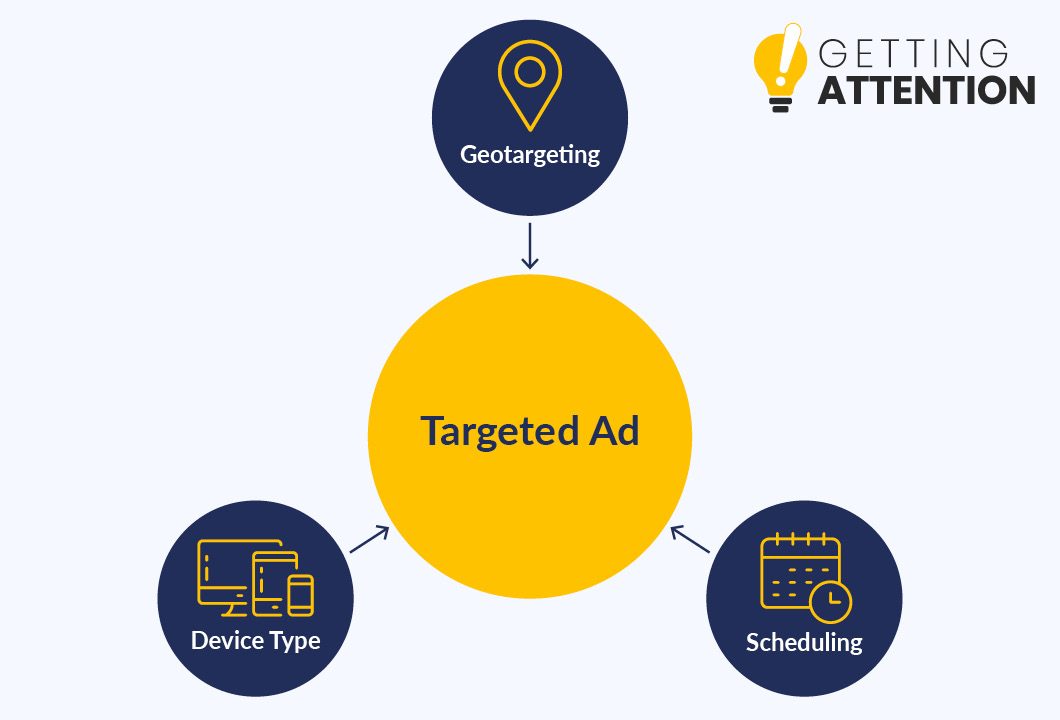

Targeting

Targeting ads help you streamline your message to address a narrow audience who are highly likely to support your cause. Let’s take a look at these three different ways you can target your ads:

- Geotargeting. Leverage the geotargeting feature to focus on areas your nonprofit serves. For example, if your nonprofit operates out of New York, ads that appear for Atlanta-based searchers won’t be very effective. However, if many of your donors reside in another area (say Chicago), you may want to target users in that area as well.

- Ad scheduling. Create an Ad Schedule for all of your campaigns—even those you’re planning on running 24/7. This will help you pinpoint specific times when your ads perform well, so you can adjust your schedule moving forward. To create a schedule, go to one of your campaigns, click on “More” under Settings, hit “Schedule,” select a campaign, choose “All Days,” and save it.

- Device type. If you’re working with a limited budget, you may want to exclude certain devices from receiving your ads. For example, eCommerce reports show that desktops tend to have higher conversion rates at 4.36%, while mobile has the lowest at 2.95%. To exclude a device from receiving your ads, go to the “Devices” tab, choose a device type, change the bid adjustment to “Decrease” by 100%, and apply the changes. Although, keep in mind that a supporter who sees your ad on mobile may decide to explore your site later on their desktop!

You want your ads to be shown to individuals who are likely to convert, so you don’t waste your grant money or negatively impact your ads’ performance. These targeting features will help you connect with likely prospects.

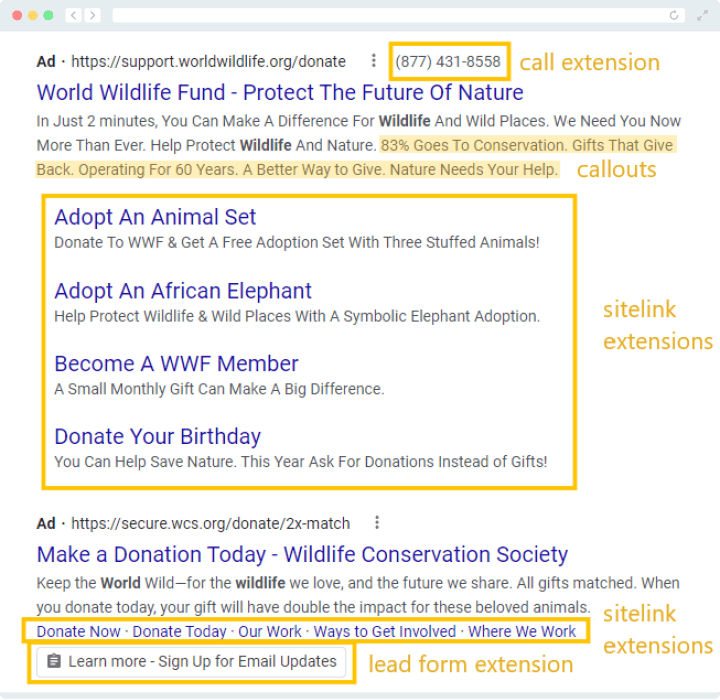

Ad Extensions

Ad extensions provide users with more information about a nonprofit’s services, programs, and mission. They help expand the ad listing, ensure it’s as useful as possible, and take up more ad space on the search engine results page.

By providing information that matches the user’s intent, ad extensions directly impact your ads’ CTR.

Some of the most commonly used ad extensions include the following:

- Sitelinks: Create mini-ads within your ads that link to other pages on your site.

- Callout Extensions and Structured Snippets: Include additional plain text within your ads to emphasize key points (great for including extra detail that wouldn’t fit in the main ad’s text).

- Price: Quantify the donation amount or cost of services that a prospect would need to know (e.g., veterinary services, event ticketing price, and so on).

- Location and Call: Display your organization’s address and phone number. Users will be able to click the number and call you directly.

Ad extensions give users with more ways to interact with your cause. Note that your ad extensions won’t always show up with your ads. Instead, Google will show them when the extension (or combination of extensions) is expected to improve the ad’s performance and when your ad’s position and Ad Rank are high enough to show extensions.

Your best bet is to include the most relevant ones for your ads, increasing the likelihood that they’ll be displayed.

Follow Website Compliance Guidelines

Like with most other aspects of the Google Ad Grants program, there are specific rules for your website to follow. An insufficient, unprotected, or otherwise useless website can lead to a temporary suspension of your Google Grant account.

Here are the basic rules you’ll need to follow to ensure your website adheres to Google’s basic eligibility guidelines:

- You must own the domain. Your nonprofit must own the rights to landing pages linked in your ads. If this landing page is a donation-hosting service, it must belong to one of these pre-approved sites.

- Add additional domains to your account. If you plan to link to other domains with Google Grant ads, add them to your account first. This way, Google is aware that your nonprofit owns these domains.

- Maintain high-quality websites. Any domains used must be high-quality web pages. Valuable web pages have several important factors that we’ll cover in the next section.

- Avoid any commercial activity that does not align with your mission. Commercial activity like selling products, services, or consultations can’t be the sole purpose of your website. Limited commercial activity is allowed, provided it aligns with your mission—think selling t-shirts with your nonprofit’s logos to help raise money for your cause.

Following these basic compliance regulations will help keep your Google Grant account compliant.

Let A Google Grants Professional Optimize Your Google Grant Account.

Working with a professional agency can take the weight off your shoulders when it comes to optimizing a Google Grant account. Professionals provide tailored services that help you set up and manage your Google Ad Grants account as efficiently as possible.

Here at Getting Attention, we strive to help nonprofits make the most of their grant money every month. We make the process simple and easy to understand from completing your application to tracking your data. Our services include:

- Google Grant Applications: The Google Grant application process can be intimidating. The experts at Getting Attention are here to help guide you through the process and make sure your account is accepted on the first try.

- Google Grant Hygiene: Data is crucial for optimizing your Google Grant account. Getting Attention is ready to help you clean up your data and make analysis more efficient. Whether you need to remove irrelevant keywords or outdated information, our experts are ready to step in.

- Keyword Research: If you’re feeling lost when choosing keywords, let our agency handle the research for you. We can ensure that your account tracks the most relevant and effective keywords to extend your ads’ reach.

- Google Grant Account Reactivation: With so many compliance rules, suspension can happen, and our team is one of the best resources for getting your account back up and running.

Our goal is to optimize Google Grant accounts so that nonprofits like yours can reinvest focus into their worthwhile missions. To learn more, contact our team to request a free consultation today. Plus, we’re happy to discuss our expertise in other areas. That way, you’re receiving the most comprehensive support possible.

Look into Google Ad Grants Training.

Even if you outsource work to a professional Google Grants manager, it never hurts to look into training. Google has plenty of free training resources that can help you optimize your Google Grant account and maximize ad performance. Not to mention, third-party sites also provide resources and advice based on their experience.

You can start your training by exploring our blog and checking out our top recommended training courses.

If you have any unanswered questions about managing your Google Grant account, our team of professionals is here to help. Reach out and request a free consultation where we can discuss your needs.

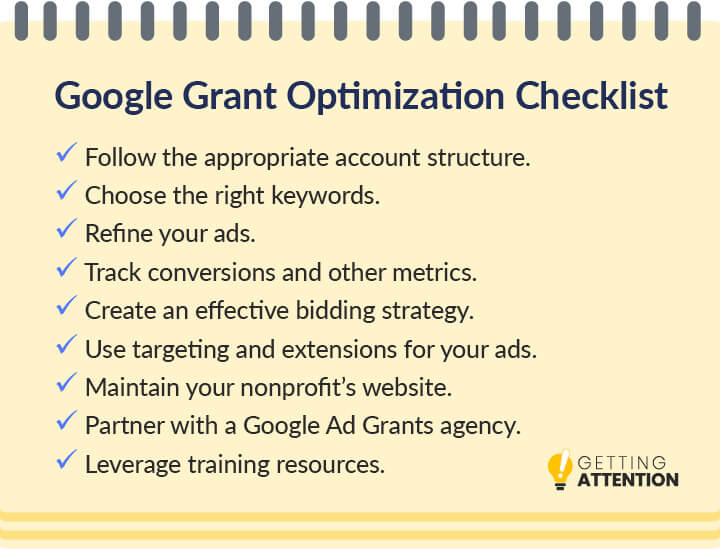

Google Grant Optimization Checklist

Now that you’ve learned some helpful tips for optimization, it’s time to put them to use. We’ve created a checklist to help you keep track of the essentials of successful account optimization:

Use our checklist below to make sure you don’t overlook anything when optimizing your Google Grant account.

Account Structure

- Center campaigns around themes

- Include 3-5 ad groups per campaign

- Have 3-5 ads per ad group

Keywords

- Include approximately 25 keywords per ad group

- Choose keywords relevant to your mission

- No generic or single-word keywords

- Target keywords based on time and geography

- Separate branded and nonbranded keywords into different campaigns

- No keywords with quality scores below 3

- Use negative keywords to avoid ranking for those terms

Conversions

- Track conversions in Google Analytics

- Set up conversion goals in Google Analytics

- Track conversions that are meaningful to your organization

- Adjust ads based on which ones increase conversions

Ads

- Use keywords in the ad copy

- Include specific calls to action in the ad copy

- Highlight your mission

- Manually rotate your ads for new campaigns

Metrics

- Track meaningful conversions for your nonprofit

- Use A/B testing to determine what drives conversions and clicks

- Have at least 1 conversion per month

- Maintain a 5% CTR each month

Bidding

- Use manual bidding when possible

- If you set up automated bidding, select the Maximize Conversions option

Targeting

- Narrow down your target audience with geotargeting

- Pinpoint specific times when ads perform well with ad scheduling

- Adjust which devices your ads can be viewed on

- Link to other pages within your ads by using sitelinks

- Include additional plain text with callout extensions and structured snippets

- Include the cost of services with the price extension

- Display your address and phone number with the location and call extensions

- Capture leads with the lead form extension

Website Maintenance

- Ensure you own your nonprofit’s domain

- Include one focus per page

- No commercial activity that’s related to your mission

- Include ad keywords on your landing pages

- Create clear calls to action

- Ensure the site is mobile accessible

Partnering with a Google Ad Grants agency

- Google Grant applications

- Account hygiene

- Keyword research

- Account reactivation

Training Resources

Getting accepted into the Google Ad Grants program is an exciting moment. Keeping up with the ins and outs of account management can be a challenge, but this streamlined checklist should help. Download a PDF version of this checklist for quick access in the future.

Final Thoughts on Optimizing A Google Grant Account

Optimizing a Google Grant account isn’t a one-and-done sort of deal. Rather, someone will need to actively manage your account, check keyword data, refine your ads, and more.

To make the most of your account, implement the tips covered in this ultimate guide. If you’re seeking more assistance with optimizing your Google Ad Grant account, reach out to the team at Getting Attention to set up a free consultation today. We’re happy to discuss your needs so that you can get more out of the program each month.

In the meantime, explore the following additional resources to continue learning about Google Ad Grants:

9 Donor Engagement Strategies to Transform Your Outreach

/in Google Ad Grants, Nonprofit Communications, Nonprofit Fundraising /by Jessica KingNonprofits rely on donors’ generosity to fund their mission programming and cover operating overhead costs. But an organization can’t expect to sit back and watch the revenue roll in without first outlining how they’ll identify donors, market their missions to them, and build relationships with them—which is where thoughtful donor engagement strategies come in.

A donor’s engagement extends beyond their donations. With the right tactics in place, you can transform them into lifelong ambassadors of your cause. On the other hand, failure to properly cultivate relationships with them means you’ll potentially lose their interest and their support altogether.

To help, we’ll walk you through the basics of engaging donors and explore proven methods that are known to drive nonprofit support, including:

At Getting Attention, we empower nonprofits to connect with new prospects and promote valuable opportunities using the Google Ad Grant program. Through our time working with nonprofits, we’ve seen how different tactics drive results for nonprofits.

We’re confident this guide will give everything you need to better connect with your supporters and drive increased support in your fundraising initiatives. Let’s get started!

What Is Donor Engagement?

Donor engagement refers to the process of building and maintaining relationships between a nonprofit and its donors. This includes all interactions that encourage donors to become more invested and involved in the organization, including communications, events, volunteer opportunities, and fundraisers.

The primary goal of a donor engagement plan is to cultivate loyal relationships with donors by forging deeper connections. The more you engage donors, the more likely they are to stick around for the long term. In other words, their engagement directly impacts your donor retention rate.

To increase commitment, nonprofits often experiment with different donor engagement strategies like unique marketing tactics and public recognition to improve fundraising outcomes.

Why Nonprofits Should Track Donor Engagement

We’ve all heard that retaining a donor is more cost-effective than soliciting donations from first-time donors. New donors need countless touchpoints before deciding to give whereas current donors have already demonstrated an affinity for your cause and need less convincing.

Plus, due to fluctuating donor retention rates and increased marketing costs, the price of replacing lapsed donors has skyrocketed. As a result, losing donors is unaffordable for many organizations.

Tracking donor engagement is imperative to your mission’s continued success. Specifically, here’s what tracking donor engagement will enable your team to do:

Tracking the right details will allow your nonprofit to cultivate meaningful relationships and reduce the number of lapsed donors. Overall, investing sufficient time and energy can help you establish a solid foundation for your mission.

Signals That Measure Donor Engagement

Donor engagement expands far beyond financial contributions. While consistent giving is a top engagement indicator, there are several other factors that communicate donor involvement.

Using a powerful CRM and other digital tools, your nonprofit can track a range of donor engagement signals, like:

As you can see, both financial and non-financial indicators can signal donor engagement. Using your CRM alongside other tools like Google Analytics for monitoring web traffic, you can identify donors who are at risk of disengagement or who are ready to upgrade their support.

For example, let’s say another donor consistently donates $50 on a regular basis, interacts with your social media posts, and fills out your surveys. They may be a great candidate for recurring giving. Monitoring the right metrics allows you to identify these upgrade opportunities!

9 Donor Engagement Strategies to Drive Support

With the fundamentals nailed down, you’re ready to craft a plan for engaging donors! Knowing what drives your supporters to stick around will help you interact meaningfully and communicate that your organization cares about its supporters.

Remember, each nonprofit’s donors are unique, so every organization finds success in different donor engagement strategies. Tailor your approach to your supporters, and you’ll be on the right path.

1. Google Ad Grants

If your nonprofit isn’t already leveraging Google Ad Grants in its marketing strategy, you’re missing out on a huge opportunity to engage with existing and prospective donors. Here’s what getting involved in the program entails:

Our guide to Google Ad Grant impact shows that search ads (like Google Ads) have the highest ROI for nonprofits using paid advertising among other platforms. And since 98% of searchers click a result on page 1 of Google, you stand to gain a lot of exposure for your digital content.

Google Ad Grants are essential for increasing donor engagement on two key fronts: attracting new supporters and providing additional engagement opportunities for existing supporters.

By utilizing the free ad space made available by the world’s most popular search engine, your organization can put your cause in front of tons of new and recurring donors, opening up even more chances for building on those relationships.

2. Matching gifts

Matching gifts are an extremely effective type of corporate philanthropy that places individual donors at the heart of their employers’ giving strategies. They help to deepen both corporate and donor relationships with your nonprofit.

Here’s how these workplace giving programs typically work:

Highlighting matching gift opportunities is one of the most effective ways to engage donors—and there are a ton of studies to back this up. Not to mention, following up with matching gift donors after their initial contribution provides your nonprofit with an additional touch point for reminding donors of your mission.

Meanwhile, companies that do not currently match employee gifts may be willing to consider a Custom Matching Gift Program. To pursue this avenue, reach out to potential corporate partners and pitch the idea of a short-term workplace giving initiative that involves matching staff donations exclusively to your nonprofit.

Not only is this an excellent way to engage previously ineligible donors in matching gift campaigns, but it can also increase your fundraising reach as your mission is exposed to the company’s other team members.

Plus, having a successful corporate philanthropy partnership with a business can lead to further opportunities in the future, such as financial, media, or in-kind sponsorships.

3. Online greeting cards

Engaging donors requires you to get creative. Digital greeting cards might be just what you need to capture supporters’ attention! When you spend time creating visually-attractive designs, your eCards can act as an easy, cost-effective, and interactive way to engage donors.

There are a few ways you can leverage eCards in your donor engagement plan, including:

We recommend that you create designs for every occasion. Create a mission awareness collection to amplify a cause awareness campaign, holiday cards to celebrate important days year-round, and tribute cards to let individuals give in someone else’s name. Your options are endless! Donors will appreciate having a fun, interactive way to support your cause and share it with their loved ones.

If you’re offering them in exchange for donations, make sure your online greeting card creation platform allows you to enable donations. No matter your approach, be sure to brand each eCard to your cause, even if you only add your logo to the corner.

4. Peer-to-peer giving

Organizations hosting peer-to-peer campaigns are able to reach new donors (via existing supporters who take on a fundraising role for your nonprofit) while offering one of the most engaging ways for existing supporters to participate.

Equipped with customizable donation pages from the organization’s peer-to-peer platform, supporters then reach out to their own networks of friends and family members to solicit donations for a cause they care about.

First-time donors are more likely to contribute when asked by peers, rather than directly by your organization. Donately’s guide to peer-to-peer fundraising explains that “even if they’re unfamiliar with your work, they can still form a personal connection thanks to the power of social proof.” That means this donor engagement strategy enables your team to get in touch with new supporters you may not have won over on your own.

All the funding goes to your organization’s mission, and you’re left with a ton of donors who are highly engaged with the cause. From there, you can work to continue building connections with new and existing individuals through additional donor engagement ideas.

5. Volunteer opportunities

Even your most dedicated donors don’t want their only communication with your team to be additional requests for funding. That’s why it’s an excellent idea to offer unique opportunities for involvement with your mission.

And one of the best ways to do so is by encouraging donors to participate in volunteer opportunities! This can be an excellent way for donors to see your cause in a new light.

Not to mention, you can even monetize this donor engagement strategy by highlighting the potential for volunteer grants. Many donors (especially those previously determined to be eligible for matching gifts) work for companies that provide financial support to the nonprofits their employees volunteer with.

6. Donor appreciation

Two of the most common reasons why donors stop giving to nonprofit organizations they’ve supported in the past are:

Both of these undersights together can lead a donor to believe that the nonprofit in question didn’t really need their donation in the first place. As a result, donor engagement may decrease.

Luckily, effectively communicating appreciation for your donors can assist in solving all of the above problems. You’ll want to thank each individual donor for supporting your nonprofit with their hard-earned dollars through meaningful outreach via a variety of methods, such as:

Not only is thanking your donors the polite thing to do, but it also helps close the loop and reiterate to the donor that you received and processed their contribution successfully. So long as you show genuine appreciation for your supporters, you can cultivate lasting relationships with them and retain their support long-term.

7. Segmentation and personalization

Unfortunately, a donation appeal that begins with “Dear donor” or “To whom this may concern” and ends with a generic request of $5, $10, $25, or $50 is not likely to produce great results. That’s because it won’t elicit the emotional connections that are required for effective fundraising nowadays.

Why not? An effective ask needs to incorporate strategic segmentation and personalization—two things that, when done well, can go particularly far for your donor engagement plan. It’s what makes a donation request feel like an intimate appeal to an essential partner in your organization’s mission (which, as you know, is what your donors are).

In order to drive donor engagement, segment your communications. You should group donors by specific characteristics to receive targeted information relevant to that slice of your network. Common segments might include:

Further, you should also personalize your communications to each individual. That may include addressing the recipient by name, referring to a recent donation, or acknowledging how long the donor has been involved with your organization.

8. Unique fundraising ideas

Choosing unique, exciting, and refreshing fundraisers is an essential part of engaging donors! And that’s not saying you have to drop your tried-and-true fundraising ideas, either. Just try sprucing them up to make them stand out, and your audience will be more than happy to participate.

A few ways to spice up your existing fundraising ideas include:

Aside from these strategies, you can also consider taking your in-person fundraising events virtual. By doing so, you’ll be able to connect with more supporters all across the country and even the globe. Or, if you’re intimidated by the thought of an entirely online event, you could make your next event hybrid instead.

9. Powerful storytelling

The story you tell about your nonprofit and its mission is essential for securing and retaining donor support.

To bring your strategic storytelling practices to the next level and inspire more supporters to get involved, it’s important to incorporate essential storytelling elements. Include these three fundamental components:

From there, you’ll also want to include supporting data, an emotional narrative, sensory details, and relevant imagery when possible.

The idea is that donors feel connected to the story and desire to play a role in the solution—thus, supporting (or continuing to support) your organization in its work!

Final Thoughts on Donor Engagement

Your donor base forms an essential component of your overall nonprofit organization, and their engagement with your cause is critical for continuous mission success. A highly engaged donor is more likely to contribute to your cause time and time again—so you don’t want to settle for base-level efforts.

Luckily, utilizing donor engagement strategies like workplace giving promotions, strategic fundraising, and cost-effective marketing can make a huge difference. That means it’s time to begin incorporating these ideas into your donor engagement plan and make sure you equip your team with the tools required to do so effectively!

Want to learn more about engaging donors in your nonprofit organization? Browse these additional resources:

Matching Gifts Remain Steady (If Not Growing) Despite Economic Downturns

/in Nonprofit Communications, Nonprofit Fundraising /by Jessica KingEffective fundraising can be difficult in the best of times, and strenuous economic circumstances can throw a wrench in any organization’s well-laid-out plans. That said, matching gift programs remain a top source of funding for many nonprofits, and matching gifts despite economic downturns is entirely possible.

In order to best craft a matching gift strategy for your organization, it’s essential to both look at past examples and cite probable trends for the future.

Which is why, in this guide, we’ll share valuable insights into the following:

The good news is this — research shows that matching gift opportunities remain steady and are likely to continue doing so. At the same time, it’s important to equip your team with the knowledge surrounding matching gift programs, their current status in the nonprofit sector, and what you can do to set your mission up for success.

Let’s begin.

What We’ve Learned From Previous Economic Downturns

Since the conclusion of the Great Depression in 1939, the U.S. has fallen into thirteen economic recessions. In the most recent circumstances, we’ve seen the effects that difficult national (and even global) financial crises have had on one of the most popular forms of corporate philanthropy—matching gifts.

Luckily, the evident impact has been largely positive, which is a benefit to the companies, their employees, and nonprofit causes around the world.

Matching Gifts in the Great Recession

The Great Recession, which occurred from December of 2007 to June of 2009, was one of the first to take place while matching gift programs were a commonplace type of philanthropy. And while many were concerned about companies taking away the giving opportunities, this didn’t tend to be the case.

In the words of Aron Cramer, president and CEO of Business for Social Responsibility, “This recession is wiping away a lot of things, but so far, corporate responsibility seems to be a survivor.” Looking back on the happenings, we’re glad to report that corporate giving continued to thrive throughout the downturns.

Here’s what a few well-known companies had to say (and do) concerning corporate giving in the 2008 recession:

In the words of GE’s Chairman and CEO at the time, Jeffrey Immelt, “When we come out of this fog, this notion that companies need to stand for something – they need to be accountable for more than just the money they earn – is going to be profound.”

In his own words, the Starbucks CEO stated, “With that mindset comes the false belief that investments in people and training can wait; that corporate social responsibility can be put on the back burner.” And the idea is reflected in Starbucks’ matching gift data, as well! Not only did the company retain its matching gift program despite overall financial hardship, but it saw a 28.6% increase in matching gift totals from year over year (source: 2007 and 2008 Global Impact Reports).

Matching Gifts + COVID-19

The next recession seen by the U.S. took place between February and April of 2020 and was the direct effect of the coronavirus pandemic during the same time period. And again, many were pleasantly surprised at the charitable responses taken by tons of businesses, small and large.

Check out these companies’ matching gift responses to the COVID-19 pandemic and resulting economic downturn:

According to chairman and chief executive officer, Richard A. Gonzalez, “AbbVie is making this donation to nonprofit partners that will have an immediate and significant positive impact in communities that have been hit hardest by this unprecedented crisis. Our 30,000 AbbVie team members around the world are proud to be able to help make a difference in the fight against this virus.”

Mary Jane Melendez, president of the General Mills Foundation, reported the following: “As a company, we have the values, insights, and partners to positively impact the lives of millions of people worldwide during this unprecedented time as the world navigates the COVID-19 pandemic. These grants will help expand food access and lend added support for many of our communities around the world.”

And it didn’t end there, either! Double the Donation compiled a list of even more key companies that chose to expand their matching gift initiatives in response to the COVID-19 pandemic. This includes Apple (introduced a two-to-one ratio as opposed to their traditional dollar-for-dollar match), Google (significantly increased their matching gift cap to $20,000 per employee), Honda, Microsoft, and more.

What We’re Seeing Regarding Recent Program Updates

This has been a significant year in terms of changes—both regarding corporate matching gift programs as well as in the overall economic landscape. Luckily, despite any economic downturns we’ve seen, the adjustments in matching gift programs have been overwhelmingly positive.

Let’s browse a few companies that have enhanced their employee donation-matching initiatives in the past year—and specifically, how they’ve done so.

Reinstated Programs

These programs that had previously lapsed have been brought back, further empowering their employees to get involved:

Increased Match Ratios

Increasing matching gift ratios enables employee donors and the nonprofits they support to do exponentially more with the funding they contribute. Now, with growing match ratios, these companies aim to double, triple, and even quadruple their team members’ individual gifts:

Elevated Donation Maximums

As corporate donation matching maximums grow, so does the capacity for donors’ matching gifts to make a difference for the causes they care about. Check out these companies’ programs, now with more room for eligible matching:

Matching gifts as a whole tend to ebb and flow; one program may end, while another few begin. However, we’ve seen the overall offerings increasing steadily in the past few years. And as we jump into the new year, we can continue to expect program enhancements, new offerings, and more.

What We Can Expect for the Future of Matching Gifts

As the U.S. economy trends downward, many are once again beginning to question the future of matching gift fundraising opportunities. Will companies cancel these programs as their own profits are in danger? Or will they up their giving efforts as their communities’ needs continue to grow?

Unfortunately, there’s no way to look directly into the future and figure out what companies will end up choosing. However, a look at the past, and an analysis of current matching gift trends, can help us craft our hypotheses.

And that being said, here’s what we can expect to occur in terms of matching gifts despite economic downturns:

Companies with existing programs will continue to match employee gifts.

First things first, most companies that already match employee donations are likely to continue doing so. A matching gift program is typically an ongoing initiative rather than something that is often canceled and re-instated at a later, more promising point in time. Most companies see matching gifts as what they are—long-term, positive investments—and will not opt to negate their offering, even despite a nearing or existing recession.

Not to mention, the vast majority of companies will have already established their matching gift budgets for the time being. Plus, cutting corporate philanthropy programming in order to increase business profits would be a pretty poor public relations strategy. This is especially true in a time when corporate social responsibility is being increasingly demanded from businesses across the globe.

More companies will begin offering employee donation-matching initiatives.

In a recent survey, 39% of companies reported plans to expand their workplace giving programs (such as matching employee gifts) in the next two years. Regardless of challenging economic conditions, the demand for charitable-minded companies is increasing.

Employees want to work for companies that support the greater good—often through nonprofit causes. Not to mention, consumers want to spend their dollars in the same way by supporting businesses that care about giving back.

This is particularly crucial in a time such as now, which is being referred to as the “Great Resignation.” Individuals are leaving their existing companies in droves in order to find employment that better suits their wants and needs. For many, that means locating opportunities with companies that prioritize social responsibility and philanthropy—especially to the nonprofits that they themselves support.

Thus, more and more businesses are looking for new ways to demonstrate their participation in corporate social responsibility. One of the easiest and most impactful ways to do so is with employee gift-matching, which is why employers are launching new programs every day. And we expect that they’ll continue to do so!

Some employers will expand their matching gift program thresholds.

Considering how many companies opted to increase their matching gift programs during the recessions of 2008 and 2020, it can be expected that some will choose to do the same now.

Economic difficulty and community needs tend to share a positive correlation—when one increases, the other follows suit. As a result, corporations see a growing demand for nonprofit services and feel compelled to do even more.

And as a bonus for nonprofits, these expanding programs tend to see particularly high levels of employee participation as well. When team members see their employers giving or offering more to charitable causes, they can be increasingly inspired to contribute their own dollars as well.

Next Steps for Elevating Your Nonprofit’s Gift-Matching

What can you do to help your organization make the most of available corporate donation-matching dollars? The #1 step you can take is ensuring your donors are aware of the opportunities in the first place.

In fact, studies show that over 26 million individuals are currently employed by companies with matching gift programs. But more than 78% of this group has never been informed about them! And, despite being eligible to participate, these individuals will be unable to secure matching gifts from their employers on your behalf if they don’t know about the programs.

So keep an eye out for companies with matching gift programs as they’re constantly changing, and new programs are being added every day. Then, be sure to educate your donors about the vast opportunities at hand—and how they can get involved.

For donors interested in matching gifts who work at employers without a program, provide them with the resources they need to pitch a matching gift program to their employer. This might be information about your nonprofit’s programs specifically and how your initiatives align with the given company’s values or general information about how matching gift programs can boost employee engagement and motivation.

Interested in learning more about matching gifts (despite economic downturns and beyond)? Check out these other information-packed resources:

An Ultimate Guide to Donor Data Research and Retention

/in Nonprofit Communications, Nonprofit Fundraising /by Jessica KingYou’ve likely heard the saying that it’s cheaper to retain a donor than it is to find a new one. It’s why maintaining high levels of retention is so crucial for many organizations. Luckily, donor data research can help!

In this guide, we’ll walk you through everything you need to know about donor data and how it can impact your overall retention rates. This will include:

By collecting detailed information about your supporters, you can develop beyond-surface-level relationships and better target your marketing outreach to each individual. In the end, you’ll see more donors continuing to support your efforts, providing your organization with improved fundraising results over time.

Ready to find out how to leverage donor data research in your retention strategy? Let’s begin with the basics.

Types of Donor Data to Prioritize

There’s a ton of information available out there about each and every person. To optimize your donor retention strategy, you need to know which types of data will be of use to you.

We recommend prioritizing the following:

Contact information

An individual’s contact information is the most essential element of their donor profile. It’s what you need to get in touch with the donor after their initial contribution, thank them for their support, and begin developing a relationship. In the end, it’s also what you’ll use to send follow-up donation requests.

Ideally, this donor data should include as many of the following details as possible:

If you have multiple ways to get in contact with a donor, it can also help to note their preferred communication methods. This might incorporate text messaging, phone calls, email correspondence, direct mailings, and more.

Nonprofit involvement

Next, it’s important to have a solid understanding of an individual’s historical nonprofit involvement—both with your organization and others. Thus, ideal data on an individual’s nonprofit involvement should include:

For example, you’ll want to engage with a long-time repeating donor much differently than you would a first-time contributor to your cause. Luckily, this information should be one of the easiest to collect and leverage—particularly when it comes to giving history in regards to your own organization—using your nonprofit’s CRM or donor management system.

Employment details

Did you know that your donors’ employment information is one of the most crucial pieces of data you can access? Not only can this information help roughly identify your supporters’ wealth status (more on that below), but it can also open up significant opportunities for matching gifts, volunteer grants, and more. Plus, understanding employment status can even help uncover invaluable business connections and open doors for potential corporate sponsorships as well.

So what exactly do you need to know? The company an individual works for is likely the simplest data point to find. From there, however, additional information such as employment type (full-time, part-time, seasonal or temporary, retired, etc.), job title, and tenure at the business can provide further insights into a donor’s employment.

Matching gift eligibility

A donor’s matching gift status is most often directly related to their employment. But an individual’s matching gift eligibility is such a key component that it should be considered its own donor data point altogether.

Once you know where your donors work (and typically, their employment type), you’ll be more likely to determine whether they qualify for workplace giving programs. From there, you’ll be able to easily and efficiently communicate that eligibility to each individual.

As a result, this data point can function as an additional engagement opportunity (or more likely, multiple). Not to mention, studies report donors being more likely to give if they know that their gift can be matched! And when you follow up with match-eligible donors after they give, you can keep your organization at top of mind for longer, remind them about the impact of potential matches, and ultimately drive more corporate revenue toward your cause.

Wealth data

Understanding a supporter’s wealth level is an essential part of determining ideal donation request amounts and, thus, optimizing your donor relations strategy. In order to craft a solid estimate for an individual’s ability to give, consider the following types of wealth marker information:

Together, these data points enable you to recognize and identify prospective major donors and target them as effectively as possible within communications.

Bonus! Hobbies and interests

An individual’s choice of hobbies and interests can tell you a lot about who they are as a person—rather than just a wallet. Though this may not be as “essential” as the other data points listed, having this information in your donor profiles is never a bad idea.

For example, let’s say you’re having a face-to-face conversation with a major donor. Knowing about their hobbies and interests, such as favorite sports (and sports teams), pastimes, animals, foods, and more, can help identify opportunities for genuine connections and similarities and begin building a rapport in the relationship.

How Nonprofits Can Collect Donor Data Insights

Now that you know what kinds of data points are of interest to your fundraising team, how exactly will you go about collecting that information?

Here are a few key methods you might use:

Online donation forms

Did you know that your organization’s online donation forms can provide a wealth of invaluable information about your donors? And if so, are you doing as much as you can with the donor data you collect?

As a donor completes their gift by utilizing your nonprofit’s online donation tool, they’re likely prompted to enter a range of details—from their name and contact info to the way they got involved with your organization.

Matching gift software

Matching gift software (such as Double the Donation) is a specific type of fundraising technology that typically integrates with an organization’s online donation form, CRM, and more. it’s one of the simplest and most impactful ways to collect information about donors’ employment—including current company and matching gift program eligibility.

There are a few ways that this software typically works! For one, a matching gift database search tool can be embedded directly into the organization’s online donation page and/or confirmation screen. Once donors visit the page, they are prompted to enter their company’s name in the auto-completing search tool, which then provides them with detailed information about the company’s available matching gift program criteria and next steps. Not to mention, the company name entered in the search tool is automatically associated with the individual’s donor profile for the organization to come back to.

Even if donors overlook the matching gift tools during the online giving experience, matching gift software may identify additional match-eligible supporters through corporate email domain screening, automated email follow-ups, and more.

Data append services

Have you already utilized multiple of the above methods for collecting donor data and realized you still have a number of holes in your donor profiles? That’s when you may want to consider data append services to help fill in the gaps!

Data appends are typically conducted by third-party agencies that have access to tons of publicly and privately held data sources on millions of individuals. All you need to do is supply the service provider with the information that you do have (for example, a donor’s first and last name and email address).

The appends service then scans that information against the rest of the data and provides additional details about each individual (such as their place of employment, mailing address, birth date, and more).

Asking directly

One of the most straightforward ways that an organization can collect information about its donors is by going directly to the source—the donors themselves.

Common ways for doing so include sending out a brief online survey in which donors can provide a range of requested information or offering donors access to a customizable online donor profile for your organization. In either case, individuals can share details about themselves, which your organization can use to get better acquainted with its audience.

The Impact of Donor Data Research on Retention

Once you’ve collected a plethora of information about your donors, it’s time to use that information to optimize your supporter relations strategy. Consequently, you’ll typically see significantly improved retention levels in no time.

These are some of the specific, tangible benefits of donor data research that result in nonprofit supporters sticking around for the long haul.

Personalization in communications

Personalized communications are more likely to grab recipients’ attention. This typically results in higher open rates, conversion rates, and more.

In order to personalize your organization’s messaging, however, you must have donor data to incorporate. At the very least, you need to know—and use—your donors’ names! Other helpful data points can include recent donation history (amount and campaign), events attended, and personal connections to your organization’s mission.

Take a look at these examples:

Increased personalization makes donors feel more intimately connected to your organization as a key component of your mission. When this occurs, they’ll be more likely to continue supporting your cause with additional gifts for years to come.

Targeted donation request amounts

Organizations often use specific donation asks to encourage donors to make larger gifts—both within online donation forms and with face-to-face major donation requests. However, you can’t just choose a set range of dollar amounts and use it as a universal suggestion for all donors.

Why? If your suggested amounts are all beyond a prospect’s giving ability, they’re likely to feel discouraged from giving and perhaps never complete their intended gift. At the same time, if you request small or mid-size “typical” donation amounts from a potential major donor, you’re likely to leave significant funding on the table.

That’s where targeted donation asks come in! By understanding your supporters—complete with a solid foundation of donor data research—you can craft ideal gift requests for each individual. The donor will be more likely to contribute to your cause, and you’re likely to maximize the donations you receive.

Workplace giving opportunities

Workplace giving programs—such as matching gifts and volunteer grants—can offer a significant form of funding for nonprofit organizations. They can also increase donor engagement, encourage on-the-fence individuals to contribute, and keep supporters coming back time and time again.

In fact, 84% of donors even report that they’re more likely to donate if they know a match is being offered, and mentioning matching gifts in your fundraising appeals results in a 71% increase in response rate.

All of that is to say that they’re great ways for nonprofits to boost donor retention. And, your donor data research sets you up for continuous success in that field by identifying eligible donors to follow up with.

Multi-channel marketing

The most effective way to ensure your marketing materials reach existing donors and encourage them to keep giving is to use data-driven approaches. Storing basic donor information such as their demographics, engagement with your nonprofit, and interests helps you hone in on the best strategy to drive conversions. Specifically, donor data can help you:

Want to learn more about Google Ad Grants? Watch the video below for a rundown:

It’s much more difficult to advertise without donor data to guide your tactics. Boost your return on investment in marketing across every channel by intentionally leveraging relevant donor information.

Main Takeaway for Donor Data Research and Retention

The more you know about your donors, the better you can craft relationships with them. And the stronger your donor relationships, the more likely they are to continue supporting your cause time and time again.

Ready to learn more about donor data management and what you can do with the information for your cause? Check out these additional resources:

5 Insider Nonprofit Graphic Design Steps to Boost Campaigns

/in Nonprofit Communications /by Jessica KingNonprofit marketing helps organizations raise awareness about their missions, promote their services in the community, and attract volunteers and donors.

Take your nonprofit’s marketing strategy to the next level by incorporating high-quality graphic design. These graphics have a host of benefits for your nonprofit—for example, studies indicate that 46% of consumers decide the credibility of an organization based on its web designs and visual content. Quality graphics also make your message more engaging for your supporters and boosts your overall brand awareness.

We’ll cover these five designer-approved steps to creating a great nonprofit graphic design strategy:

Graphic design has high rewards for nonprofits, but getting started can be difficult. To help you take that first step, we’ll jump into how to develop your nonprofit’s brand.

1. Establish Your Nonprofit’s Brand

Every organization needs a unique brand, including nonprofits. While you may not be selling a product or service to customers like most brands do, you’re still selling something—your impact. When potential supporters come across your marketing materials, they’re deciding if they want to “buy” into your mission by supporting the cause.

Your nonprofit’s brand needs to be recognizable to supporters immediately. Surveys show that choosing a signature color to represent your organization can increase brand recognition by 80%. That way, anyone who comes across your marketing materials will immediately associate them with you.

Here are the key visual branding elements to include in your graphic design strategy:

To keep your branding consistent across all marketing materials, create a nonprofit brand guide that details all the elements above, as well as information about the communication platforms you use and the audience for each one.

2. Choose Graphic Design Tools to Get Started

Once you’ve established a brand for your nonprofit, you can start designing! You’ll need to have a set of graphic design tools that will help your work, not hinder it. Choose tools that are beginner-friendly and cost-effective.

Here are our recommendations to get you started:

Graphic Creator

According to recent studies, 45% of marketers use infographics to promote their products or services. Join this movement by creating graphics that are custom to your nonprofit. To get started, you’ll need to choose a beginner graphic creator where you can use templates to design flyers, infographics, social media posts, and even short videos.

Canva is a streamlined, beginner-friendly tool. It’s more user-friendly and low-cost than platforms like Adobe Illustrator, making it perfect for busy nonprofit professionals. The platform offers customizable templates for documents, presentations, social media posts, videos, and more. You’ll also have access to Canva’s library of free-use graphics, images, and fonts.

Make sure to apply for Canva’s nonprofit plan to access premium features for free.

Stock Image Source

When you can, take pictures of your supporters engaging with your cause during events or your staff working with beneficiaries. These images will communicate the work you do and show your audience the real people behind your impact.

However, it’s not always feasible to have a professional-quality, organization-owned image ready for every occasion. This is where stock photos can come in handy.

There are many different sources you can use for quality stock images. While some require paid subscriptions, there are plenty of free options available as well.

Pexels is an online source for free stock images. The website has an easy-to-use search bar where you can type keywords related to your nonprofit to find the perfect images. The site offers stunning, unique images for various terms from “animal rescues” to “charity food pantry,” so you’re bound to find media that suits your organization.

Don’t forget to look here for videos, too—Pexels offers thousands of clips that could be the perfect B-roll footage for your next video campaign.

Website Builder

With an intuitive website builder, you can create and update your organization’s website without having to hire a web developer to code the site from scratch.

WordPress is one of the most popular website builders across all sectors. Select a sleek theme and easy-to-use layout to give your supporters a pleasant user experience. This solution is flexible and allows you to get creative. For example, you can include blogs, newsletter signup pages, eCommerce stores, and even educational courses within WordPress.

Morweb, on the other hand, provides web support specifically for nonprofits and other mission-driven organizations. Morweb can help you develop a custom website with modules streamlined to provide an intuitive user experience, meet accessibility compliance, and integrate with external APIs. Additionally, Morweb’s team will be there to support you each step of the way, even during the migration and post-launch phases.

3. Tell Stories Through Your Graphic Design

No matter what graphic design tools you use, everything you create should point back to your nonprofit’s mission. Using graphic design to tell stories is a great way to highlight your organization’s community impact and function.

Storytelling is the way to go in order to get your message to stick in your supporters’ minds. People often remember stories considerably more than statistics, and using this method can increase conversions by 30%. Stories also get your supporters emotionally involved in your mission, inspiring them to take action.

You don’t have to—and shouldn’t—limit your storytelling efforts to words alone. Graphic design can add to verbal stories or become a story in itself. To incorporate graphic design into your nonprofit’s storytelling on different platforms, start with these ideas:

Wherever you use stories in your designs, make sure they reflect both your organization’s overall goals and the intent of that particular piece of communication.

4. Keep Your Nonprofit’s Audience in Mind

Your goal is to make your nonprofit stick in your supporters’ minds. So, you’ll need to shape your designs to reflect their needs, wants, and interests by analyzing your donor data.

However, not every supporter of your nonprofit has the same needs, wants, or interests. To develop designs that appeal to various segments of your audience, keep these considerations in mind:

Demographics

Gathering demographic data on your supporters is the first step to understanding your audience. If you know more about the groups who support your cause, you can tailor your design strategy to their interests.

These are some common demographic factors that will be helpful to know about your nonprofit’s audience:

These factors all influence how your audience thinks and what they value, shaping their unique motivations for engaging with your nonprofit. For example, younger generations may want to see social media graphics or digital flyers about creating positive change in society, while older generations might prefer charts incorporated into presentations related to tax-deductible giving.

Past Engagement

Demographics give you more context about who your donors are, but past engagement data will tell you more about how individual supporters interact with your nonprofit.

These considerations will be most useful from a design-strategy standpoint:

Engagement analytics can also help you prioritize certain groups within your audience to boost retention rates. After all, retaining your current supporters is more cost-effective for day-to-day operations than attracting new ones.

Decide which set of engagement data is most important to your graphic design strategy based on your nonprofit’s current goals. If you want to increase the frequency of the donations, for example, highlight the benefits of becoming a monthly donor in your designs.

Supporter Segmentation

When you combine demographic and past engagement data, you can start segmenting your supporter base.

A supporter segment is a group of people who interact with your nonprofit and share characteristics. Your segments may include a group of long-term major donors who are likely older, wealthy, and educated. Another segment might be made up of volunteers acquired through social media who are younger and have fewer means to donate at this point.

Once you’ve established segments that represent your core group of supporters, you can use your understanding of who you’re targeting in each of your marketing campaigns to adapt your graphic design choices. When communications are personalized to them, your audience will be more likely to engage with your nonprofit’s communications and respond to your calls to action.

5. Stay Open to New Graphic Design Ideas

When you’re getting started with nonprofit graphic design and developing a marketing strategy, you’ll need to stay flexible with your ideas and process.

Flexibility doesn’t make planning any less important—you should still outline each of your design ideas in detail and make sure they align with your goals. But don’t be surprised if you end up going in a different direction based on initial reactions to your concepts, new data on your audience, or new trends in your space.

Here are some popular nonprofit marketing trends that can help your organization reach and resonate with its audience:

Consider reaching out to specialized consultants to improve your marketing results. To help manage your Google Grant account, you might work with a marketing consultant. They’ll help you pick relevant keywords, maintain compliance, design engaging ad copy, and more.

If you work with a graphic designer, for example, you’ll give them an overview of your strategy and tell them about your plans for certain designs. Then, they’ll come back with examples of content.

Additional Resources